William Watts , MarketWatch

NEW YORK

EnergiesNet.com 06 10 2022

Gasoline futures surged Thursday, logging another record finish, while oil futures edged down after hitting a three-month high.

Price action

- West Texas Intermediate crude for July delivery CL00, -0.61% CL.1, -0.61% CLN22, -0.61% fell 60 cents, or 0.5%, to finish at $121.51 a barrel on the New York Mercantile Exchange.

- August Brent crude BRN00, -0.62% BRNQ22, -0.62%, the global benchmark, declined 51 cents, or 0.4%, to settle at $123.07 a barrel on ICE Futures Europe. Both WTI and Brent ended Wednesday at their highest since March 8.

- Back on Nymex, July gasoline RBN22, -0.80% jumped1.3% to finish at a record $4.2762 a gallon.

- July heating oil HON22, -0.04% rose 2.1% to $4.4037 a gallon.

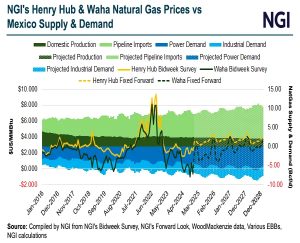

- July natural gas NGN22, +0.23% gained 3% to close at $8.963 per million British thermal units.

Market drivers

Strong U.S. gasoline demand remains a driver for oil futures, analysts said. The Energy Information Administration on Wednesday reported that gasoline inventories fell by 800,000 barrels last week, with implied demand jumping even as pump prices hit records.

With summer driving season under way in the U.S., analysts said oil was likely to remain underpinned by tight product inventories.

“Whatever weakness emerges for crude will likely be short-lived as this will be one of the busiest driving seasons ever. The pent-up demand for vacation and travel will be front-loaded and demand for crude will be robust even if gas prices make a move towards $6 a gallon,” said Edward Moya, senior markets analyst at Oanda, in a note.

Pressure on oil futures, however, were attributed by analysts, in part, to renewed lockdowns in Shanghai. A lifting of COVID-19 restrictions earlier this week had been credited with boosting crude back toward the March highs.

Natural-gas futures saw volatile trading, losing ground after a fire at one of the country’s largest liquefied-natural-gas export facilities on Wednesday. The Texas facility operated by Freeport LNG has capacity of 2 billion cubic-feet a day, equal to around 2% of U.S. output, according to Dow Jones Newswires.

Natgas bounced Thursday after the Energy Information Administration said the amount of the fuel in storage rose by 97 billion cubic feet last week, in line with expectations from analysts surveyed by The Wall Street Journal. That leaves natural gas in storage 340 billion cubic feet below the five-year average.

marketwatch.com 06 09 2022