- IEA data showed Russian crude selling well below $60 threshold

- EU aims to keep limit at 5% below average market rates

Alberto Nardelli, Ewa Krukowska and Jennifer Jacobs, Bloomberg News

LONDON/BRUSSELS/WASHINGTON

EnergiesNet.com 03 21 2023

Group of Seven nations are unlikely to revise a price cap on Russian oil this week, despite initial evidence that crude is selling well below the current $60 threshold.

European Union member states were informed over the weekend by the bloc’s executive branch that there is little interest among the G-7 — in charge of setting and changing the price cap — to modify price levels at this stage, according to people familiar with the matter. Talks between the European Commission and the G-7 will likely continue beyond a summit of EU leaders taking place in Brussels this week, two of the people added.

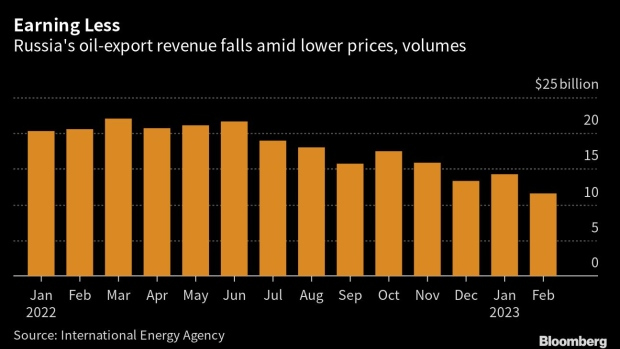

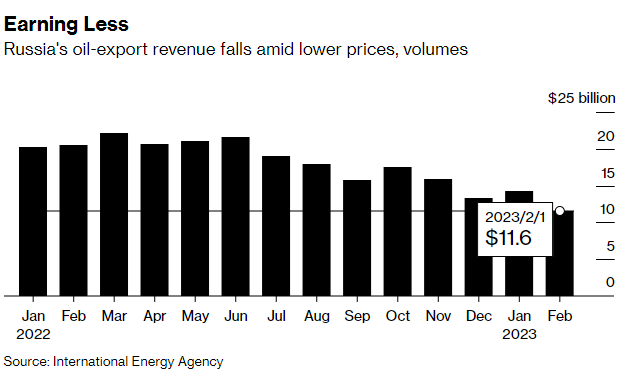

European countries and their allies have taken a number of steps to reduce Russia’s oil proceeds, a key source of revenue for the national budget, in order to limit the Kremlin’s ability to finance its war in Ukraine. Ceilings on the price of Russian crude oil and refined products are also designed to keep the country’s energy flowing onto world markets while curbing revenue.

The G-7 previously agreed to review the price level in mid-March, and EU legislation stipulates that the aim should be to keep the threshold at 5% below average market rates.

A report by the International Energy Agency last week showed that Russian crude oil and petroleum products sold for less than the price cap last month. The weighted average export price of Russian crude was at $52.48 a barrel, excluding shipping and insurance costs. Urals crude, Russia’s key export blend, sold for $45.27 in the Black Sea market, while blends such as ESPO, Sakhalin and Sokol, designed to be sent to Asia, traded well above the cap, according to the IEA.

A spokesperson for the commission didn’t immediately comment. Treasury spokeswoman Megan Apper said last week that the IEA report underscores the price cap is working, limiting Russian revenues and its ability to fund its war while keeping energy markets well-supplied.

Read more: Russia’s Oil Revenue Drops Sharply as Price Caps Work, IEA Says

Poland and the Baltic nations have been pushing to lower the price cap to at least $49 to place additional pressure Russia’s finances, an EU diplomat said. Estonian Prime Minister Kaja Kallas said on Twitter last week that it’s “time to review and lower it further to cut Russia’s ability to wage war against Ukraine.”

EU ambassadors were told on Sunday that G-7 discussions showed no signs of changes, two people familiar with the negotiations said. The commission told the diplomats that discussions would continue, including after this week’s summit of EU leaders, and the bloc’s executive arm would continue to engage with the G-7 on the basis of data provided by the IEA, the people said.

Nations such as the US have been less inclined to alter the price levels, arguing that the cap is working as Russia’s revenues are down and its costs are up, while oil continues to flow on the global markets, the people said.

However, measuring the impact of the cap itself is complex, in part because it was introduced in parallel to an EU embargo that cut Moscow off one of its largest markets.

A group of researchers recently reported that Russia has been selling some of its oil above the price cap and recommended stepping up enforcement.

Under the agreed rules, EU and G-7 companies can only provide shipping and services such as insurance needed to transport Russian oil to third countries around the world when the products have been purchased at or below the price threshold. Russia is free to transport and sell oil at any price if it doesn’t use G-7 and EU services and vessels.

EU and G-7 firms providing ships and those services must carry out due diligence and collect attestations showing that the oil was purchased below the agreed price threshold. The records have to be kept so that government authorities can access them in the event of checks and investigations. But it’s essentially a self-regulatory regime with few controls and active reporting requirements that depends on companies playing by the rules and national authorities’ willingness to check.

bloomberg.com 03 20 2023