Grant Smith, Bloomberg News

LONDON

EnergiesNet.com 02 17 2023

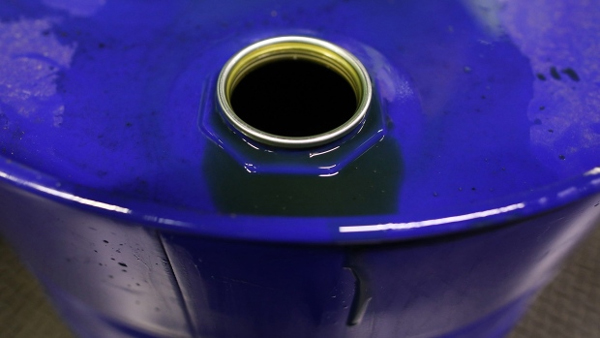

The International Energy Agency boosted forecasts for global oil demand as China reopens its economy following years of anti-Covid lockdowns.

The agency raised global demand estimates by a hefty 500,000 barrels a day for the first quarter, and by just under half as much for the year as a whole. As a result, world consumption will climb by 2 million barrels a day this year to average 101.9 million a day, it said in a monthly report.

“China’s reopening will give a welcome boost to the listless world economy,” the Paris-based adviser to major economies said. “The country is set to resume its established role as the primary engine of world oil demand growth.”

Nonetheless, the IEA said global oil markets will likely remain in surplus in the first half of the year amid surprisingly robust output from Russia.

While the country announced last week that it will cut production in response to Western sanctions, the IEA sharply downgraded its expectations for the extent of the Russian supply slump. Output will be down 1 million barrels a day by the end of the first quarter, versus prewar levels, rather than the 1.6 million estimated last month.

Oil has had a shaky start to the year, trading near $85 a barrel in London as traders assess whether China can successfully resume economic activity without triggering a wave of virus cases, and as the uptick in demand is clouded by tighter monetary policy and lingering fears of a recession.

Still, global markets are set to tighten in the second half of the year as sanctions take a toll on Russia and China’s recovery gains momentum, according to the IEA.

Flip to Deficit

“World oil supply looks set to exceed demand through the first half of 2023, but the balance could quickly shift to deficit as demand recovers and some Russian output is shut in,” the agency said.

Chinese demand will climb by 900,000 barrels a day this year after a record contraction in 2022, reaching 15.9 million barrels a day, the IEA said.

Domestic flights soared 80% over the Lunar New Year holiday, national aviation data show, and oil trader Unipec — a division of refining giant Sinopec — has led a buying spree among Chinese companies, snapping up millions of barrels from the Middle East.

“Prompt indicators for January suggest a sharp uptick in Chinese activity and mobility,” the IEA said. “Following Beijing’s late-2022 about-turn on its stringent anti-Covid restrictions, we expect Chinese oil demand to quickly pick up steam and comfortably exceed 2021 levels by the end of the year.”

bloomberg.com 02 15 2023

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment