An industry sea change and a tremendous investment by Berkshire Hathaway helped fuel shares of Occidental Petroleum

Phillip Van Doorm, MarketWatch

MIAMI

EnergiesNet.com 12 26 2022

It has been a brutal bear-market year for stocks in 2022. Stocks have plunged by nearly 19%, as measured by the S&P 500, and many once-highflying tech stocks have fallen even more.

Which makes MarketWatch’s stock of the year even more notable. Amid the stock-market carnage, one big company stock has outperformed the others. What has made the stock even more remarkable is that not so long ago, it was trading as if the company were headed for bankruptcy.

Occidental Petroleum OXY, +3.48% is MarketWatch’s 2022 stock of the year. Occidental is the best-performing stock in the S&P 500 SPX, +0.59% this year and by some measures the stock is still cheaply priced, despite Berkshire Hathaway CEO Warren Buffett’s vote of confidence and the strength of the energy sector.

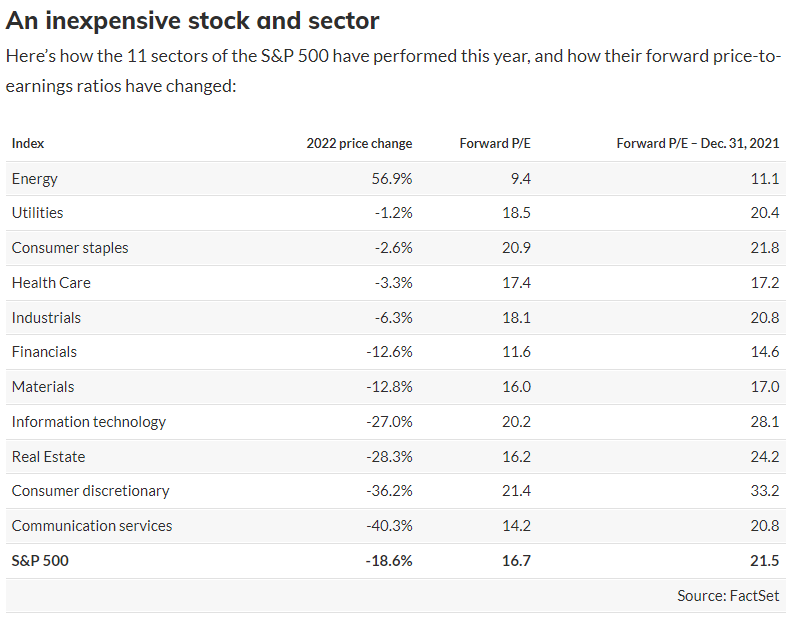

Shares of Occidental Petroleum have risen 120% during a year in which the energy sector has been the only one in the benchmark index to show a gain, as you can see below.

Russia’s invasion of Ukraine served as a catalyst for oil and natural gas producers as the world energy supply was disrupted.

Then during the first quarter, Berkshire Hathaway BRK.B, +1.26% began buying Occidental’s stock, after Buffett complimented Occidental CEO Vicki Hollub’s plans to pay down the oil producer’s debt and repurchase shares.

