…grants ExxonMobil “reasonable time” to provide “financial assurance”

Kaieteur News

GEORGETOWN

EnergiesNet.com 11 29 2022

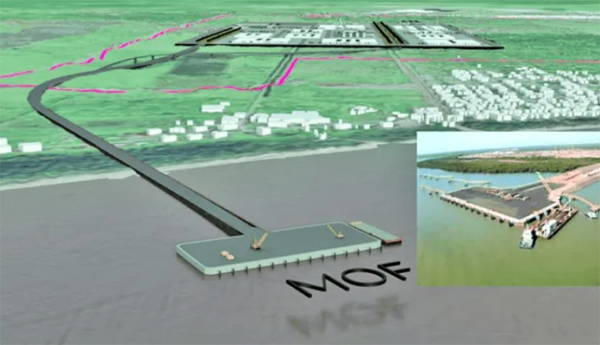

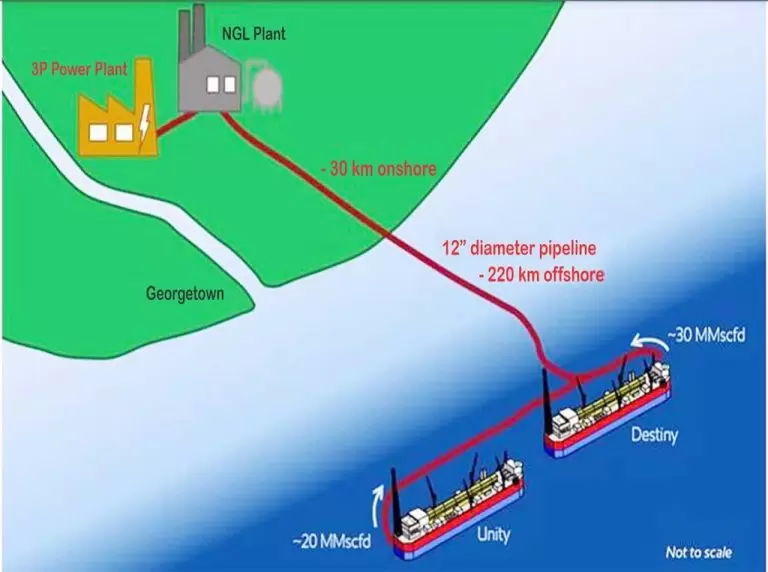

The Environmental Protection Agency (EPA) on November 25 gave US oil giant, ExxonMobil its blessings to commence the US$1.3 billion Gas-to-Energy project that will allow for the construction of a natural gas pipeline, as well as a Natural Gas Liquids (NGL) facility and supporting infrastructure.

While many stakeholders had raised concerns regarding the safety of the project, the EPA in its decision to grant the Permit said the project’s Environmental Impact Assessment (EIA) and Environmental Impact Statement (EIS) have been declared acceptable, by the Environmental Assessment Board (EAB) in accordance with section 11(13) of the Environmental Protection Act, Cap. 20:05.

“The EPA is satisfied that the project can be conducted in accordance with good environmental practices, and in a manner that avoids, prevents and minimizes any adverse effects which could result from the activity,” it said.

Thirdly, the agency said technical reviews and recommendations from a team of independent International Experts, the public inputs at the scoping stage, views expressed by members of the public during consultations, the submissions made after the EIA was submitted for public review, and all other relevant considerations, indicate that the project is environmentally-sound and in the public’s interest.

However, when the five-year Environmental Permit was examined by this newspaper, it was discovered that Exxon has been given the opportunity to decide when it will provide insurance for the project, as there is no definitive timeframe set out by the regulator. According to Section 108 of the 50-page document issued by the EPA, “The Permit Holder is liable for all costs associated with clean up, restoration and compensation for any damages caused by any discharge of any contaminant, including the cost of all investigations into pollution incidents or discharge of contaminants, conducted at the instance of Agency.”

Meanwhile, Section 109 goes on to explain, “The Permit Holder shall provide and/or declare within reasonable time upon signing of this permit a combination of the following forms of Financial Assurance to cover all its legitimate liabilities under this Permit. These shall include: a) Insurance in accordance with Condition 114 and shall cover clean up and third party liability on terms that are market standard for the type of coverage: and b) A Parent Company/Affiliate (of Operator and Co-Venturers (CoVs)) undertaking that provides indemnification for liabilities under this Permit.”

The amount of Insurance will be guided by an estimate of the sum of the “reasonably credible costs, expenses, and liabilities that may arise from any breaches of this Permit.”Meanwhile, Liabilities are considered to include costs associated with responding to an incident, clean-up and remediation and monitoring. The estimation is not expected to address unidentifiable or inestimable costs which may be associated with compensation for loss and ongoing damage to other parties, and which are able to be pursued through civil action, the Permit said.

Section 118 of the Permit states that the Permit Holder shall submit to the Agency, as soon as reasonably practicable upon its request: a copies of the Environmental Liability Insurance policies; a summary of the Environmental Liability Insurance policies detailing the insurer, the type of insurance, the amount of coverage provided by each policy, key terms of the insurances policies, what types of environmental damage the policies cover, what types of environmental damage the policies do not cover, and the duration of each policy. It also wants evidence that the insurer is authorised to provide the insurance in Guyana; evidence of authorisation of the institution or parent (insurers) to provide insurance; evidence of the insurer’s financial strength; and evidence of the insurer’s BBB grade.

“The Permit Holder must, as soon as reasonably practicable, provide from the Parent Company or Affiliate Companies of Permit Holder and its Co-Venturers (“Affiliates”) one or more legally binding agreements to the Agency, in which the Parent Company or Affiliate Companies of Permit Holder and its Co-Venturers undertake to provide adequate financial resources for Permit Holder and its Co- Venturers to pay or satisfy their respective environmental obligations regarding the Stabroek Block,” Section 119 of the Permit states. It goes on to explain that if the Permit Holder and/ or its Co- Venturers fail to do so, it must provide evidence of the following: (i) That the Affiliate(s) are authorised to provide that guarantee or agreement in this jurisdiction; (ii) That the Affiliate(s) have sufficient financial strength for the amount of the potential liability; (iii) That the Affiliate(s) have the corporate legal capacity to enter into the agreement.

Additionally, it must also agree to provide notification of cancellation, expiration, renewal or non-renewal and expiry dates of the Agreement as well as provide audited annual financial statements and notification if the Affiliate(s) are no longer likely to be able to meet specified financial obligations. The Permit will remain in effect until November 24, 2027. It will be renewed only after the Permit Holder submits an application form six months before its environmental authorization expires.

It must be noted that Guyana is still currently struggling to secure full liability coverage from ExxonMobil for its oil production activities offshore Guyana in the Stabroek Block. Exxon has told the nation that each of its Stabroek Block projects is covered by a US$600M policy, while it is still in discussion with the government for a combined US$2B package of affiliate company guarantees; bringing the total coverage cost to US$2.6B.

This means that Guyana may very well left to foot any additional costs related to the clean up, restoration or compensation following a large-scale oil spill. For instance, emergency response and cleanup of the British Petroleum (BP) Macondo oil spill in the Gulf of Mexico has so far cost more than US$70 billion according to reports.

kaieteurnewsonline.com

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment