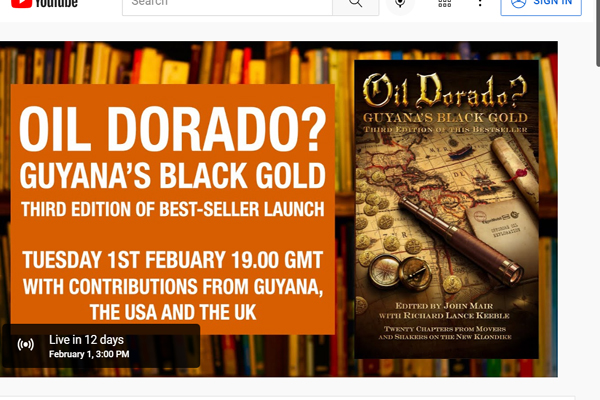

Oil Dorado? Guyana’s Black Gold | Live Book Launch

YouTube Tuesday February 1, 2022

Guyana Energy Conference and Expo 2022

February 15-18, 2022

- 150 companies, four heads of state confirmed for February energy conference | OilNow

BOOK: From Rags to Riches: Is Guyana Ready for the Oil Bonanza? – by Terence M Yhip | Guyanese Online

Persaud, Guyana and inattention | Commentary | Jamaica Gleaner

The Santiago Principles and the NRF Act 2021 (Final Part): Stabroek News (Columnist) Accountability Watch by Anand Goolsarran

Tomorrow, Transparency International will be releasing its 2021 Corruption Perceptions Index (CPI) along with a comprehensive look at corruption over the last decade indicating which countries have improved or regressed over this period. Anti-corruption advocates worldwide, civil society organizations and the academia will be eager to learn how their countries have been rated and ranked on the Index. In 2012, Guyana’s CPI score was 28 out of 100. Eight years later, it moved to 41. This 13-percentage point increase occurred mainly during the last five years when its CPI moved from 29 in 2015 to 41 in 2020. The largest increase was in 2016 when the score moved from 29 to 34.

Several companies prequalified for Gas-to-Shore project: Guyana Times

Progress is being made on the Gas-to-Shore project, with 13 companies being prequalified for the construction of the natural gas-fired power plant and the natural gas liquids plant components of the project. During last Thursday’s bid opening at the National Procurement and Tender Administration Board (NPTAB), it was recorded that 12 bids from local, regional and international firms were received. Among the companies whose Expressions of Interest were deemed acceptable enough to earn them prequalification, were CH4 Guyana Incorporated in collaboration with Lindsayca Incorporated, a Texas-based company.

U.S. eager to help Guyana with oil spill plan but, silent on absence of full coverage insurance from oil companies: Kaieteur News

The US Embassy here recently announced that the United States Coast Guard (USCG) and the Guyana Civil Defence Commission (CDC) commenced a six-month series of joint activities designed to assist Guyana in the development of a reliable national response system for oil spills while enhancing the CDC’s maritime oil spill prevention, planning, and response capabilities. Kaieteur News understands that the USCG is able to do this with support from the US Department of State’s Energy and Mineral Governance Programme (EMGP).

Audit report on Exxon’s US$460m pre-contract costs still to be released by gov’t: Stabroek News

-opposition seeking answers in Parliament today

Despite promises that oil and gas transactions would be transparent and the public would be kept up to date, the audit by UK firm IHS Markit of the US$460M in pre-contract costs claimed by ExxonMobil still has not been released by government and the opposition will today be asking for answers when the National Assembly meets. “Can the Minister confirm that the audit of ExxonMobil pre-contract costs of US$460M was completed? If yes, can the Minister provide the Parliament with a copy of the Audit Report?” questions on a notice paper to Minister of Natural Resources Vickram Bharrat from oil and gas Shadow Minister, David Patterson stated.

Labour relations conference for O&G companies in the works: Guyana Chronicle

-to focus on labour laws, penalties for breaches

THE Ministry of Labour (MoL) is planning to host a labour relations conference with approximately 80 companies involved in Guyana’s oil and gas sector by this month-end. During a recent interview with the Guyana Chronicle, subject minister Joseph Hamilton shared that invitations for the conference which will tentatively be held on January 28, have already been sent out to the companies. He sees the conference as a pivotal event, as it will be used to put the companies on notice regarding areas where they are breaching labour laws in Guyana and sanctions that will be imposed for non-compliance.

