By Ben Geman and Andrew Freedman/AXIOS

WASHINGTON

EnergiesNet.com 01 27 2022

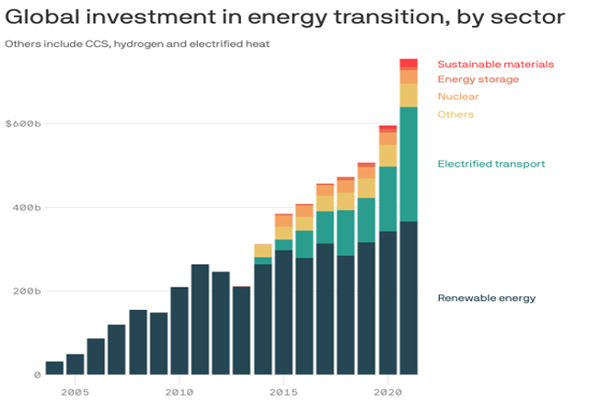

The world invested $920 billion in clean energy deployment and innovation in 2021, a record high. However, in order to meet the goal of net-zero emissions by 2050, this figure must at least triple in the next few years, warns a report out today from BloombergNEF, Andrew writes.

Why it matters: This report provides a crucial snapshot of where public and private sector money is helping to shift economies away from their reliance on fossil fuels and meet climate goals.

The big picture: The report shows that global energy investment for the deployment of clean energy totaled $755 billion last year, up from $595 billion in 2020, while finance for new climate tech came to $165 billion.

- On the deployment side, while the largest sector may have been renewable energy, with $366 billion, the standout was electrified transport, which hit $273 billion. That was a 77% boost from the year before, BloombergNEF found.

- If current trends hold, EVs and related charging infrastructure would overtake renewable energy investment in 2022.

- While investment rose to record levels in all regions, the fastest growth was the Asia Pacific, which also had the highest investment, at $368 billion. Much of that occurred in China, where energy deployment funding hit $266 billion.

- The only sector that did not see an increase in investment in 2021 was the deployment of carbon capture and storage, which stood at $2.3 billion.

Yes, but: While money going to clean energy deployment has climbed steadily since 2013, it is nowhere near where it needs to be in order to avoid some of the worst consequences of global warming, the report finds.

- According to BloombergNEF’s scenario for meeting net-zero emissions by 2050, funding for clean energy deployment needs to average about $2.1 trillion between 2022 and 2025, or about three times last year’s level.

- The report finds that only the transport sector may be on track for a spending increase at a rate consistent with a net-zero scenario. Renewable energy deployment spending during the past five years has increased at a comparatively slow rate of just 6%.

- To meet the net zero target, clean energy transition investment would need to double again between 2026 and 2030, to about $4.2 trillion per year.

What they’re saying: “It’s really great to see a big total like 750 billion,” Albert Cheung, head of global analysis at BloombergNEF, told Axios. “It’s more than we’ve ever seen.” “We are moving in the right direction, we are accelerating. And yet there’s a huge mountain to climb very shortly actually to get on track.”

axios.com 01 27 2022