Sheela Tobben and Devika Krishna Kumar, Bloomberg News

CALGARY/LONDON

EnergiesNet.com 07 15 2022

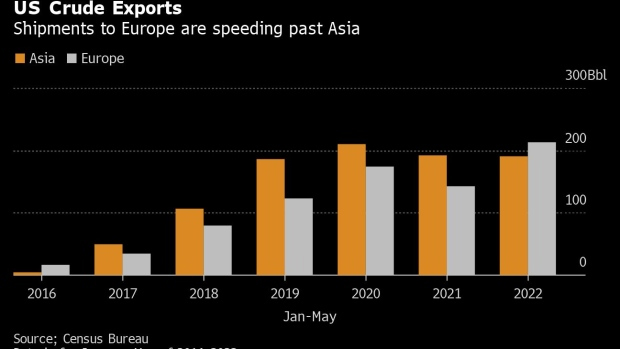

Europe has surpassed Asia to become the top consumer of American oil for the first time in six years.

From January to May this year, Europe took an average of about 213.1 million barrels of crude while Asia received 191.1 million barrels, according to the latest available US Census Bureau data. The last time Asia’s volumes fell behind Europe for the same five-month period was in 2016, when the US reversed its crude export ban, data show.

This shift in oil flows underscores how significantly Russia’s invasion of Ukraine has redirected energy supplies. In an effort to cut off funding for Putin’s war, the US and other nations have imposed sanctions on Russian oil. As a result, more European nations have turned to the US for oil imports, while Russia offers its crude at steep discounts to countries like India and China, which have not imposed any bans.

As Europe tries to lessen its dependence on Russian energy and switches to sweeter crudes to replace Russian oil, its likely these trade-flow patterns persist, Christopher Haines, global crude analyst for Energy Aspects, said by email. US crude production is growing but not fast enough to accommodate the needs of both Asia and Europe. Additionally, the Middle East appears to be constrained in how much more it can send to Europe.

The region’s largest producers, Saudi Arabia and the UAE, are already struggling to meet their OPEC+ production commitments to the OPEC+ agreement. Other suppliers, like Libya, have been grappling with political unrest that has limited exports.

“All eyes will be on how OPEC manages to increase its capacity for higher production in the year ahead and how much market share it can regain,” said Elisabeth Murphy, an upstream analyst for consultant ESAI.

bloomberg.com 07 15 2022