Starr Spencer, Platts

HOUSTON

EnergiesNet.com 02 01 2024

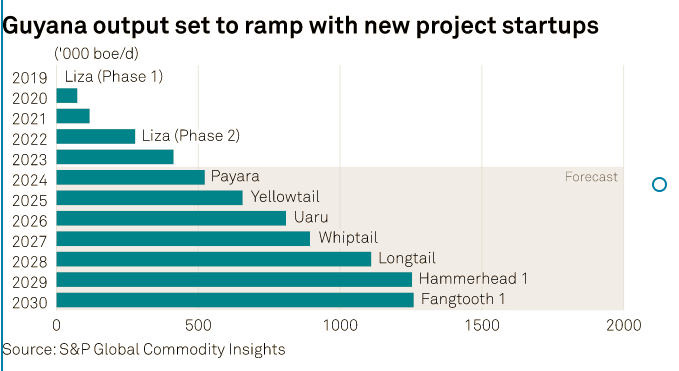

Production from Payara, the third oil development on the ExxonMobil-operated Stabroek Block in Guyana, has already reached maximum gross capacity of 220,000 b/d in January – just two months after startup, 30% project partner Hess said Jan. 31.

That would place total gross production at Stabroek near or at 600,000 b/d, including Liza Phase I, the initial field which has been producing since 2019, and Liza Phase II, which has flowed since February 2022. Liza I produces at least 145,000 b/d and Liza II at times reaches 240,000 b/d although its nameplate is 220,000 b/d.

Payara’s fourth-quarter gross production averaged 47,000 b/d after starting up the FPSO Prosperity Nov. 14, Hess said in a statement.

The Stabroek partners — ExxonMobil with a 45% stake and China’s CNOOC with 25% — are in various stages of progressing three additional oil block developments. Liza, their first discovery, was made in May 2015.

Stabroek’s fourth and fifth developments, Yellowtail and Uaru, will each have 250,000 b/d of production capacity and are anticipated to come online in 2025 and 2026 respectively.

Yellowtail was sanctioned in April 2022 and Uaru in April 2023.

Guyana government reviewing Whiptail

In October 2023, ExxonMobil submitted the field development plan for the sixth Stabroek oil development, Whiptail, to Guyana’s government. Whiptail was envisioned with a preliminary start date of 2027 and production capacity also of 250,000 b/d.

Guyana’s Ministry of Natural Resources has begun seeking proposals to monetize its gas resources. The MNR launched a Request for Proposal for the design, finance, construction and operation of natural gas-related infrastructure to support the country’s upstream developments, S&P Global Commodity Insights analyst Amanda Nelson said in a Jan. 24 report.

The project is to be 100% owned by the private sector, and the project operator will be granted an exclusive right to negotiate terms for gas deliveries. Interested qualified operators have until Feb 27 to submit proposals.

Guyana’s government estimates Stabroek alone could hold recoverable gas resources of up to 17 Tcf. Currently the country has limited infrastructure to support gas development and relies mostly on heavy fuel oil and diesel generators for power, Nelson said.

Guyana’s oil production capacity is on track to reach about 1.2 million b/d by 2027, all of it from Stabroek. So far, all associated gas produced is reinjected to maintain reservoir pressure, although that could change in the medium term owing to a planned gas-to-power project, said Nelson.

In August 2022, the company awarded a contract to Subsea 7 and Van Oord to construct a gas export pipeline from its offshore production facilities to onshore gas facilities located west of Guyana’s capital Georgetown. The facilities are to include a gas processing plant, NGL plant and a gas-fired power plant with a capacity of 250 MW.

Throughput is projected to start by end-2024 with an initial capacity of 50 MMcf/d, which will later increase to up to 120 MMcf/d, potentially accompanied by future plant phases adding 150 MW of capacity.

Hess oil, gas output up 11% on year

Hess said its total oil and gas net production averaged 418,000 b/d of oil equivalent in fourth-quarter 2023, up 11% from 376,000 boe/d in the same year-ago quarter, pro forma for assets sold.

Hess’ Bakken Shale net production totaled 194,000 boe/d in Q4 2023, compared with 158,000 boe/d in the same 2022 period. The company ran four rigs in the oil-rich play in Q4 and plans to continue that drilling pace in 2024.

Hess expects to be awarded in Q1 2024 the 20 leases on which it was high bidder in US Gulf Lease Sale 261 in December. The company spent a total $88 million in total high bids for the tracts, which were mostly clustered in the Gulf’s Green Canyon area offshore Louisiana.

Hess’ net US Gulf production in Q4 averaged 30,000 boe/d, down from 35,000 boe/d in Q4 2022.

Hess will be acquired by Chevron sometime in first-half 2024, a deal the companies announced in October. While Hess no longer holds quarterly investor calls, Chevron’s Q4 call is scheduled for Feb. 2.

“[The] visible production growth Guyana offers is a primary reasons why we see the Hess acquisition as beneficial for Chevron,” UBS analyst Josh Silverstein said in a Jan. 31 investor note, adding UBS projects a May 31st close date although the companies have not publicly disclosed a specific date.

spglobal.com 01 31 2024