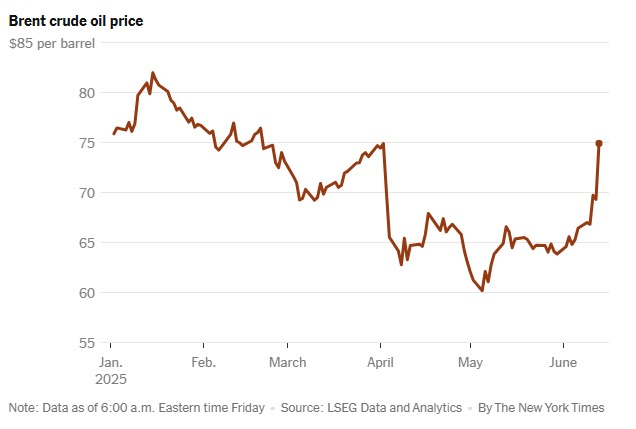

Israel launched a series of strikes against Iran on Friday morning, targeting nuclear sites, missile facilities and other military infrastructure. The strikes were also a major blow to Iran’s chain of command, killing top generals. Oil prices rise: Crude oil prices jumped sharply following the Israeli attack, with Brent crude jumping 9 percent to nearly $78 a barrel.

The New York Times

JERUSALEM/TEHERAN

EnergiesNet.com 06 13 2025

The latest Friday, June 13, 13:24 GMT

Israel said it had damaged a key nuclear facility, and Iran said several military commanders were killed. President Trump warned Tehran to agree to new limits on its nuclear program or risk “even more brutal” attacks.

Israel launched a stunning series of strikes Friday morning on Iranian nuclear sites and killed several of the nation’s security chiefs, in a remarkable coup of intelligence and military force that decapitated Tehran’s chain of command. President Trump warned that further attacks would be “even more brutal” and redoubled pressure on Iran to reach a new deal to curb its nuclear program.

The Israeli military said that its strikes were continuing on Friday afternoon, as Prime Minister Benjamin Netanyahu described the assault as a last resort to prevent a nuclear-armed Iran, which Israel views as an existential threat. The attacks also killed top Iranian officials and nuclear scientists and hit Tehran’s long-range missile facilities and aerial defenses.

Mr. Trump, whose administration has been holding nuclear talks with Iranian officials, said on Friday that Tehran “must make a deal, before there is nothing left.”

For years, Israel fought Iran’s proxy forces across the Middle East and more recently it has exchanged previous volleys of strikes with Iran. Yet Friday’s strikes were the first time it successfully hit Tehran’s nuclear facilities, including Iran’s main nuclear enrichment facility at Natanz, which a military spokesman said had suffered “significant damage.”

Iran’s supreme leader, Ayatollah Ali Khamenei, said that Israel “should anticipate a harsh punishment.” Later on Friday morning, the Israeli military announced that Iranian forces had fired about 100 drones at Israel, as Mr. Netanyahu vowed the fighting would last “as many days as it takes.” The Israeli military said it was working to intercept the Iranian attack, and there were no immediate indications of significant damage caused by the drones.

Oil prices rise: Crude oil prices jumped sharply following the Israeli attack, with Brent crude jumping 9 percent to nearly $78 a barrel.

By Keith Bradsher, NYTimes

Reporting from Beijing

Israel’s military strikes against Iran shook global markets, as oil prices surged and stocks tumbled on worries that the attacks could set off a broader Mideast conflict that would disrupt the world’s energy supplies and stoke inflation.

Prices of Brent crude oil, the international benchmark, jumped on Friday, rising 8 percent to around $75 a barrel. It was oil’s largest daily gain this year, and capped a choppy week of trading, as investors anticipated a potential strike.

Stock markets fell broadly across Asia and Europe. Futures for the S&P 500 indicated that U.S. stocks could decline nearly 1 percent when they open in New York.

Investors seeking less risky places to put their money bid up the price of gold, and yields on the 10-year U.S. Treasury note, which move inversely to prices, were lower.

Iran is among the world’s largest producers of oil, and it sells almost all of what it produces to China, which consumes 15 percent of the global supply. Sales by Iran’s state oil company to China represent about 6 percent of Iran’s entire economy, and are equal to about half its entire government’s spending.

Iran’s exports have lagged in recent years as international sanctions have limited its ability to modernize its oil extraction and transportation technology.

But Iran’s shipments have begun to recover in the past year on strong demand from China, which would be forced buy oil elsewhere if a broader conflict were to interrupt Iranian supplies.

