James Young, Argus Media

MEXICO CITY

EnergiesNet.com 03 05 2024

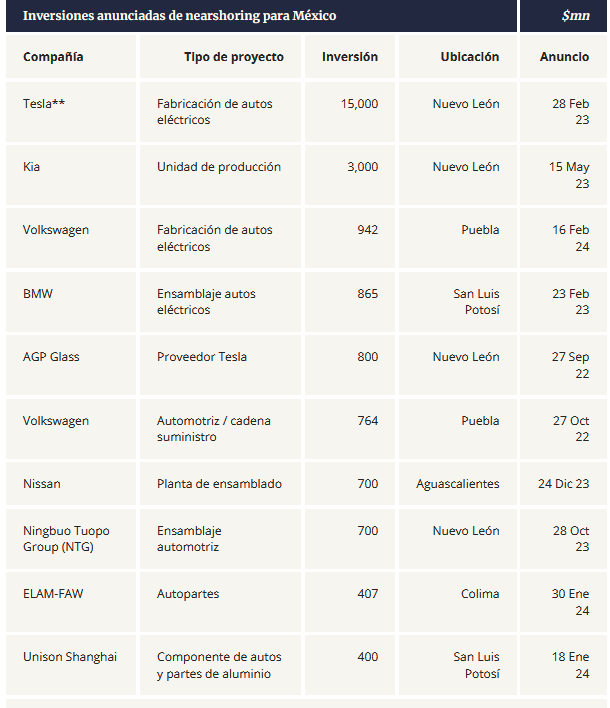

Mexico has seen nearly $60 billion in nearshoring-related investment plans in just 10 projects announced in the last 12 months.

While the extent of nearshoring development in Mexico will largely depend on overall policies this year, attention is already focused on large projects by automakers such as Nissan of Japan, Kia of South Korea and a burgeoning sector comprised of 13 smaller Chinese-based manufacturers such as Chirey, MG, BYD, Geely, Omoda, Jetour, among others.

The Mexican auto parts industry (INA) estimates that Mexico could attract up to $44 billion of investment in auto parts and automotive suppliers through nearshoring in the next few years. The relocation or expansion of production chains to Mexico to be closer to the United States attracts investment throughout the industry, INA President Francisco González said recently.

Given that the government estimates that Mexico has already received $110 billion from nearshoring since the phenomenon began, the association has estimated that about 40pc of that is related to the automotive sector.

Nuevo León favored

The state of Nuevo Leon alone, on the northern border of Texas, could receive $23 billion over the next few years, largely due to the construction of a planned gigafactory by electric vehicle manufacturer Tesla outside the city Monterrey.

In addition to Tesla’s estimated investment of approximately $5 billion, this would attract a number of OEMs and other parts and service suppliers, which could bring the total investment to as much as $15 billion.

However, the Tesla gigafactory that would be built in Santa Catarina, in suburban Monterrey, will get the go-ahead until the same company’s plant in Austin, Texas, has completed development of a lower-cost build model by 2025.

But that hasn’t stopped a number of OEMs and others in the supply chain from starting to plan to build new facilities near the gigafactory site to be ready when Tesla builds its plant.

Among them is AGP eGlass, which said it plans to spend $800 million to build a high-tech automotive glass plant to supply manufacturers such as Tesla.

Of the 278 automotive projects registered in 2023, a total of 54 are in Nuevo León, which puts it in second place nationally, only behind Coahuila with 56 projects in total, and above Guanajuato with 49 and Querétaro with 28.

And of the 54 investments registered in Nuevo León, 23 are focused on electric mobility.

This makes Nuevo León the entity that attracted the most electromobility projects in 2023, above Coahuila, with 19 projects and Guanajuato, which registered 13 projects of this type.

As for the job generation anticipated as a result of nearshoring, the government of Nuevo Leon claims that it has already generated more than 42,000 jobs directly related to the automotive sector.

Translated with www.DeepL.com/Translator (free version)