– 10 percent royalty, 50/50 profit sharing, signing bonuses, 10 percent corporation tax among benefits for new agreements

– penalty to be implemented for not meeting work programme

Kiana Wilburg, Kaieteur News

GEORGETOWN

EnergiesNet.com 11 07 2022

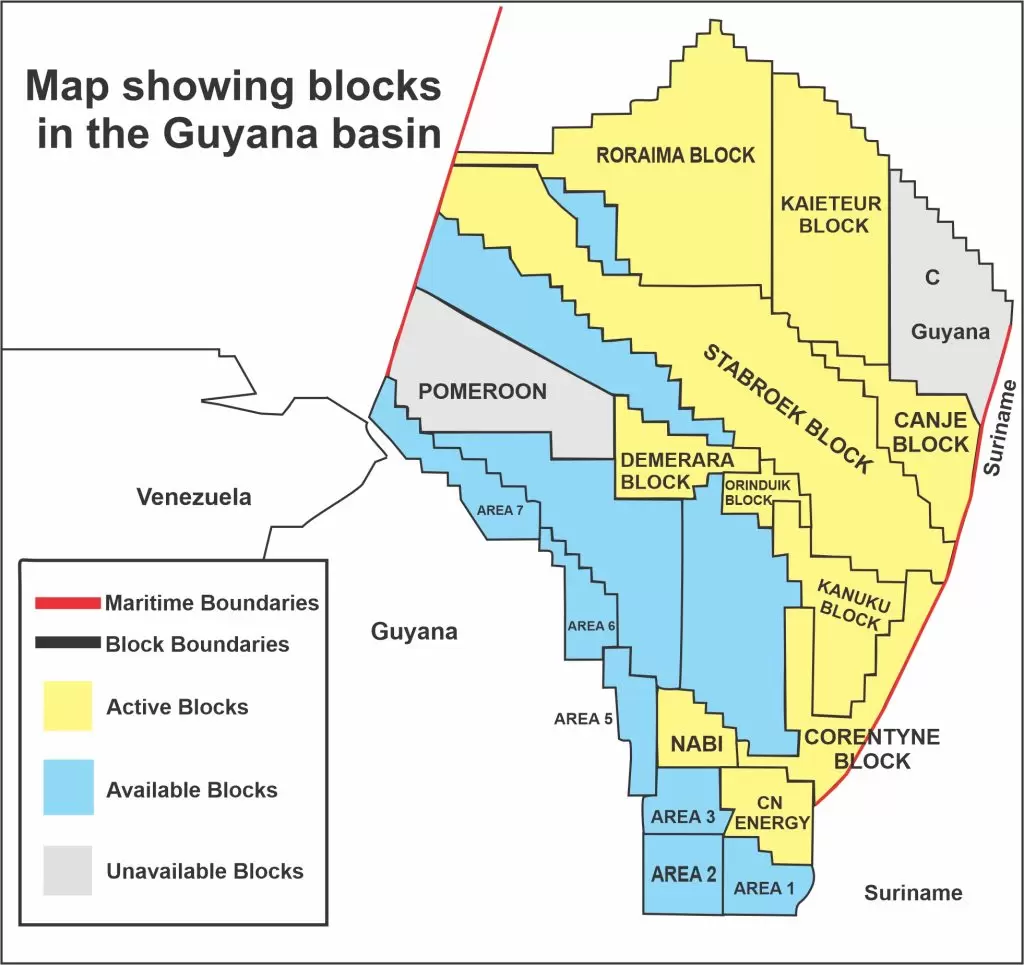

Vice President, Bharrat Jagdeo on Thursday announced that Guyana will put on auction 14 oil blocks in its first such exercise since finding oil. The auction will last for five months.

Speaking to members of the media at a news conference held at the Office of the President, Jagdeo said Petroleum Agreements for these blocks will also feature new fiscal terms. These include: a 10 percent royalty, 50/50 sharing of profit oil and a 10 percent Corporation Tax. He said these terms, among others, were had following work that was undertaken with several consultants. Jagdeo said IHS Markit, a leading information services provider headquartered in the UK is taking lead on guiding The Guyana Government on the auction.

