Anna Shiryaevskaya and Vanessa Dezem, Bloomberg News

LONDON/FRANFURT

EnergiesNet.com 04 22 2022

European gas prices for now have shed all the gains accrued after Russian President Vladimir Putin demanded that the nation’s gas be sold in rubles.

Benchmark futures are trading about 15% lower than their closing price on March 23, when Putin unveiled the plan. The European Union has indicated the demand may violate sanctions imposed on Russia following its invasion of Ukraine. Nations including Germany and the Netherlands have also rejected the idea.

Prices did rise briefly around the formalization of the decree, when Putin said gas shipments from Russia — Europe’s largest supplier — could be halted if the ruble-payment demand isn’t met. However, the downward trend soon resumed. Here are four reasons why.

Room for Maneuver

Putin’s order would apply to payments for gas delivered in April. Most of those bills are due in May, so there’s still time for buyers to adjust, according to Russian Deputy Prime Minister Alexander Novak. That delays any imminent impact on prices as nations decide what to do.

“Gas delivered during April will not be paid for until around 20 May, so we are still a month away from this really being an immediate issue,” said Tom Marzec-Manser, head of gas analytics at Independent Commodity Intelligence Services in London. “I certainly don’t see any risk to pipeline supply in the coming month in relation to the currency decree, and really not into June either.”

Summer Is Coming

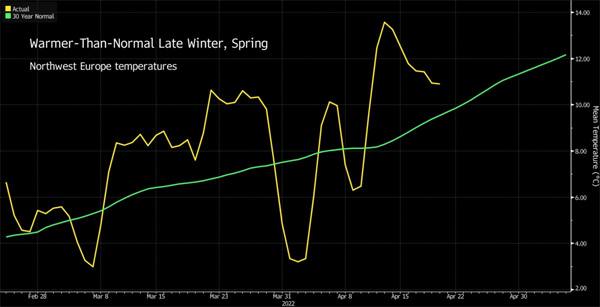

Any disruption in gas flows from Russia would come when European demand seasonally wanes. A warmer spring and an early start to refilling storage sites — which were already historically low when winter arrived — have removed some of the bullishness from the market.

If average weather conditions continue for the rest of the year, heating requirements are expected to be lower than in 2021, “when Europe faced a particularly long heating season extending into April,” the International Energy Agency said in its latest quarterly gas report. Likewise, “the rapid expansion of renewables is set to weigh on thermal power generation,” it added.

LNG Wave

Europe is no longer the market of last resort for liquefied natural gas. The region is importing record volumes, which is set to continue as long as prices on the continent remain competitive with spot LNG rates in Asia.

While Asia’s traditional premium over European gas prices will return this summer, the difference will be so small that Europe will continue pulling LNG from the U.S. for at least another year, according to Goldman Sachs Group Inc.

Spreads below $1 per million British thermal units favor “strong Atlantic LNG flows to Europe vs to Asia,” the bank’s analysts, led by Samantha Dart, said in a note earlier this month.

The EU is seeking to cut its dependency on Russian gas by two-thirds this year, and a cut-off would add more urgency to plans to line up alternative suppliers. Gas demand in China is also expected to expand at a slower pace than last year, according to the IEA. That may spare more LNG for Europe.

Demand Destruction

Even without a disruption in flows, European gas prices are already more than six times higher than the five-year average, as the energy crunch started late last year amid lower supplies and inventories.

Prices already hold a “substantial premium” for the risk of disruptions, Morgan Stanley said in a report earlier this month. They’re high enough to attract significant LNG volumes, but also to “visibly erode demand.”

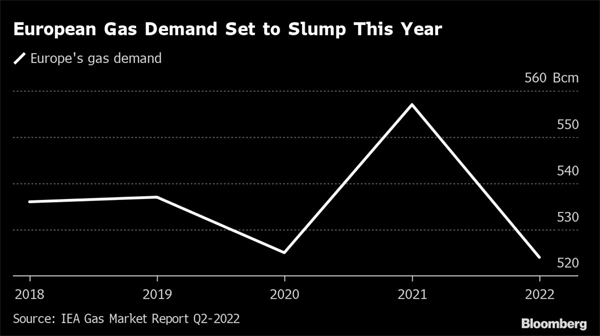

Europe’s gas demand fell by almost 4% year-on-year in the past heating season, and it’s expected to contract by 6% for 2022 on the whole, the IEA said in its quarterly report. Amid high prices, industrial gas demand will slip to nearly 2020 levels, when it was pressured by Covid-related downturns.

bloomberg.com 04 21 2022