By Juan Pablo Spinetto

With Donald Trump seemingly cruising to the Republican nomination in the US, attention is shifting to the November rematch with Joe Biden. But there’s another big election in North America this year that deserves your attention. On June 2, voters in Mexico will pick a new president, all 500 members of the Chamber of Deputies, all 128 members of the Senate, as well as leaders in nine states, representatives to state legislatures and officials for more than 1,500 municipalities. Polls show the ruling Morena party and its presidential candidate Claudia Sheinbaum to be in a very strong position, so much so that some commentators have argued that the election is already decided.

Yet the outcome is not a foregone conclusion, given the tendency of many voters to make up their minds at the last minute and the wide range of variables inherent in a contest of such scale. The scope of this transition promises to influence policy and business for years to come, with significant consequences for Mexico’s neighbors. So keep your eyes on these four factors that could upend expectations and radically shift the country’s trajectory.

Open Race

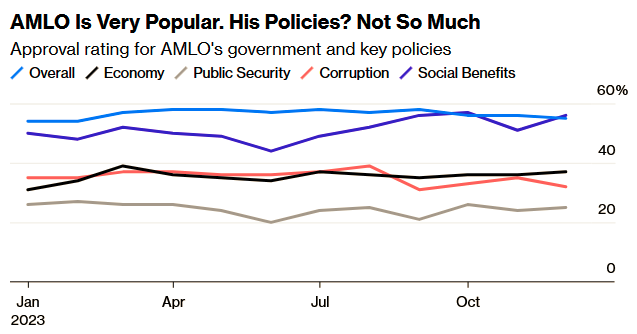

Sheinbaum’s lead in the presidential race is clear: With little more than 18 weeks to go, she holds an edge of 20-plus points in the polls (some say it’s more than 30 percentage points). The approval rating for Andrés Manuel López Obrador, know as AMLO, hovers at an impressive 55%-60% and has been stable for most of his six-year presidency. The economy is growing. Mexico is close to full employment. Morena controls most of the country’s states. Voters aren’t expressing the clear demand for change or animosity toward the incumbent that we have seen in other elections, most recently in Argentina. The candidate herself exudes confidence, recently declaring her party “is the strongest social and political movement on the planet.”

Yet despite all this, some signs suggest that Morena should worry: According to a recent survey by pollster Alejandro Moreno for El Financiero, the government gets the thumbs down in three key categories likely to be much on voters’ minds on election day. On the economy, 49% say AMLO is doing a bad or very bad job; on corruption, 45% argue the same; on the crucial issue of insecurity, 62% of Mexicans disapprove of the president’s strategy. Only in the realm of public social programs is AMLO accorded strong marks, with 56% approving the government’s support for the disadvantaged.

Note: 1,200 Mexicans adults polled by phone during December, 95% confidence, +/- 2.8% margin of error

Those numbers speak to a latent dissatisfaction on which the opposition has yet to capitalize, votes that could be up for grabs once Mexicans start paying more attention. Morena’s strategists have been promoting the idea that Sheinbaum’s victory is a done deal to give her an air of invincibility and keep the the undecided or indifferent disengaged. But the success of that tactic will be tested on voting day. As we saw elsewhere in Latin America, voters only tune in at the end and have a preference for new faces instead of established figures.

Xochitl Effect

After decades of rivalry, the main opposition parties — the PRI that governed for most of Mexico’s modern history and the pro-business PAN of former presidents Vicente Fox and Felipe Calderón — have joined forces to try to unseat Morena. The two parties remain unpopular and have deep differences that raise questions about their ability to work together in the event of a victory. But in agreeing on Xóchitl Gálvez, they still managed to pick a competitive and charismatic presidential candidate.

Gálvez is a self-made woman of indigenous background and just enough outsider appeal not to be associated with traditional party figures. I interviewed her last year and was struck by both her forward-looking ideas and combative spirit. Those qualities may serve to draw in an electorate that may not be following Mexican politics on a daily basis. As the pollster Moreno rightly pointed out, almost 27% of the electorate is under 30 years old: voters who aren’t loyal to parties, are informed mainly by TikTok and other social apps and care less about politics than previous generations. Only now, at the end of his mandate, has AMLO started a TikTok account; he didn’t do it before, he says, because he doesn’t speak fast enough.

The three presidential debates planned before the vote will give Gálvez a chance to go face-to-face against Sheinbaum, a workaholic who’s known to be more technocratic than charismatic. The odds may be against Gálvez, but a surprise can’t be ruled out in the closing stages of the election. Even if I would still bet on Sheinbaum, the race is likely to be more competitive than what’s generally seen now.

Congress Matters

Even if logic prevails and Sheinbaum ends up being Mexico’s first female president, her margin of victory will be critical. With AMLO pushing for Morena and its allies to attain a supermajority that would empower them to change Mexico’s constitution, the configuration of congress over the next sexenio will be as important as who’s going to be president. And it’s now way too early to make bets.

The fact is, AMLO has left some enormous challenges for his successor, from a rapidly weakening fiscal position and more than $100 billion debt at Pemex, the ailing national oil company, to a security crisis. Sheinbaum will also face pressure from her own leftist party, which has already showed it won’t necessarily march in lockstep as it did with AMLO — one more reason why the success of the next president will depend heavily on the extent of her congressional support.

AMLO’s Role

AMLO is heavily involved in his succession race and has made no secret of his willingness to do whatever it takes to guarantee that Sheinbaum achieves a supermajority. But in so doing, he’s also conditioning the inheritance he’ll leave for the next president.

He is calling for pension and minimum salary reforms before leaving, an expensive way to please the electorate. If anything, a series of corruption scandals that recently broke in the local press will prompt him to push harder for these shiny and costly gambits. On Feb. 5, he’s set to announce a package of other proposals with the same purpose: to retain the initiative, put the opposition in the awkward role of choosing whether to reject popular measures or give the ruling party a political win, and shape the next government’s policies.

The race may indeed be Sheinbaum’s to lose, but these and other factors mean the larger outcome is still uncertain. Remember, also, that elections are very violent in Mexico: More than 100 candidates, politicians and former officials were killed in the 2018 presidential vote, and things are likely to be much worse this time around. Moreover, the consensus among pundits projecting a Morena win doesn’t extend to the political configuration likely to result from it.

The game is still very much afoot, and it remains far from obvious how it will end.

______________________________________

Juan Pablo Spinetto is a is a Bloomberg Opinion columnist covering Latin American business, economic affairs and politics. He was previously Bloomberg News’ managing editor for economics and government in the region. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on January 26, 2024. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 01 29 2024