Jennifer A. Dlouhy, Bloomberg News

WASHINGTON

EnergiesNet.com 08 30- 2023

The first-ever US government auction of leases to build wind farms in the Gulf of Mexico ended with only one tract sold, a blow for advocates cheering on renewable-power development in the region.

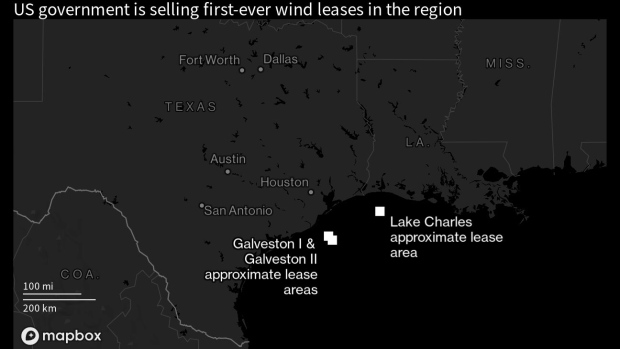

RWE Offshore US Gulf LLC won a 102,480-acre (41,472-hectare) tract near Lake Charles, Louisiana, for $5.6 million, after just two rounds of bidding. The area has room for enough turbines to generate approximately 1.24 gigawatts of power, which could supply nearly 435,400 homes.

The results reflect the technological challenges of erecting turbines in the Gulf, despite the opportunity to take advantage of the region’s rich infrastructure and supply chain.

The area has a softer seabed, hurricanes and lower wind speeds compared to the US East Coast, where other projects are under construction. The hurdles in the Gulf are in addition to the economic obstacles already challenging development in US Atlantic waters, where winds blow harder and states have made commitments to buy the resulting renewable power.

RWE Renewables already holds a lease off the coast of northern California, purchased in an auction last year.

Offshore wind advocates stressed that the sale itself offers a chance to diversify energy production — and develop a new industry — in the Gulf of Mexico, long wedded to oil and gas. It also creates an opportunity for an offshore wind project to be developed alongside carbon sequestration and hydrogen ventures in the region, said Erik Milito, head of the National Ocean Industries Association.

“It’s a key moment in the continued growth of the Gulf of Mexico as a comprehensive and integrated energy hub,” Milito said in an email. “The Gulf is firmly established as a premier global offshore energy region, recognized for its low-carbon oil production, and today the region took a step to expand its energy portfolio.”

The auction is part of the Biden administration’s bid to deploy 30 gigawatts of offshore wind capacity by the end of the decade, with the emission-free power helping meet US climate goals.

Elizabeth Klein, director of the Interior’s Bureau of Ocean Energy Management, called the sale an “important milestone” as the Gulf Coast and US “transition to a clean energy future.”

Three tracts, including two near Texas, were offered in the auction, and more than a dozen companies had pre-qualified to participate, including energy giants with existing oil operations in the Gulf.

bloomberg.com 08 29 2023