Kaieteur News

GEORGETOWN

EnergiesNet.com 06 06 2022

The bountiful oil scenario in Guyana has served as a major lifeline to foreign operators such as Hess Corporation which has a 30 percent stake in the over 6 million-acres Stabroek Block it shares with partners, US-based ExxonMobil and Chinese company, China National Offshore Oil Corporation (CNOOC). In fact, Hess is seeking to lure investors with the unprecedented level of positive fiscal returns coming from Guyana’s oil discoveries.

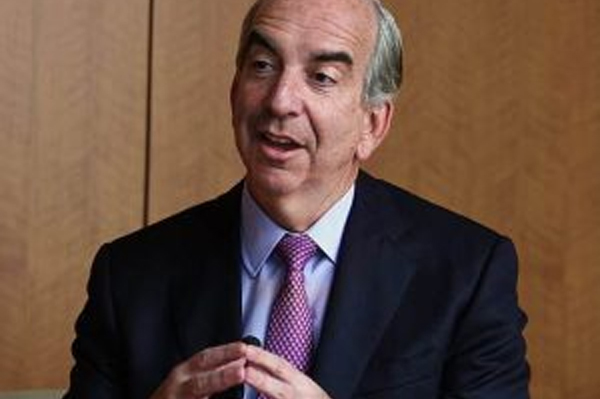

During the Bernstein’s 38th Annual Strategic Decisions Conference held in New York on Thursday (June 2, 2022), Hess Corporation’s Chief Executive Officer (CEO) John Hess spoke extensively on the many positives coming out of the Stabroek Block. Hess told attendees that Guyana is the fastest growing offshore development globally, with significant value coming out of that venture.

He said that in discussion with partner agency, ExxonMobil during the country’s initial oil find in 2015, former CEO Rex Tillerson had denoted the company’s intention to go as fast as it can, while preventing any leakages. What this means, Hess explained, is that Exxon, with operator rights and the largest shareholder in the block with 45 percent, wants to maintain the growth of the offshore fields while maintaining capital and operating efficiency.

Despite the huge undertakings involving project management and other industry supporting tasks such as procuring large storage vessels, Hess lauded Exxon as being the best in the business to do the necessary work. As such, where Guyana is concerned, he described Exxon’s philosophy of design one (floating production storage and offloading unit (FPSO) build many as being industry leading.

“And we have a page in our investor pack that actually shows our development of oil production is two to three times faster than any other global offshore development. So we are going fast and we are bringing value forward,” Hess related. He continued that Guyana’s offshore operators are going as fast as one can and still maintain capital and operating efficiency in such a deepwater operation. Guyana’s operation could also be two to three times better than any other industry player, the Hess boss boosted.

Additionally, Hess explained, that to be successful in the oil industry business companies must grow their resources; something the company was most recently criticized for. He continued that the discussion among investors at the time was for the company to stop investing and that they should return investor’s money. “We said look, we have higher returns specifically in Guyana. We are going to benefit from that investment as we grow the resources, we grow the cash flow.”

“Now that we have the second ship on, every ship at US$65 dollars Brent adds a billion a year of EBITA (Earnings before interest, taxes, and amortization). And as a consequence our cash flow, because we have these low cost developments coming on every year, our cash flow growth is 25 percent a year compounded each year for the next five years. And quite frankly with more ships, it can actually go out to 20, 30.”

Reiterating the company’s position of growing resource for success, Hess described Guyana’s oil as being low cost, high margin, low carbon footprint crude. He said this quality of crude would be needed in the next 20 years, and the quality product also gives the Stabroek Block operators an advantage compared to what operators are getting at other locations. Hess noted too, that while in some locations, and at this time it takes as much as five years to bring a field to production, it is about three years in Guyana. “Guyana is actually different. It is accelerating oil development and production which the world is going to need,” Hess said. Hess informed that in March the company increased dividend by 50 percent and is expected to grow again in the near future.

kaieteurnewsonline.co 06 04 2022