Vanessa Dezem, Bloomberg News

FRANKFURT

EnergiesNet.com 02 17 2023

Large European energy companies are preparing for lingering high gas prices, curbing hopes for significant further declines after mild weather and strong inventories helped get Europe through the winter.

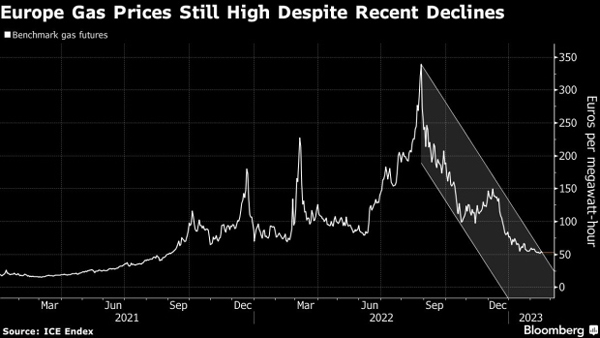

Natural gas prices in Europe have plunged about 80% since last summer’s peaks, but remain higher than historic averages. Shell Plc said it expects volatility to remain in the short term, and Repsol SA cautioned that high prices may be structural due to obstacles to production.

“Whilst customers may see some relief given recent easing of prices, it remains clear that some will continue to need help,” said Centrica Plc Chief Executive Officer Chris O’Shea.

Lower gas prices in recent months have given end-users and policy makers a breather, allowing supply concerns and historic inflation rates to ease. A mostly mild winter put a lid on the use of gas for heating, while strong liquefied natural gas flows have helped buyers to replace Russian supplies.

But company earnings reports this week highlight that the same conditions seen in 2022 might not repeat this year. Europe still faces the prospect of gas shortages this year unless it further curbs demand, the International Energy Agency warned in a report on Wednesday.

Gas markets are in “better shape than many expected one year ago,” IEA Executive Director Fatih Birol said. “But the reality is that winter 2023-2024 is likely to be the real test.”

Forecasters see northwest Europe ending this month with colder weather, as temperatures are expected to drop by late next week. While that could lead to heavier withdrawals of gas supplies, market participants are showing little concern over a squeeze for the remainder of this winter. Benchmark contracts fell as much as 3.5% on Thursday.

Further ahead, Shell said in its LNG Outlook that gas demand in Europe will increasingly exceed supply until 2030.

“Europe’s increased need for LNG looks set to intensify competition with Asia for limited new supply available over the next two years and may dominate LNG trade over the longer term,” Shell, a major trader of the fuel, said.

Dutch front-month gas futures, Europe’s benchmark, were trading 3.2% lower at €53 per megawatt-hour by 10:56 a.m. in Amsterdam.

–With assistance from Elena Mazneva.

bloomberg.com 02 16 2023