Iran holds a strategic position on the northern side of the Strait of Hormuz, at the exit of the Persian Gulf. That means Iran could block oil and natural gas exports from other Mideast oil producers in retaliation for the Israeli strike. About a third of the world’s seaborne oil shipments pass through the strait.

ational security adviser specializing in the Mideast, said the United States military had the ability to force a reopening of the Strait of Hormuz, but that could create bigger issues.

“Such action would bring America squarely into the conflict, moving it to greater levels of regional disruption and global uncertainty,” said Ms. O’Sullivan, who is the director of the Harvard Kennedy School’s Belfer Center for Science and International Affairs.

In any case, Iran has strong financial reasons not to close the Strait of Hormuz: Nearly all of its oil exports must pass through it. And much of the oil imported by China is shipped through the strait.

“If I were Iran, I would think twice before closing the Strait of Hormuz,” said Muyu Xu, senior Asia oil analyst at Kpler, a global commodities and shipping data firm. “If they choke the Strait of Hormuz, they cannot move barrels out.”

The United States in recent years has become far less dependent on oil from the Persian Gulf, because of the rise of fracking and other advanced techniques to extract oil. Europe, along with China, import large quantities of oil from the region.

Iran has long had tense relations with Saudi Arabia, which tilts toward the United States, an ally of Israel. In 2019, Iran and its proxies used drone strikes to destroy oil facilities in Saudi territory.

Saudi Arabia, the third-largest producer of oil after the United States and Russia, has a backup plan in case of a wider conflict. It has built an extensive pipeline system leading south from the coast of the Persian Gulf, where it produces most of its oil, to the Red Sea, where oil could be loaded onto tankers.

“It’s hard to see what comes next, but the oil market isn’t yet pricing in a catastrophic scenario,” which would include the disruption of oil and gas supplies through the Strait of Hormuz, said Justin Alexander, director of Khalij Economics, a research and consulting firm focused on the Gulf.

In the worst case, estimates suggest “something like a doubling of the oil price,” he added. But if only Iran’s oil and gas supplies are disrupted, then spare capacity from the OPEC Plus group of countries, already in the process of ratcheting up production

, could make up the difference and limit the potential rise in prices.

Jason Karaian contributed reporting from London.

Keith Bradsher is the Beijing bureau chief for The Times. He previously served as bureau chief in Shanghai, Hong Kong and Detroit and as a Washington correspondent. He has lived and reported in mainland China through the pandemic.

nytimes.com 06 13 2025

Updates:

- Top Iranians assassinated: Mohammad Bagheri, the commander in chief of the military and the second-highest commander after the supreme leader, was killed, according to the Israeli military and Iranian media, as well as other top security officials. Ali Shamkhani, a leading politician who was overseeing the nuclear talks with the United States, was also killed, officials said. Mr. Khamenei moved quickly to appoint replacements, aiming to avoid the appearance of a leadership vacuum. Read more ›

- What was hit: In targeting the Natanz nuclear site, Israel struck at the beating heart of the Iranian nuclear program. The Israeli military said it had “caused significant damage” at Natanz and hit an underground compound housing centrifuges. Rafael Grossi, the chief of the International Atomic Energy Agency, said that there were no indications of attacks at two other major Iranian nuclear sites, the deep-underground uranium enrichment center at Fordow or the Isfahan nuclear fuel site.

- How it happened: Israel attacked at least six military bases around the capital Tehran, residential homes at two highly secured complexes for military commanders and multiple residential buildings around Tehran, according to four senior Iranian officials. Read more ›

- Tehran on edge: Residents of Tehran, the Iranian capital, reported hearing huge explosions, and Iranian state television broadcast images of smoke and fire billowing from buildings. Long lines were forming at gas stations and grocery stores. The Iranian government said that a number of civilians had been killed, including children, and dozens injured. Read more ›

- Threats to U.S. facilities: This week, the United States withdrew diplomats from Iraq, Iran’s neighbor to the west, and authorized the voluntary departure of the family members of U.S. military personnel from the Middle East. The U.S. military has a large fleet of warplanes, naval vessels and thousands of troops stationed in the region.

- Oil prices rise: Crude oil prices jumped sharply following the Israeli attack, with Brent crude jumping 9 percent to nearly $78 a barrel.

Oil Prices Surge and Stock Markets Stumble After Israel Attacks Iran

The military strikes jolted investors, raising concerns that a broader Mideast conflict would disrupt the world’s energy supplies.

NYTimes Updated June 13, 2025, 8:56 a.m. ET