By The Value Portafolio/Seeking Alpha

NEW YORK

EnergiesNet.com 01 31 2022

Summary

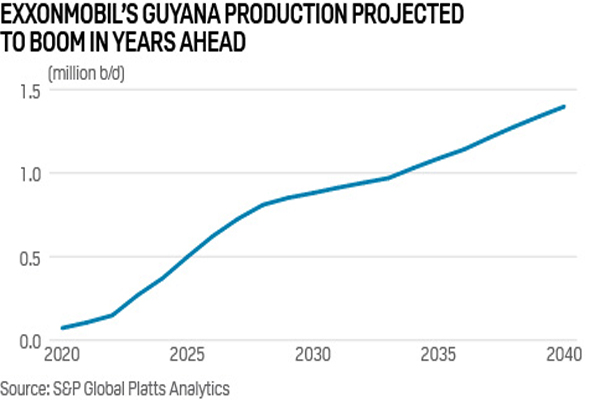

- Guyana is defining a new era for ExxonMobil with the ability to generate massive cash flow.

- The company’s business can hit >2 million barrels / day and in our view can move towards double that given multi-decade resource estimates.

- The total basin can output >$42 billion in annual profits given ExxonMobil’s production estimates.

- Overall, ExxonMobil has a unique ability to drive significant long-term earnings for shareholders.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Exxon Mobil (NYSE: XOM) recently announced two new discoveries in offshore Guyana on top of the company’s recently updated 10 billion barrel estimate. As part of the same guidance, the company is guiding for 10 development projects. As we’ll see throughout this article, the company’s impressive Guyana asset portfolio, combined with a low breakeven, could enable the company to generate massive earnings.

Guyana Asset Overview

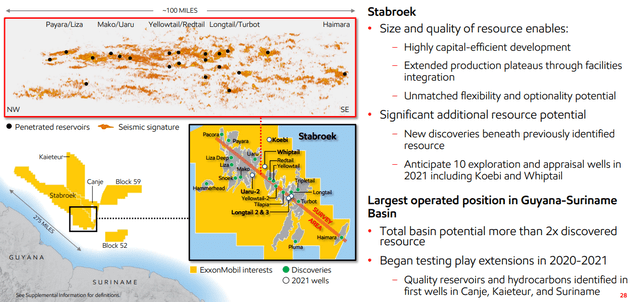

The company’s Guyana assets are a massive play with several possible extensions.

Guyana Asset Overview – ExxonMobil Investor Presentation

The current discovered assets are almost 11 billion barrels stretched across roughly 100 miles. The company used extensive 3D seismic data and drilled what it sees as numerous high potential reservoirs, finding an average of 500 million barrels per discovery. The company has a >90% success rate in drilled wells.

The company’s 2 most recent discoveries include a deep drilled well to test the theory of new discoveries beneath previously identified resources. The company is continuing to drill, both extensions of other basins, and across the remainder of its Stabroek block. These drillings show the massive strength of the company’s Guyana assets.

Guyana Production Ramp-Up

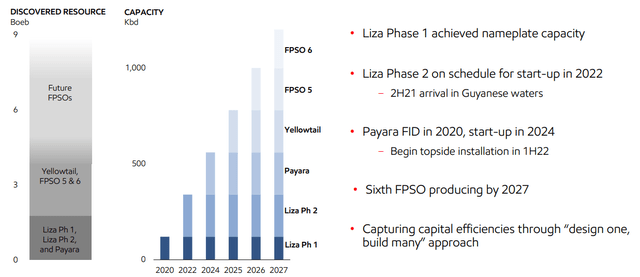

ExxonMobil’s most recent drilled wells guided for up to 10 development projects.

ExxonMobil Discovered Resource – ExxonMobil Investor Presentation

The company is growing to 2027 production capacity of 1.3 million barrels per day across 6 FPSOs (with 2 yet to be named). These FPSOs tackle roughly 4 billion barrels of total resource. That implies roughly 700 million barrels of tackled resource per FPSO with a reserve life of a decade. The company is moving towards 1 FPSO / year in 2024 in-line with its 10 FPSO peak estimate.

The company’s “design-one” “build-many” approach is leading to strong efficiencies with $35 / barrel breakeven (Brent) for Liza Phase 1 and $25 / barrel breakeven (Brent) for Liza Phase 2. Payara is expected to have breakeven at $32 / barrel and Yellowtail is expected to be at $29 / barrel for investors.

Long-term we expect a breakeven to be at $27-29 / barrel for the company’s long-term FPSOs. The company’s first 3 development projects (Liza Phase 1 – (100k barrels / day @ $35 / barrel, Liza Phase 2 – 220k barrels / day @ $25 / barrel, Payara – 200k barrels / day @ $32 / barrel) have a weighted average at $29.6 / barrel. We expect additional cost improvements to get it to our $27-29 range given Liza Phase 1 as the highest cost project and half the size.

If the company reroutes earlier FPSOs to later projects once the reserves are utilized capital costs for future wells could be much lower (potentially in the high $10s / barrel given that Payara has $15 / barrel in initial capital costs). ExxonMobil’s own guidance is for roughly 2.1 million barrels / day in production with a breakeven at roughly $28 / barrel.

