Elena Mazneva, Bloomberg News

LONDON

EnergiesNet.com 08 04 2022

Natural gas prices in Europe headed for a second day of losses, with signs of extra supplies from the US offsetting concerns about shipments from Russia.

Benchmark futures fell as much as 4.6% following a recent rally as traders assessed several conflicting factors.

A major export terminal in Texas, shut earlier this year after a blast, reached an agreement with regulators to restart in early October at almost full capacity. While the Freeport LNG facility had already indicated that it planned to resume operations by then, traders expected a more gradual return.

The restart of the plant should come as a relief for Europe, which desperately needs additional supply from the US as Russia curbs supplies to the continent. The region is facing an historic energy squeeze that is rippling through the broader economy, fanning inflation.

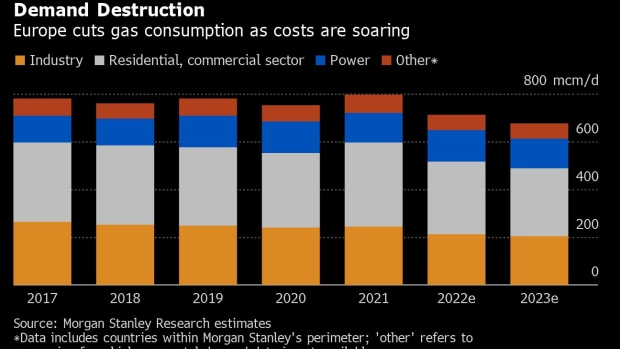

Last week, Gazprom PJSC cut shipments on the Nord Stream pipeline to Germany to 20% of capacity, citing issues with turbines, sending gas prices to the highest levels since March — during the first weeks of Russia’s war in Ukraine. The build-up of European stockpiles, coupled with falling consumption by industry, has helped to keep prices in check in recent days.

Dutch front-month gas contract, the European benchmark, traded 2.1% lower at 195 euros per megawatt-hour by 8:53 a.m. in Amsterdam. The UK equivalent declined 1.4%.

Still, supply risks remain. Russian gas exports to Europe, already at about a third of normal levels, may stay curbed and further disruptions can’t be ruled out.

A standoff between Moscow and Berlin over a piece of equipment for the Nord Stream pipeline has become an apparent stalemate. Gazprom said late Wednesday that sanctions are making it “impossible” to deliver a spare turbine from Germany.

Read: Don’t Expect Nord Stream Gas Revival as Turbine Blaming Drags On

“The Russian government decides what the export level is,” said Thierry Bros, a professor at the Paris Institute of Political Studies. “The rest is just a show for prime time TV.”

Separately, Uniper SE said Wednesday that it might need to curb output at a German coal plant as fuel supplies on site are limited because of low water levels of the Rhine river. Electricite de France SA said it’s likely to extend cuts to nuclear generation as scorching weather pushes up river temperatures.

bloomberg.com 08 03 2022