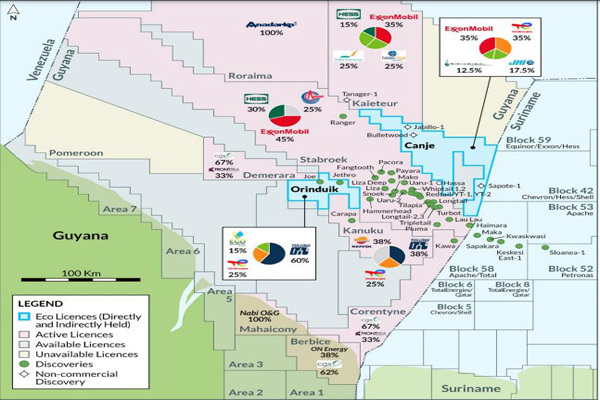

Map showing the location of the Orinduik Block

Kaieteur News

GEORGETOWN

EnergiesNet.com 03 23 2022

Eco (Atlantic) Oil & Gas Ltd., the exploration company focused on the offshore Atlantic Margins, was pleased to disclose on Monday that it updated its Competent Person’s Report (CPR) on its assets Offshore Guyana, Namibia and South Africa.

Kaieteur News understands that the CPR was compiled by WSP USA Inc., of Boulder Colorado, USA, an independent third-party auditor and can be found on the company’s website.

With respect to its Guyana asset, the main one being Orinduik Block, it was noted that the concession carries a best estimate of 8.1 billion barrels of unrisked oil and gas liquids along with 6.8 billion cubic feet of gas. It was observed from the report that 681 million barrels of oil and 544 billion cubic feet of gas are net to Eco.

Colin Kinley, Co-Founder and Chief Operating Officer of Eco Atlantic noted that given the company’s current strategy for increasing stakeholder asset base, it has focused solely on strategic acquisitions that can add material and near-term growth and catalysts for the company.

Kinley said, “The addition of the Azinam assets in Namibia and South Africa has quickly added prospective resources to our portfolio. As we work towards the completion of our recently announced binding term sheet to acquire JHI’s 17.5 percent interest in the Canje Block offshore Guyana plus the maturation of additional resources currently being interpreted from ongoing 3D processing in Block 3B/4B we expect to see even further growth of the portfolio from here in the coming months.”

Importantly, Kinley said Eco’s acquisitions and strategy to deliver mature drillable prospects in the near term is driven in part by the current heated energy market, the reduction in worldwide exploration, and the marked cycling it anticipates through energy transition in the coming years.

The COO said Eco has the capacity to participate and provide strategic value accretion through the drill bit. “…We are also confidently progressing towards drilling in Orinduik Block offshore Guyana, subject to available funding, and look forward to confirming a drill target and timing with our partners in the coming months,” Kinley stated.

Assuming the acquisition of JHI, one of the original Canje Block owners, completes as planned in the coming months, Kinley said this acquisition will also provide Eco with the opportunity to participate in a number of targets on the Canje Block as prospects are matured by ExxonMobil

ABOUT ECO

Eco Atlantic is an oil and gas exploration company with offshore licence interests in Guyana, Namibia, and South Africa. Eco has often said it aims to deliver material value for its stakeholders through its role in the energy transition to explore for low carbon intensity oil and gas in stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the company holds a 15 percent Working Interest in the 1,800 km2 Orinduik Block operated by Tullow Oil. In Namibia, the Company holds Operatorship and an 85 percent Working Interests in four offshore Petroleum Licences: PEL’s: 97, 98, 99 and 100 representing a combined area of 28,593 km2 in the Walvis Basin.

Offshore South Africa, Eco will soon become designated Operator and hold a 50 percent working interest in Block 2B, and a 20 percent Working Interest in Blocks 3B/4B operated by Africa Oil Corp., totalling some 20,643 km2.

kaieteurnewsonline.com 03 22 2022