Joy Wiltermuth, MarketWatch

SAN FRANCISCO

EnergiesNet.com 01 27 2023

U.S. gasoline prices have shot up an unusually strong 9.2% in January to average about $3.50 a gallon as of Thursday, which could throw a wrench in the Federal Reserve’s inflation fight, according to Bespoke Investment Group.

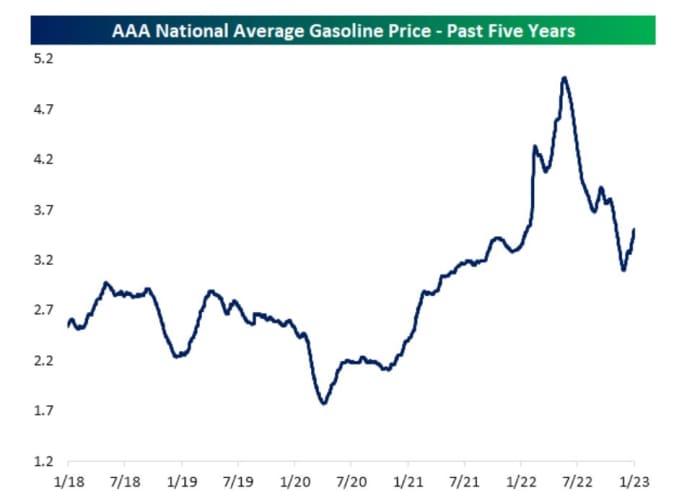

Prices at the pump fell sharply in the second half of 2022 to a low of $3.096 a gallon on Dec. 22, giving back all six months of earlier gains, plus some (see chart), according to Bespoke, when looking at the AAA reading of national average gas prices.

“Roughly one month out of that [Dec.] low, national average gas prices have risen 12.9% for the sharpest one-month increase since last June,” Bespoke analysts wrote in a Thursday client note.

Gas prices tend to be seasonal, often rising in the first six months of a year. The Bespoke team also found that double-digit monthly increases haven’t exactly been rare since mid-2004.

Last year gas prices were particularly volatile, jumping to a record above $5 a gallon in June, but falling back to around $3 a gallon in December, a factor credited with helping pull U.S. inflation down from a 9.1% annual peak last summer to 6.5% in December, based on the consumer-price index.

However, in a “seasonally unusual pattern” gas prices “have rocketed higher throughout January,” according to the Bespoke team. “Whereas prices have historically risen an average of less than 1%” year-to-date through Jan. 26, “this year the increase has been 9.16%.”

While refinery issues play a role, as does global energy demand with China’s easing of its COVID restrictions, higher gas prices in January already have “negative implications for inflation data,” according to Bespoke.

Specifically, the Cleveland Federal Reserve Bank’s “Nowcasting” reading in recent days has pegged the January consumer-price index as up 0.58%, month-over-month. It fell 0.1% in December.

U.S. stocks SPX, +1.10% have rallied to start 2023, partly on hopes that the Federal Reserve will raise its rate by a smaller 25 basis points increase at it policy meeting next week, and potentially cut rates next winter.

Fed officials have said its rate could peak above 5% this year, and stay high for some time, as it works to bring inflation down to its 2% annual target.

“I think the markets have talked themselves into a position that they are going to lose,” said Kent Engelke, chief economic strategist at Capitol Securities, adding that energy prices the have come down are heading back up, which could keep inflation elevated.

“I believe they are going to continue to go higher,” he said of energy prices, in a phone interview. “But the markets have convinced themselves that the Fed is going to lower interest rates in the second half of 2023.”

Oil prices ended higher Thursday, with West Texas Intermediate crude for March delivery CL.1, 1.42% CL00, 1.42% CLH23, 1.42% up 1.1%, to settle at $81.01 a barrel on the New York Mercantile Exchange.

marketwatch.com 01 26 2023