Verity Ratcliffe, Bloomberg News

DUBAI

EnergiesNet.com 03 01 2022

European natural gas surged as traders grapple with the risk Russia might cut supplies after being hit with sanctions.

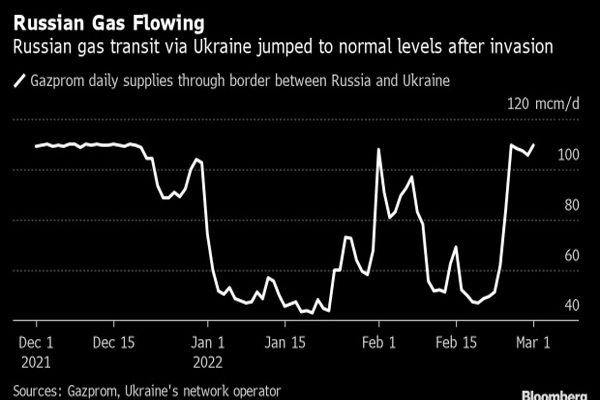

Benchmark futures jumped 23%, rising for a second day. Despite Russian gas continuing to flow uninterrupted to Europe, even picking up since the invasion of Ukraine last week, policymakers are preparing for any stoppages by the Kremlin in retaliation to sanctions.

Europe relies on Russia for about a third of its gas, with many of those shipments flowing through pipelines crossing Ukraine. Any disruption could keep prices high for longer as refilling storages in the summer could become more difficult and stretch the energy crunch into the next heating season. The exclusion of some Russian banks from the SWIFT international payment system also could upend gas trade.

“With some of the harshest sanctions in history being doled out by the West, the probability of Russian retaliation through energy supply disruptions has increased significantly,” JPMorgan Chase & Co. said in a note.

But gas flows continue for now. Gazprom PJSC reiterated Tuesday it will send supplies to the continent in line with customer requests, with some shipments entering Germany via the Yamal-Europe pipeline overnight and flows through Ukraine expected to increase Tuesday.

Dutch front-month gas futures closed 23% higher at 121.67 euros a megawatt-hour. The U.K. equivalent contract gained 22%.

Prices are also getting a boost with the forecast for cold weather at the tail-end of the winter heating season. Below-average temperatures are seen across Europe at the start of next week, Maxar said in a report.

Warmer temperatures in February helped slow withdrawals from Europe’s gas storage facilities, although traders already are looking ahead to potentially tight gas markets next winter.

“There is enough gas in European stocks to meet winter demand given the current weather forecasts,” Vattenfall AB Chief Executive Officer Anna Borg said. “Europe will at some point have the requirement to start to replenish stocks over the summer, which could be more difficult if no solution is found.”

bloomberg.com 03 01 2022