Fabiola Zerpa, Bloomberg News

CARACAS

EnergiesNet.com 05 31 2024

India’s Jindal Power Ltd. will partner with Venezuela’s state oil company in a crude venture just months after securing a contract to run the country’s largest iron-ore complex, according to people familiar with the agreement.

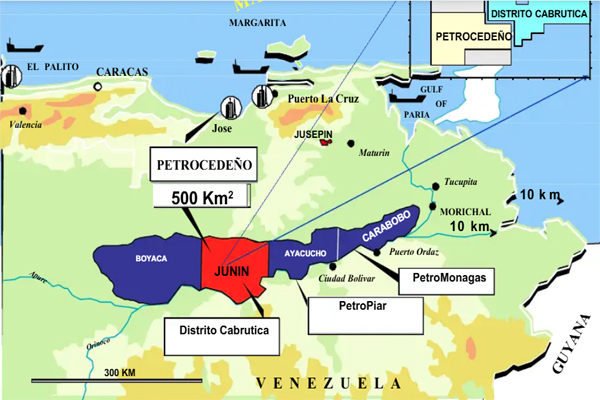

Jindal executives agreed to partner with Petroleos de Venezuela SA in the oil-rich Orinoco Belt, the people said, asking not be named discussing non-public information. The move to operate the Petrocedeno venture marks Jindal’s first foray into the oil business and will fill the void left when TotalEnergies SE and Equinor ASA departed the project in 2021.

Jindal’s entrance comes as Venezuela reshapes its oil partnerships amid the reimposition of US sanctions after President Nicolas Maduro’s fell short of promises to ensure fair elections. PDVSA and Jindal didn’t respond to requests for comment.

After years of economic crisis, hyperinflation, mismanagement and sanctions, many foreign companies quit the country. PDVSA has been working to attract new foreign partners to revive oil production, increase revenue and reduce debt.

The Jindal-PDVSA deal was reached in Caracas in mid-April, hours before the US announced the imminent reimposition of sanctions. Jindal has submitted an application for US Treasury Department permission to operate in Venezuela, one of the people said, which could be necessary after May 31 to avoid breaching US restrictions.

At least four companies, including France’s Maurel & Prom, Spain’s Repsol, US’s Global Oil Terminals and Trinidad and Tobago’s NGC have been granted US licenses for oil and gas projects in the sanctioned country. US chief of mission of the Venezuelan Affairs Unit, Francisco Palmieri, estimated last week that the government had received as many as 50 private license requests.

The Petrocedeno venture was among the top producers in Venezuela by the mid-2000s, with a 400-square- kilometer (155-square-mile) field and an oil upgrader with processing capacity of 190,000 barrels a day.

bloomberg.com 05 30 2024