Kaieteur News

GEORGETOWN

EnergiesNet.com 06 08 2022

Guyana’s oil sector is a guaranteed cash cow for the companies involved in its production that is unequal anywhere else in the world, with a revenue stream that increases each year as new projects are brought on-stream.

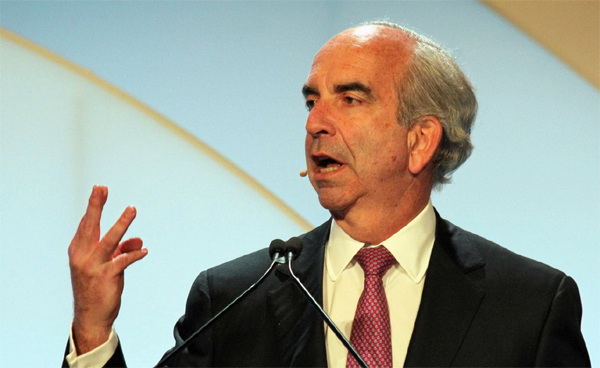

This was the sentiment expressed by Hess Corporation’s Chief Executive Officer (CEO), John Hess, during the recently held 38th Strategic Decisions Conference 2022—organised by Bernstein Anonymous.

“If you just think about this year we have three liftings in Guyana in the first quarter, a million barrels a ship, the second quarter is about seven liftings, the third quarter and fourth quarter, eight liftings.”

He elaborated by pointing out that with each lift of one million barrels, and with oil price at over US$100 a barrel, “you are going from US$300M of incremental cash flow from Guyana to US$700M in the second quarter, US$800M in the third, US$800M in the fourth.”

The ExxonMobil partner who holds a 30 percent stake in the Stabroek Block bragged, “that’s a rate of change just for this year.”

According to Hess, “people use to say why invest in Hess, I will wait for the production to come on in Guyana; it’s on, and that continues to compound at a billion dollars a year of incremental cash flow as each ship comes on.”

He added that “our third ship called Payara comes in second half of 2023, then we have Yellowtail in 2025, a fifth ship (Uaru) will get sanctioned for 2026.”

With this in mind, he stressed, “it’s not just rate of change for this year, its rate of change in the years ahead and that’s why it’s a durable cash flow story that is unequaled anywhere in the business.”

Lashing back at critics, Hess recalled being criticised about three years ago for investing, saying, “a number of investors said, stop investing just give us the cash back, (and) we said look we have higher returns specifically in Guyana, we are going to benefit from that investment; as we grow the resource, we grow the cash flow.”

According to Hess, now that “we have a second ship on, every ship at US$65 Brent adds US$1B a year…as a consequence, our cash flow, because we have these low cost developments coming on every year, our cash flow growth is 25 percent a year, compounded each year for the next five years, and quite frankly with more ships it can actually go out to 2030.”

Part of the success story for Hess, he said, is the downward curve in the costs associated with production.

He explained further saying, “our cash cost per barrel goes down 25 percent to US$9 per barrel of oil 2026, our breakeven as a company will be US$45 Brent for 2026 and at the end of the day that cash flow growth is going to compound, where we grow in intrinsic value but also start to return cash alone way as well.”

According to Hess, as a result of its investments in Guyana, the company has not only managed to increase its dividends paid to shareholders by 40 percent but also managed to pay off some $500M on a US$1B loan “we needed to get through the cycle to continue to the Guyana investment and then as we go forward we are going to continue to grow our dividend.”

With two FPSO vessels in production this year, Senior Minister with responsibility for Finance, Dr. Ashni Singh had said during the reading of budget 2022 that there will be 94 lifts from the Stabroek Block, 13 of which will be Government lifts. From this, it is estimated that deposits into the Natural Resource Fund for 2022 will total US$957.6 million, comprising some US$857.1 million earned from the Government lifts of profit oil, and an additional US$100.5 million from royalties.

By Kaieteur News’ calculations, Exxon’s subsidiary and operator of the Stabroek Block, Esso Exploration and Production Guyana Limited (EEPGL), is poised to walk away with US$3.9B while CNOOC will get US$2.2B this year.

It therefore means that Exxon and partners will walk away with tax-free US$8.7B profit in 2022. Meanwhile, Guyana must pay the company’s share of income taxes for 2022 from its projected US$957.6 million revenue.

kaieteurnewsonline.com 06 07 2022