The Vice President said: “We decided to auction 14 blocks and these would range from about 1000 square kilometres to 3000 square kilometers with the majority of them being close to 2000 square kilometers. Eleven of these will be in the shallow area and three in the deep Area C,” the former Guyanese leader said.

He explained that the new fiscal regime which will not only apply to the auction but also all subsequent Production Sharing Agreements (PSAs) to be signed for areas such as the Kaieteur and Canje oil blocks. He was keen to clarify that it will not apply to the ExxonMobil-led Stabroek Block which holds all of Guyana’s commercial discoveries thus far.

In addition to the 10 percent royalty, Jagdeo said government also agreed for there to be a 65 percent cost recovery ceiling in a given year. The Vice President said, “We have the consultants working to strengthen the (model) PSA in a number of other areas. The laws of the country will also be amended accordingly to support the auction.”

Jagdeo noted that IHS is a global powerhouse which monitors the pulse of the industry. In light of this, it was able to determine that Guyana is not the only country vying for the interest of investors via auctions. He said 65 countries in this 2022 period are either doing a bid round or launching one. The United Kingdom for example has launched a massive bid round with over 900 oil and gas blocks up for grabs. “We know the funds are scarce largely because of climate change targets companies have to meet too. It is harder to raise funds for the sector because we have some cases where loans garnered by companies are being vetoed for the oil sector. We have seen globally from the international oil companies as well that about 70 to 80 percent of their total spending used to go to upstream activities,” the Guyanese Vice President said.

Jagdeo said by 2025, this is anticipated to drop around 60 percent. He said too that some companies are even shaving off global assets due to climate change commitments. Even with such an environment, Jagdeo said he believes Guyana will succeed with the new fiscal formula to be applied to oil contracts going forward.

LOCALS HAVE A CHANCE

Importantly, Jagdeo said Guyanese will have a chance to compete alongside foreign entities for the oil blocks and that there will be minimum technical and financial qualifications that have to be met. “We don’t want it to be too onerous. The qualifications will be more stringent for the ultra deep areas because only few companies can work there,” the Vice President said.

He also shared that government will be asking for a minimum signature bonus of US$20M for companies that win the deepwater blocks and US$10M for winners of the shallow water concessions. The former President said there are no restrictions on how many blocks a company can bid for but three is the most one company can get.

RELINQUISHMENT

Jagdeo said government will also tighten up relinquishment provisions for the awarded blocks. In this regard, he said companies will be able to hold the blocks for 10 years and have an initial three year period to do seismic work. Once that period expires, the company would have to give up 50 percent of the block. Two extensions, each carrying a one-year lifecycle, will be granted to execute the drilling programmes. The VP said this aggressive relinquishment approach is being taken to prevent companies from sitting idly on the blocks and preventing the country from making full use of it.

Importantly, he said the companies would have to outline how much they plan to spend on their seismic work. If they don’t commit to it, they would be penalised. In this regard, he said the company would be made to pay the State the full amount committed for the work the seismic work. They would also lose the block. He said also that competing companies would be considered against each other for their work programme and spending therein as well as the signing bonus they are willing to pay.

RINGFENCING

One of the most highly criticised loopholes of the 2016 Stabroek Block Production Sharing Agreement (PSA) signed with ExxonMobil and its partners is the absence of ring-fencing provisions. Such clauses are necessary to protect the revenues of one producing field from being significantly decreased by expenses associated with another project. The International Monetary Fund (IMF) had said for example that Guyana runs the risk of having a smaller pie to take from the Liza Phase One Project since the money made from that development would be used by Exxon to offset costs associated with developing or drilling other fields. If there were ring- fencing provisions in place, Exxon would only be able to deduct expenses related to Liza One from the revenue made.

Jagdeo noted on Thursday that this was indeed an area of concern, hence none of the blocks put up for auction are as large as the Stabroek Block which stretches 26,800 square kilometres. As a result of most blocks being 2000 square kilometers, Jagdeo said there would be no need to worry about several projects being developed to the scale that is being done on the Stabroek Block. As is already being done, once a company signs a contract for any of the 14 blocks, they would not be able to take expenses from one block over to another. Jagdeo said the bid round will be launched soon and last for five months.

kaieteurnewsonline 11 04 2022