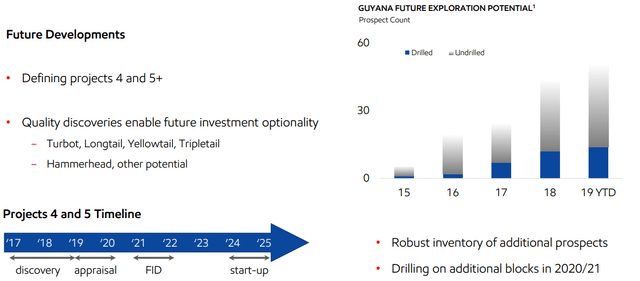

Guyana Resource Potential

Guyana also has significant long-term resource potential outside of ExxonMobil’s initial guidance.

Future Developments – ExxonMobil Investor Presentation

ExxonMobil has found its massive resources with roughly 10-15 drilled wells and it has 2x as many undrilled prospects as that. The company’s own estimate for final basin resources is >2x its current discoveries pointing towards 25 billion barrels in resources. That’s a 30-40 year reserve life at 2.1 million barrels / day.

We see the company look to accelerate that and continue the 1 FPSO / year trend if not also slightly accelerated that. In our view we see the basin’s total production reaching 3+ million barrels / day especially when combined with ExxonMobil’s newer assets in Suriname etc. that are still being explored. Counting Suriname the basin is seen as potentially holding >30 billion barrels.

By the early-2030s we expect total production to range from the 2.1 million barrels to 3.5 million barrels.

Guyana Income Potential

With current Brent prices at almost $83 / barrel, versus our $28 / barrel breakeven, we see Guyana as having potential margins of roughly $55 / barrel. These incredible margins show the asset’s strength, its low cost, and the strength of ExxonMobil’s design one build many approach to its FPSOs, lowering capital cost.

That implies, based on our 2.1 to 3.5 million barrel / day production range total basin profit ranging from $42.2 billion to $70.3 billion implying that the basin’s profits can give the company a P/E of 8 to 14 by itself alone (when adjusting for the fact that ExxonMobil has a 45% stake in the Stabroek block). This highlights how the asset could be a “company maker” by itself.

ExxonMobil’s Opportunity

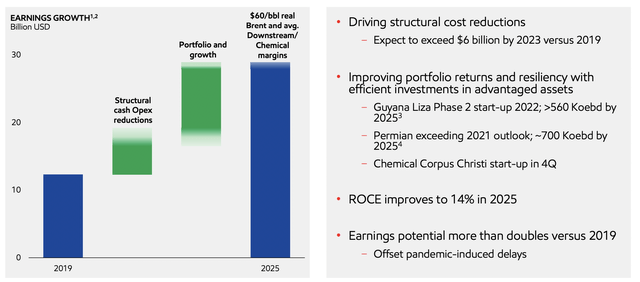

ExxonMobil is focused on growing significantly. The company’s original plan was for earnings to grow from $15 to $30 billion from 2019 to 2025.

ExxonMobil Opportunity – ExxonMobil Investor Presentation

The company was assuming $60 / barrel Brent at these prices. Since then, oil prices are now at $83 / barrel or $23 / barrel higher. Given estimated production of ~4 million barrels / day that means at current crude oil prices, 2025 earnings could be $10s of billions higher. Already quarterly earnings for the 4Q could annualize at almost $40 billion.

ExxonMobil is jumping to shareholder returns. The company has already significantly improved its debt load although it’s considering improving it further. The company has $52 billion in net debt costing it ~$2-3 billion in annual interest. The company’s 3Q 2021 earnings annualize at $25 billion and can grow at current prices to >$50 billion by 2025.

With that earnings strength, the company’s net debt is incredibly manageable especially with the potential of further 2022 reductions.

The company has a 5% dividend yield. It recently guided for $10 billion in share repurchases over the next 12-24 months giving itself the ability to repurchase 4% of stock. At current crude oil prices, the company could do both those, earning roughly 10% for shareholders and having ~$10 billion leftover. This highlights the strength of ExxonMobil’s overall portfolio.

Thesis Risk

The risk to the thesis is two-fold. First, the company is still betting on significant growth exploration from Guyana with reserves doubling. There’s no guarantee that it’ll find the expected additional reserves. Second, the assumption is that oil prices stay at their current levels. There’s no guarantee that that’ll happen.

Conclusion

Every so often companies arrive at “company maker” discoveries, products, etc. Guyana has the potential to be a “company maker” for ExxonMobil especially with current prices >$80 / barrel Brent. The Guyana basin reasonably has the potential to earn $10s of billions. Margins at current Brent prices are a massive $55 / barrel showing the portfolio’s strength.

ExxonMobil has guided for up to 10 FPSOs of production or production of more than 2 million barrels / day. With a multi-decade reserve life, we see production as having the potential of reaching 3+ million barrels / day. That’s enough for a minimum of $42 billion in earnings growing significantly at current prices.

That asset strength combined with ExxonMobil’s other assets could help support significant shareholder rewards.

seekingalpha.com 01 08 2022