Max Lin, Platts S&P Global

LONDON

EnergiesNet.com 11 08 2023

Eni and Repsol have envisaged more liftings and production of Venezuelan oil in the coming months with a temporary US sanctions relief, even as analysts expect shipments from the South American country to be curbed by geopolitical uncertainty and decades of underinvestment.

On Oct. 18, Washington announced that sanctions on Venezuela’s oil sector would be eased for six months in response to the electoral agreement signed between the government of Nicolas Maduro and the Venezuelan opposition.

Senior executives of Eni and Repsol, Europe’s top lifters of Venezuelan crude with significant investments in the country’s upstream production, both suggested their companies could benefit from a brightened outlook in Venezuela in their recent earnings calls.

Describing Venezuela as “an opportunity,” Francesco Gattei, CFO of Italy’s largest oil firm Eni, said his company was seeking to have more liftings from the country amid a forecast production recovery.

Josu Jon Imaz, CEO at Spain’s largest refiner, Repsol, said the relief is “good news” and provides the company opportunities to raise upstream output in Venezuela and process more of its crude.

In 2019, when the US first imposed sanctions on Venezuela’s oil sector in an attempt to oust Maduro, Europe imported 31.3 million barrels of crude and condensate from the OPEC member — including 1.9 million barrels for Eni and 13.9 million barrels for Repsol — based on S&P Global Commodities at Sea data.

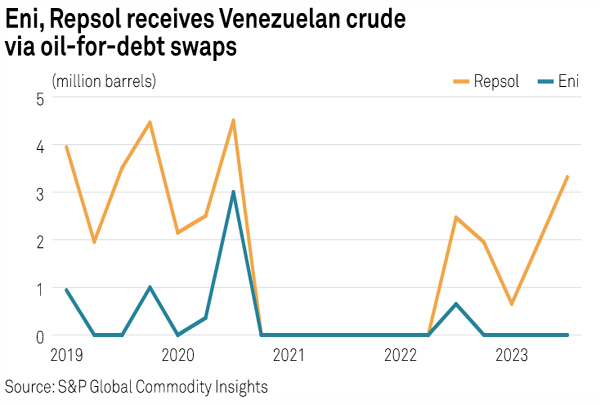

The two later became Europe’s only oil firms that traded with Venezuela under US exemptions, but volumes were unstable due to policy shifts by Washington: Eni and Repsol had to halt imports in 2021 before taking 5.1 million barrels in the second half of 2022 and nearly 6 million barrels in the first three quarters of this year, with the latter showing much more appetite.

Oil flows

The European majors’ renewed ambition comes as questions linger over whether Venezuela can significantly raise its output from its upstream fields, where investment has been lacking for much of this this century.

While sitting on the world’s largest proven oil reserves, Venezuela’s crude production fell from nearly 3 million b/d in 2008 to 716,000 b/d last year, according to OPEC data.

With large investments required to revive the Venezuelan oil sector taking time to materialize, and the sanctions relief depending on Maduro’s willingness to hold a free election next year, S&P Global Commodity Insights analysts suggest the country’s crude production could be capped at 850,000 b/d in the next six to 12 months versus the current level of 750,000 b/d.

Venezuela’s heavy sour crude could offer opportunities to Spain’s coking refineries to increase utilization, while refineries elsewhere in Europe might also blend those barrels with West Texas Intermediate or Johan Sverdrup following the loss of Urals, according to the analysts.

“However, the potential upside for European refiners is limited,” they added. “Since the US Gulf Coast is likely to absorb most of the incremental Venezuelan barrels, Europe’s additional imports from Venezuela are likely to be volumetrically small.”

Corporate plans

Eni and Repsol has been mainly taking Venezuelan crude under oil-for-debt arrangements, as Venezuela’s cash-stripped state oil firm PDVSA struggles to pay for the gas it receives from the Perla field operated by Cardon IV, a 50:50 joint venture between Eni and Repsol.

As of the end of 2022, Eni recorded overdue Cardon-related trade receivables by PDVSA at Eur566 million ($604 million), while Repsol — which had lifted more crude — reported total equity exposure to the country at Eur411 million.

“This [swap] mechanism could be expanded and still be used to settle the accumulated debt by PDVSA,” said Carlos Bellorin, a senior analyst with S&P Global.

Separately, Eni and Repsol hold minority stakes in several oil fields in Venezuela, whose output could be lifted with more investments on operations.

According to company reports, Eni’s liquids production in Venezuela rose to 4,000 b/d last year from 2,000 b/d in 2020, while Repsol’s liquids output increased to 3 million barrels from 2 million barrels.

“I do see more investments on mature fields and production optimization on existing JVs,” said Bellorin, adding that significant investments would however depend on Washington’s future sanctions framework beyond the six-month relief.

Late last month, Venezuela’s supreme court ordered the suspension of the results of the opposition’s primary elections, raising doubts over the Maduro regime’s willingness to uphold its agreement.

“The low-hanging fruit in order to increase production in Venezuela are mature fields …But for this to happen major investments are needed and only may come from private investors that need certainty,” Bellorin said.

“This will depend on Maduro’s government honoring [the electoral agreement].”

spglobal.com 11 07 2023