reuters

Reporting by Neil Marks and Marianna Parraga, Reuters

GEORGETOWN/HOUSTON

EnergiesNet.com 09 06 2022

Guyana could bank about $1.25 billion this year from the sale of oil as its share of offshore production and royalties, up 30% from a prior estimate, the government’s finance ministry said over the weekend.

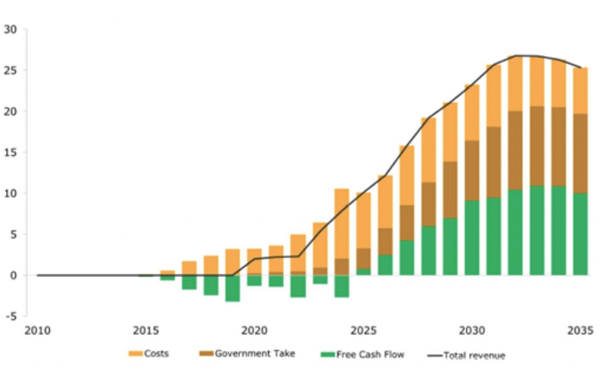

Historically one of South America’s poorest nations, Guyana this year expects proceeds from oil discoveries off its coast to jump on a tripling of output. An Exxon Mobil-led consortium opened a second production facility this year, and four more are planned through 2027.

Guyana received through mid-year five cargoes of oil worth $307 million from the two vessels and $37 million in royalties, the government said on Saturday. It expects eight more cargoes through year-end for a total of 13.

Hess Corp, which holds a 30% share of the consortium, in July forecast it will receive about 26 cargoes of 1 million barrels this year. The consortium’s total production is 360,000 barrels per day, it said.

Guyana’s $1.25 billion revenue projection is up $290 million from an earlier forecast of $958 million here from oil production, royalties and interests. The amount could change with oil price fluctuations, it said.

Oil is up this year on rising demand and turmoil from Russia’s invasion of Ukraine. Brent crude futures on Friday traded at about $93 per barrel, up 19.6% year-to-date. In April, Guyana received $106 per barrel for one cargo, compared to $76 per barrel from a mid-2021 sale.

The country’s gross domestic product grew 36% in the first six months, led by a 73.5% gain from the petroleum sector. Total oil production reached 34.6 million barrels in the first half of the year, the ministry said.

Guyana’s Natural Resource Fund, which collects the county’s oil proceeds, contained $753.3 million at mid-year, after withdrawing $200 million in May, the ministry reported.

Reporting by Neil Marks and Marianna Parraga; writing by Gary McWilliams; Editing by Bernadette Baum

reuters.com 09 05 2022