Court challenge to ‘tax-free ride’ in Exxon deal could level playing field for Guyanese – Ram: Kaieteur News

The recent legal challenge filed by Kaieteur News Publisher, Glenn Lall via his lawyer, Mr. Mohamed Ali, against the extraordinary tax-free ride given to the affiliated companies and subcontractors of ExxonMobil, Hess Corporation and CNOOC Limited as noted in the Stabroek Block Production Sharing Agreement (PSA) could, if successful, level the playing field for locals that struggle to compete in the industry. This is the viewpoint of Chartered Accountant and Attorney-at-Law, Christopher Ram in his column titled, “Every Man, Woman and Child Must Become Oil-Minded” which was published in the Stabroek News.

Nominee to procurement commission named as Managing Director of shore base company: Stabroek News

Days after he was named as a nominee of the Public Procurement Commission (PPC), financial analyst Joel Bhagwandin was appointed as the Managing Director of an oil and gas shore base company, TriStar Inc. The appointment will raise various questions as PPC members are meant to be full-time employees even though some of the previous members were allowed to undertake other jobs. Further, with the rapid expansion of state contracts in the oil and gas sector, observers say it is possible that a conflict of interest could arise where Bhagwandin might have to adjudicate in cases that might come to the PPC connected to shore bases.

ExxonMobil and the regulators: Stabroek News (Editorial)

It is increasingly clear that ExxonMobil’s business of unbridled extraction of oil offshore Guyana has taken pre-eminence over responsible governance and regulatory authority. There is no starker evidence of this than the contentment, if not jubilation, in government circles that US$607m in Guyana’s oil earnings will be emptied from the nascent Natural Resource Fund into the Consolidated Fund for expenditure this year. The debate is now being shaped around what prestige projects this sum will be spent on instead of the repercussions of this huge injection into the economy and most importantly whether the take thus far shouldn’t have been much higher.

As much as US$600 million could be delivered per year from local content targets, says Guyana VP: OilNOW

Guyana’s Vice President Dr. Bharrat Jagdeo says the administration is leading from the front to ensure the country of just over 750,000 people benefit from the more than 10 billion barrels of oil equivalent resources which have been found offshore since 2015. “I don’t think any country has led more from the front as we have recently on ensuring that their people benefit from oil and gas resources,” Mr. Jagdeo said during an interview last week with the National Communications Network. “I’ve examined the experience of Trinidad and Tobago, many of the other countries on ensuring this.”

Guyana receive bids for combined construction of gas-to-energy facilities: OilNOW

Bids from 12 companies were opened last Thursday for the combined construction of a natural gas fired power plant and natural gas liquids (NGL) plant for Guyana’s landmark gas-to-energy project. According to an update from the Department of Public Information, the 12 bidders include Amerapex Cooperation (USA); NGC Group (Trinidad and Tobago); China Machinery Engineering Cooperation; CEPCOII Electric Power; CH4 Guyana Incorporated and Lyndsayca Incorporated; China Enegy International Guyana Company Limited; Apan Energy; Wison Offshore and Marine Limited; Constutora Queiroz Galvao; Tecnicas Reunidas; and Power China International Group Limited.

Guyana gas projects pique Chinese interest | Argus Media

Net-Zero emissions by 2050 a development priority for the region- President Ali – News Room Guyana

Elevated geopolitical risks in Europe, Middle East push oil prices up: OilNOW

(Reuters) – Oil prices rose on Monday on worries about supply disruption amid concerns about Russia-Ukraine discord and rising tensions in the Middle East, which could make an already tight market even tighter. Brent crude rose 31 cents, or 0.4%, to $88.20 a barrel by 1009 GMT. U.S. West Texas Intermediate (WTI) crude gained 21 cents, or 0.3%, to $85.35. “Oil prices are profiting from supply risks and geopolitical tensions,” said Commerzbank analyst Carsten Fritsch.

More jobs, social services promised with new Tristar Energy Park – News Room Guyana

Dr. David E. Lewis

Vice President

Manchester Trade Ltd. Inc.

International Business Advisors

2200 Pennsylvania Avenue NW – 4th Floor

Washington, DC 20037

Tel 202-507-5669

Email: DavidLewis@ManchesterTrade.com

Web: http://www.ManchesterTrade.com

Skype: ManchesterTrade.Lewis