Karl Maier, Bloomberg News

ROME

EnergiesNet.com 04 08 2022

To understand how Vladimir Putin pays for his war machine, look no further than Europe.

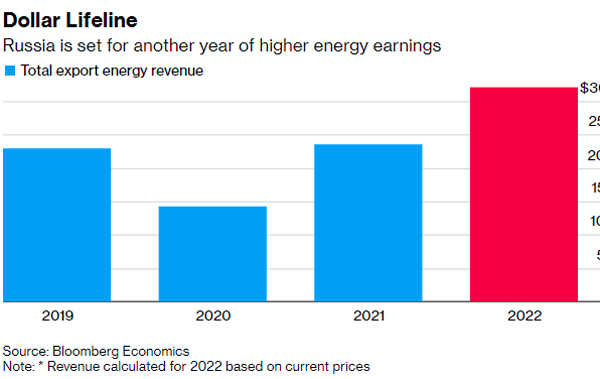

While European nations, along with the U.S. and others, have slapped stiff economic sanctions on Moscow since its troops rolled into Ukraine in late February, their dependence on Russian oil, gas and coal supplies provides Moscow with a vital financial lifeline — one that dwarfs military aid to President Volodymyr Zelenskiy’s administration in Kyiv.

As EU foreign policy chief Josep Borrell put it yesterday, what Europe has given so far to Ukraine — roughly 1 billion euros — it hands to Russia each day for energy purchases. Cut-price cargoes are also heading to Japan, South Korea, China and India.

The cash has not only helped push up the value of the ruble — mocked last month by U.S. President Joe Biden as having been reduced to “rubble” — back up to pre-invasion levels, it has allowed Putin to crow to his domestic audience that all these sanctions really aren’t doing damage.

Of course the currency is also being propped up by drastic emergency measures, and the penalties are having a severe impact. They include everything from a halt to international investment, asset seizures, banning Russian banks from the SWIFT financial messaging service, and sanctions on oligarchs — and soon Putin’s daughters. Although Moscow has avoided a default on its debt so far, it’s a distinct possibility within a year.

While the alleged atrocities in Bucha and other Ukrainian towns have provoked widespread outrage and heightened the pressure to ban Russian fuel imports, they remain the lifeblood of Europe’s energy system — and Putin’s invasion. Restrictions on coal may be announced soon, but there’s firm resistance from Germany, Hungary and others to cut off the biggest ticket item: gas.

After Lithuania became the sole EU member to halt natural gas imports from Russia, its foreign minister, Gabrielius Landsbergis, tweeted, “Dear EU friends, pull the plug. Don’t be an accomplice.” — Karl Maier

Sign up here for the Special Daily Brief: Russia’s Invasion of Ukraine and share this newsletter with others too. They can sign up here.

— With assistance by Gordon Bell

bloomberg.com 04 07 2022