By Kiana Wilburg

Guyana has sanctioned four projects thus far in the ExxonMobil-led Stabroek Block: Liza Phase One, Liza Phase Two, Payara, and Yellowtail.

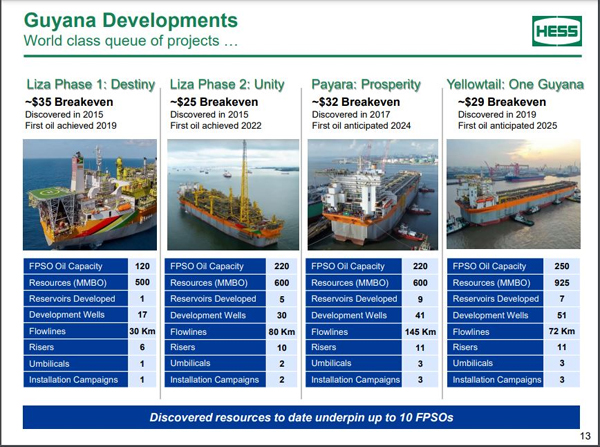

Liza Phase One, which commenced production in 2019, carries a breakeven of US$35 per barrel. It also utilises the Liza Destiny Floating Production Storage and Offloading (FPSO) Vessel which will be producing up to 140,000 barrels of oil per day following a period of optimisation. The total resource estimate for the Liza Phase One Project is 500 million barrels of oil.

As for Liza Phase Two, it achieved first oil this year and utilises the Liza Unity FPSO. Its daily production capacity will soon reach 220,000 barrels of oil per day with a US$25 breakeven. The resource estimate for this project is 600 million barrels of oil.

The Payara field was initially anticipated to reach first oil in 2024 but that date has been brought forward to the latter part of 2023. It will produce up to 220,000 barrels of oil per day and carries a resource estimate of 600 million barrels of oil. Its breakeven per barrel is $32 and it will utilise the Prosperity FPSO.

The most recently sanctioned project for the Stabroek Block is Yellowtail and it is poised to utilise the ONE GUYANA FPSO. Kaieteur News understands that it will likely achieve first oil in 2025 and produce up to 250,000 barrels of oil per day. Exxon and partners have said over a 20-year life cycle, it will produce 925 million barrels of oil from the field with a US$29 breakeven per barrel.

From these four projects alone, all of which carry a 20-year life cycle, Guyana will produce 2.6 billion barrels of oil. At US$112 per barrel Brent, this would amount to US$294B or GYD$61.5 trillion worth of oil.

ExxonMobil has said that the resource estimate for the Stabroek Block has increased to almost 11 billion barrels of oil with potential for up to 10 FPSOs. If the magnificence of the reserve has not hit home as yet, here are some other perspectives for consideration.

By the end of the decade, Head of Upstream Oil and Gas at ExxonMobil, Liam Mallon has said oil production from Guyana could exceed one million barrels a day – enough to make us one of the world’s top 20 producers. He noted in one of his recent blogs that the increased resource base represents more than 10 percent of all the new conventional resources discovered anywhere in the world between 2015 and the end of last year. (https://energyfactor.exxonmobil.com/perspectives/guyana-oil-gas-production/)

Dr. Zainab Usman, a senior fellow, and director of the Africa Programme at the Carnegie Endowment for International Peace in Washington, D.C has also spoken about the significance of the country’s reserves as she noted in an analytical piece that Guyana’s oil wealth could result in oil earnings that are beyond what Qatar, Kuwait, and Norway earn on a per capita basis by 2025.

With such mammoth-sized resources, Guyana is poised to be a key player in the global oil and gas sector given her advantaged, low carbon barrels. Importantly, just recognition of her black opulence must be met by just management of this endowment so that future generations are able to benefit too.

To do so, there are several keys Guyana’s leaders must use to unlock and maximise value from the US$61T in projects sanctioned to date. These keys include but are not limited to the following:

1) Conduct timely audits of cost recovery statements by oil operators

2) Ensure the Local Content Law is effectively implemented

3) Putting in place appropriate and independent technology offshore to monitor the measurement of oil remotely

4) Outline benchmarks for what constitutes meaningful Corporate Social Responsibility from oil companies

5) Establish a Decommissioning Policy

6) Outline a structure for what is to be expected in Field Development Plans

7) Strengthen key auditing agencies, specifically the Office of the Auditor General

8) Strengthen institutions that will be responsible for the expenditure of the oil money-including the Ministry of Finance, the Ministry of Public Infrastructure and the Ministry of Health

9) Improve Guyana’s capacity to monitor and record emissions offshore, particularly in the case of the Environmental Protection Agency (EPA)

10) Provide resources to the EPA so that it can make unannounced visits to the FPSOs while following safety standards

11) Hire technical experts needed within the Ministries of Natural Resources, EPA, the Guyana Geology and Mines Commission (GGMC), the Guyana Revenue Authority (GRA), etc. to ensure proper contract administration

12) Update our oil laws and regulations to address issues of ring-fencing, health and safety of workers, monitoring of the environment (regarding issues such as flaring and stiffer penalties for such infractions), pre-qualification criteria for oil blocks, etc.

13) Establish a Petroleum Commission

14) Implement appropriate fiscal policies and sound public financial management (PFM) infrastructure

15) Ensure amendments to the Income and Corporation Tax Acts to minimise tax avoidance.

16) Build capacity for revenue forecasting, modeling, and tax administration

The foregoing recommendations are but a few of the many mechanisms Guyana must put in place to realise its goals as it embarks on a transformational pathway with its oil.

As a brief reminder, I wish to note that one should not be fooled for one moment that oil discoveries automatically guarantee high incomes. Angola, Indonesia and Nigeria are all among the world’s top 20 oil producers but they remain lower-middle-income due in large part to their low-rents per capita.

Additionally, attaining high-income status from natural resources wealth does not translate into improved human development outcomes. This was explicitly noted by Dr. Usman, and we, like many others, concur with her views. (https://www.kaieteurnewsonline.com/2022/04/20/guyana-will-need-more-than-updated-laws-proper-oversight-for-oil-to-be-springboard-for-development-expert/).

It is on this premise that I argue, for Guyana to truly be the Kuwait, Oman, Qatar, and the Saudi Arabia of this region, we have got to do our part in good governance.

Exxon is doing its best by its shareholders; the onus is on us to do same or more for current and future generations.

_____________________________________________________

Kiana Wilburg is a Senior Journalist at Kaieteur News, specialising in the oil and gas industry. China Guyana offshore oil. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Kaieteur News on May 15 , 2022. EnergiesNet.com reproduces this article in the interest of our readers. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of socially, environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 05 16 2022