- Oil output increased to 616,000 bpd from 391,000 bpd. Oil revenue rose to $2.57 billion, including crude sales, royalties

Kemol King and Marianna Parraga, Reuters

GEORGETOWN

EnergiesNet.com 01 20 2025

Guyana’s economy achieved its fifth consecutive year of double-digit growth in 2024, expanding 43.6% as oil output and exports showed solid increases, the Finance minister said on Friday, but the expansion is expected to slow this year.

Latin America’s newest oil producer last year became the region’s fifth-largest crude exporter after Brazil, Mexico, Venezuela and Colombia, and was identified as one of the main contributors to the growth of global oil supplies.

The oil sector expanded 57.7%, while the non-oil sector grew 13.1% last year, the minister said.

Oil output rose to an average of 616,000 barrels per day from 391,000 bpd the previous year as a consortium led by U.S. major Exxon Mobil (XOM.N) , which controls all production in the country, continued expanding operations and completed a key upgrade at its offshore facilities.

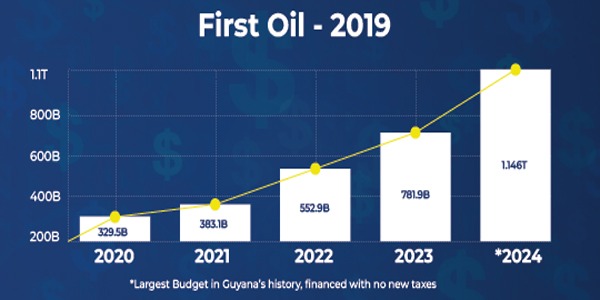

“Guyana’s economy continues to perform exceptionally well,” Singh said during the presentation of Guyana’s $6.63 billion public budget.

The economic growth is expected to slow in 2025, with a 10.6% expansion mainly fueled by the non-oil sector for the first time in years. Oil sector expansion is expected to slow from recent years to 9.5% growth, due to lower crude prices.

Guyana forecasts an average of $71.9 per barrel for its crude this year, down from $78-80 last year, which would secure about $2.2 billion in revenue from oil exports.

EXPORTS FLOWING

Energy minister Vickram Bharrat said this week the country exported 225 crude cargoes in 2024, with 28 cargoes of them shipped by the government from its share of oil produced by the Exxon group. In 2023, the government received and exported 136 crude cargoes, according to LSEG shipping data.

Guyana’s shipments last year met demand from European refiners for easy-to-process sweet crudes to replace some Middle Eastern grades, according to traders and the LSEG data.

The nation’s oil revenue increased to $2.57 billion in 2024, including crude sales made by the government and $348 million in royalties received from the Exxon group, compared with $1.62 billion in 2023, including $218.1 million in royalties.

A fourth floating oil production facility expected this year will add 250,000 bpd of output capacity to the Exxon consortium’s operations.

Reporting by Kemol King and Marianna Parraga; editing by Chris Reese, Daniel Wallis, Rod Nickel and David Gregorio

Reuters.com 01 17 2025