Myra P. Saefong, Marketwatch

SAN FRANCISCO

EnergiesNet.com 12 02 2022

The European Union reached an agreement Friday for $60-a-barrel price cap on Russian seaborne oil, but analysts have already questioned the effectiveness of the cap.

The price cap will have “relatively little impact,” given that $60 is close to what Russia receives from China and India, said James Williams, energy economist at WTRG Economics.

Read The Wall Street Journal: EU Backs Russian Oil Price Cap of $60 a Barrel

Global benchmark Brent crude saw its front-month February contract BRN00, 0.25% BRNG23, 0.25% settled Friday at $85.57 on ICE Futures Europe.

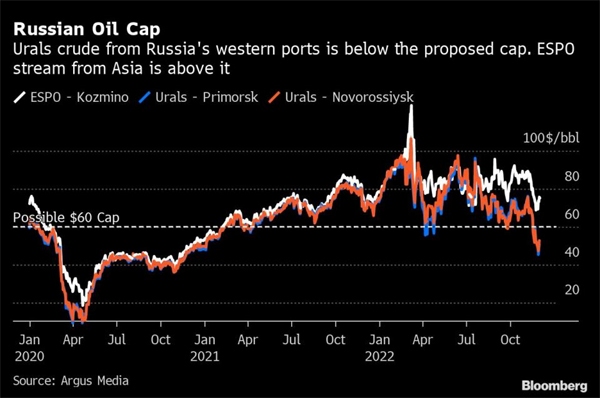

Russian Urals type oil, however, currently trades at a discount of $24 a barrel to Brent, according to Pavel Molchanov, an analyst at Raymond James.

Before the Russia-Ukraine war, the discount was only $1 to $2 a barrel, but it peaked at $35 this past summer, Molchanov told MarketWatch. That shows that in “wartime conditions, Russian producers are able to export [oil] only by offering cut-rate pricing to buyers,” he said.

The current discount between Russian Urals and Brent reflects a combination of legal and sanctions “headaches,” reputational risk of doing business in Russian, and it also means that the price cap is “equivalent to Brent in the mid-$80s” — on par with current spot pricing, says Molchanov.

Ursula von der Leyen, president of the European Union Commission, said in a video tweeted on Friday that the cap aims to strengthen the effect of EU sanctions, further diminish Russia’s revenues, and stabilize global energy markets because it “allows some Russian seaborne oil to be traded, brokered, transported by EU operators to third countries, as long as it is sold below the cap.”

The price cap will be adjusted over time so the EU can react to market developments, she said

Read: Why the EU ban and G7 price cap on Russian oil won’t guarantee a lasting rally for oil

In reaction the price cap news, John Kemp, a Reuters market analyst specializing in oil and energy systems, tweeted Friday that that price cap wasn’t going to be linked to market prices at first, but now will be subject to a review mechanism very two months.

So the price cap , “which is not really a cap, more a suggestion, is sort of $60, but not necessarily $60, and will be reviewed as early as January and then every two months thereafter,” Kemp said in a separate tweet.

The EU and U.K. ban on Russian seaborne oil takes effect on Monday, with a ban on Russian petroleum products to follow on Feb. 5, and the U.S. and Japan have already eliminated their historically modest imports from Russia, Molchanov pointed out.

Given all of that, he said the price cap is intended to have an “extraterritorial effect.”

It will be applied to all countries that are importing Russian oil, said Molchanov. China, India, and Turkey stand out as the major Russian oil importers that lack their own sanctions against Russia, he said.

Manish Raj, chief financial officer at Velandera Energy Partners, referred to the Russian price cap as a “joke,” and said Asian buyers are already paying less than that $60 price.

“The EU and Russia will now engage in a game of chicken — whoever blinks first loses,” Raj told MarketWatch.

“The EU and Russia will now engage in a game of chicken — whoever blinks first loses.”— Manish Raj, Velandera Energy Partners

“Will Russia curtail production and lose on revenue,” he said, or will the EU raise the price cap to get more Russian oil in the market.

The developments also come ahead of an expected decision on production levels by major oil producers known as OPEC+ on Sunday.

marketwatch.com 12 02 2022