By Barbara Powell/Bloomberg News

HOUSTON

EnergiesNet.com 02 08 2022

When the second-largest U.S. refinery shuts down unexpectedly with no clarity as to when operations will return to normal, it could have an outsized impact on a market already squeezed for supplies.

Marathon Petroleum Corp.’s 593,000 barrel-a-day Galveston Bay refinery in Texas City, Texas, got knocked out of commission Friday as frigid temperatures took out power across the Gulf Coast city. Marathon declined to comment on operations but the refiner has started buying some oil product, indicating it needs to cover obligations to customers, according to a person familiar with operations. Marathon may take several weeks to resolve issues that cropped up during the shutdown.

Refiners this year are poised to enjoy fatter profit margins as stronger U.S. demand meets a market where more than 1 million barrels of capacity has been lost during the past two years. With a tightly supplied market and demand set to challenge 2019 levels, the last thing crude oil refiners need are unplanned outages slowing them down.

Two Valero Energy Corp. refineries also shut. Along with Marathon’s plant, they represent about 1.08 million barrels a day of Gulf Coast refining capacity. Conventional spot gasoline in Houston jumped 1.38 cents to a 1.5 cent premium to futures in New York on Monday, its strongest showing since Dec. 7.

Valero’s 225,000 barrel-a-day plant in Texas City had begun restarting some production units as of Saturday after the Friday power loss, but could also take some days to restore full operations. Big production units like crude processors, cokers and fluid catalytic crackers can take time to restart after abrupt shutdowns leave liquid trapped in cooling pipes. Valero hasn’t responded to a request for comment.

Meanwhile, Valero’s 263,800 barrel-a-day Houston refinery shut unexpectedly Monday amid heavy flaring.

Refinery utilization on the Gulf Coast, the largest concentration of U.S. refining might, was only 86% as of the week ended Jan. 28. This reflects the heavy maintenance season in progress as plants perform work that was pushed back in 2020 and 2021 to conserve cash during the height of the pandemic.

Energy Aspects has already forecast that planned maintenance alone will take out more than 1.4 million barrels a day of U.S. crude capacity January through April. That’s about 200,000 barrels a day more than during the same period in 2015-2019 that got taken offline for work.

The market for their products is robust if refiners can keep increasing run rates. The four-week average for products supplied in the U.S. jumped 2.1% to 21.6 million barrels a day in the week ended Jan. 28, the highest since Aug. 2019.

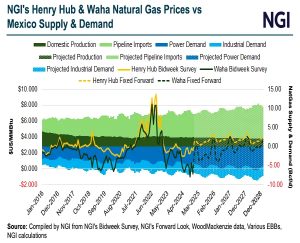

Gulf Coast gasoline supplies have fallen for two consecutive weeks. Distillate inventories in the region fell 4.8% to the lowest since Dec. 24. On the East Coast, distillate stocks have dropped eight straight weeks to the lowest since April 2020.

The 3-2-1 crack spread, which measures the profit for refining crude oil into products like gasoline and diesel, jumped above $24 a barrel for the first time since August in early Monday trading. Expectations are for that spread to widen further as the summer driving season approaches.

Refining margins (in $/bbl):

- Maya U.S. Gulf coking at $16.23 (Feb. 3)

- LLS U.S. Gulf cracking at $13.24 (Feb. 3)

- WCS U.S. Midcontinent coking at $38.03 (Feb. 3)

- East Coast Forcados cracking at $8.93 (Feb. 3)

- U.S. West Coast WCS crude oil 3-2-1 crack spread at $39.11

- Nymex 3-2-1 front-month crack spread at $22.50 (Feb. 4)

- For more crack spreads, see CRCKs

bloomberg.coim 02 07 2022