By Global Data

LONDON

EnergiesNet.com 01 27 2022

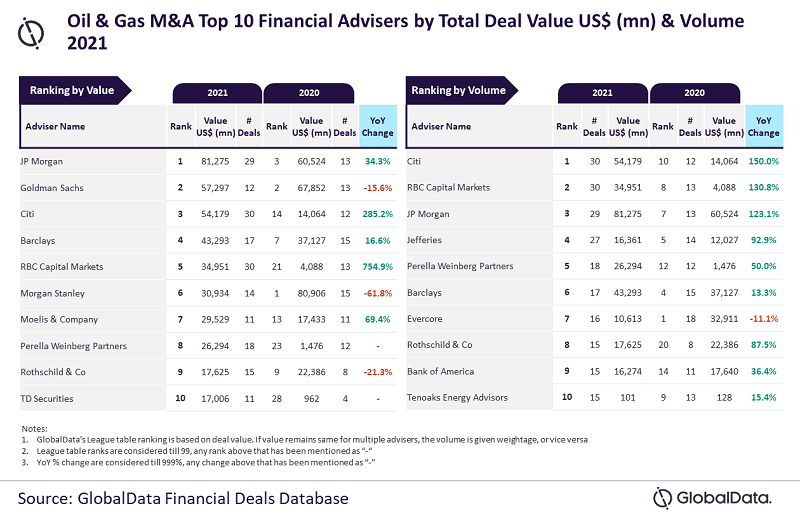

JP Morgan and Citi were the top mergers and acquisitions (M&A) financial advisers in the oil & gas sector for 2021 by value and volume, respectively, according to GlobalData’s Financial Deals Database. The leading data and analytics company notes that JP Morgan advised on 29 deals worth $81.3 billion, which was the highest value among all advisers tracked. Meanwhile, Citi led in volume terms, having advised on 30 deals worth $54.2 billion. A total of 1,799 M&A deals were announced in the sector during 2021.

According to GlobalData’s report, ‘Global and Oil & Gas M&A Report Financial Adviser League Tables 2021’, deal value for the sector increased by 16.4% from $287.9 billion in 2020 to $335 billion in 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “JP Morgan was the only adviser to surpass $80 billion in deal value during 2021, thereby outpacing its peers by a significant margin in terms of value. It also gave strong competition in terms of volume and was just short of one deal for the top spot by this metric.

“Meanwhile, Citi and RBC Capital Markets were the only two firms to touch the 30 deal volume mark during 2021. Citi advised on fewer big ticket deals due to which it also secured the third position by value. Interestingly, JP Morgan also occupied the third position by volume.”

Goldman Sachs occupied the second position in terms of value, with 12 deals worth $57.3 billion, followed by Citi. Barclays occupied the fourth position by value, with 17 deals worth $43.3 billion, followed by RBC Capital Markets, with 30 deals worth $35 billion.

RBC Capital Markets occupied the second position in terms of volume, followed by JP Morgan. Jefferies occupied the fourth position by volume, with 27 deals worth $16.4 billion, followed by Perella Weinberg Partners, with 18 deals worth $26.3 billio

About GlobalData 4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

globaldata.com 01 27 2022