By Javier Blas

Business is brisk at one of London’s top electric-vehicle charging hubs, owned by BP Plc, in the western suburb of Hammersmith.

Spend time here watching how Tesla Inc.’s and competitors’ EVs come and go and you might leave convinced that gasoline’s days are numbered in Europe.Turn to the right, however, and that impression would vanish like disappearing ink: A conventional fuel station is doing even brisker business selling fossil fuels for conventional cars.Perhaps gasoline doesn’t have a future — but its present is rather healthy. Blame the lopsided world of cars and oil in Europe, where old and new trends collide in tense and counterintuitive ways.

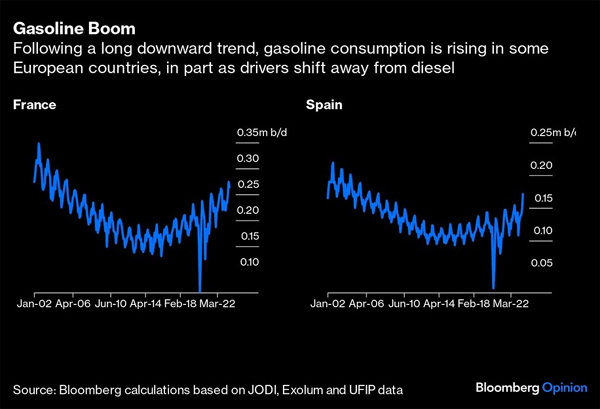

Consider fuel consumption. In the UK, gasoline demand was the strongest for the January-to-June period this year since 2015, according to Bloomberg calculations based on government data. In France, demand hit a 20-year high during the summer. In Spain, it’s risen to the highest in more than a decade. And in eastern European nations like Poland, it’s the strongest ever.

How is this trend possible in Europe when EV sales are also surging? And does it reflect a swan song or a shift toward stronger-for-longer fuel consumption?

To answer these questions, one must investigate the bowels of the region’s car and oil markets, which have changed beyond recognition since 2015, and how consumers drive those automobiles.For a time, European gasoline demand was dropping year after year, with oil executives assuming that consumption would fall somewhere between 1% and 2% per annum, driven by two factors: more efficient engines and the rise of diesel-powered vehicles, particularly in Germany and France.

That trend changed around 10 years ago. First, gasoline use stabilized, and then it started to climb. Based on preliminary data, it looks like European Union gasoline consumption hovered this summer at a 10-year high. The shift, from falling to plateauing to rising, has much to do with one of the biggest business scandals in recent memory.In 2015, Volkswagen AG, the German automaker synonymous with diesel cars, admitted it engines polluted more than the company had ever made public.

The scandal, dubbed “Dieselgate,” soured European appetites for the cheaper but more polluting fuel. Gasoline became the choice for many in the continent, boosting demand.At the same time, Europeans were keeping their cars far longer than in the past, damping the impact of newer, more fuel-efficient models on overall consumption. Cost is one reason: New cars are pricey, and families are more budget conscious.

Another was supply, with fewer new models due to chip shortages. Then add the fact that automobiles today are better built and thus age more gracefully than they did one or two decades ago. Finally, consumers fear choosing the wrong kind of vehicle as battery technology quickly advances, opting to delay their purchases as long as they can.

The result of all those trends together is an older fleet: In 2006, the average European car was 8.4 years old; today, it’s more than 12. There are more automobiles on European roads, too. Over the past decade, the number has surged by nearly 40 million, reaching almost 250 million in 2022.

Even if electric vehicles are taking a progressively larger share of new registrations, the overall increase means the absolute number of gasoline-powered cars is holding.Then there’s the question of how Europeans drive — and fuel — their cars. The post-Covid-19 era shows contrarian trends. Working from home has reduced commuting into downtown from the suburbs.

In the US, that trend has curbed miles driven; in Europe, however, where public transport networks are stronger, it hasn’t eroded fuel demand as much. On the other hand, remote work has made it possible to live in the countryside, making cars a daily need rather than a weekend necessity.

Now add the post-pandemic desire for holidaying and traveling.

In polls, most Europeans say climate change is one of their biggest worries. That concern was mostly absent on the continent’s roads this summer, with highways to beaches packed.Ironically, the shift toward greener cars may be escalating gasoline demand as well. Not every electric car is the same. Some are powered only by their battery; others are plug-in hybrids, sporting an internal combustion engine to supplement their batteries.

The problem is that it’s clear some consumers aren’t plugging in those cars, instead largely running them on gasoline. Ultimately, gasoline demand will decrease as people replace their fossil-fuel cars for battery-powered ones. When — and if — the cost of electric vehicles falls, the shift could be quick. But the current surge in consumption indicates that, for now, the stylized graphics governments often parade of declining oil use are misleading.

The energy transition will have fits and starts; perplexing, illogical and contradictory trends, as well as parting shots. The future is electric, but in the world of today, gasoline is king. Even in green-conscious Europe.

___________________________________________

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He previously was commodities editor at the Financial Times and is the coauthor of “The World for Sale: Money, Power, and the Traders Who Barter the Earth’s Resources.” @JavierBlas. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on Sept. 1 , 2023. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 09 101 2023