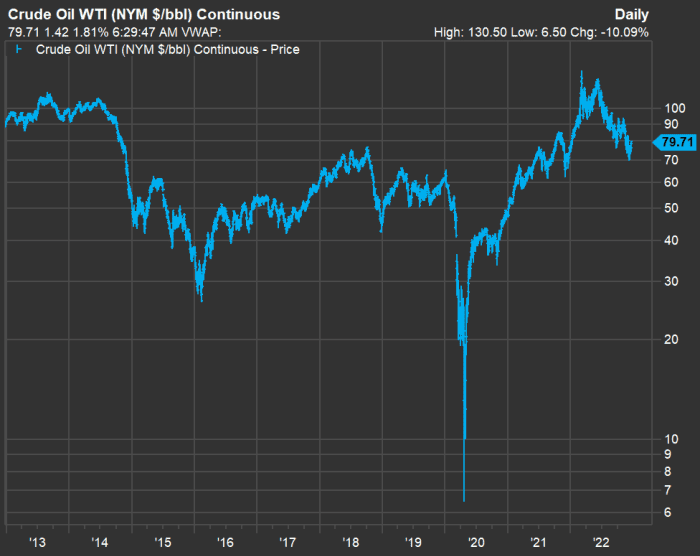

Oil prices have given up most of their gains from early in 2022, falling from a momentary peak for WTI at $130.50 on March 7 to $79.71 on Dec. 22. But prices are still relatively high for the period following the broad decline that began during the summer of 2014. At that time, the stage was set for a tumble because U.S. shale oil producers had changed the world market through a long period of heavy capital investment and increasing supply. Saudi Arabia further increased oil production and the resulting price crash sent many U.S. players into bankruptcy and forced industry consolidation, including Occidental’s acquisition of Anadarko in 2019.

Then the temporary elimination of demand during the early stages of the coronavirus pandemic in 2020 sent oil to incredibly low prices. For a while, Occidental’s Anadarko deal looked like a disaster that could sink the entire company. But with rising oil prices and prudent financial management, Hollub has turned things around and resisted calls from the White House to push for more production.

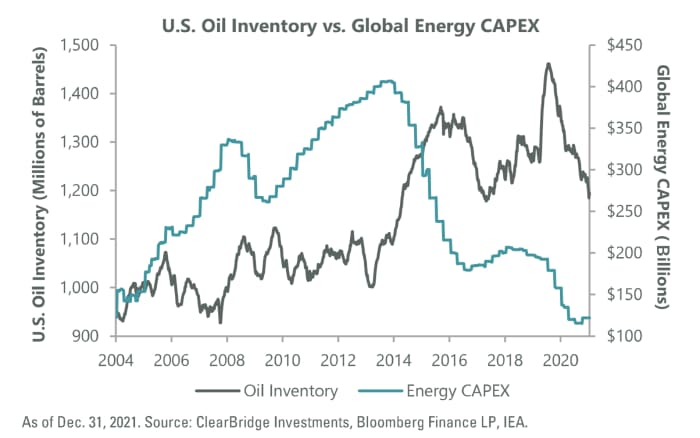

What lies ahead? Take a look at this chart showing how oil-industry investment was declining as demand was increasing through 2021:

The chart was provided by Sam Peters, a portfolio manager at ClearBridge Investments. It shows an energy industry that has learned its lesson. If supply expands too rapidly, the eventual drop in prices will hurt the bottom line.

We are now in a long period during which management teams at major oil producers are more focused on prudent spending to maintain supply, rather than expand it, as they deploy excess cash through buybacks and dividends.

In an interview with Matt Peterson as part of the MarketWatch 50 series, Hollub explained that with a $40 break-even point for production, “there’s no pressure to increase production right now, when we have these other two ways that we can increase shareholder value.”

P/E ratios have declined for the index and all but one of its sectors, but this is especially notable for the energy sector when it has risen 54%.

Occidental Petroleum trades for 8.3 times the consensus earnings-per-share estimate for the next 12 months among analysts polled by FactSet. That’s down from 9.9 at the end of 2021.

The energy sector has, by far, the lowest P/E of any S&P 500 sector. On this basis, it is trading for only 56% of the S&P 500’s value. If we look back five years (averaging monthly prices to limit the effect of very short spikes or declines), energy on average has traded at 57% of the S&P 500’s forward P/E. But if we look back at 10-year, 15-year and 20-year averages, those numbers rise to 104%, 99% and 94%, respectively.

Energy stocks remain relatively inexpensive based on long-term averages and the supply and demand setup still looks good for investors who can remain committed.

Click here for a detailed guide to the wealth of information available for free on the MarketWatch quote page.

All but two of these companies are in the energy sector, and the other two, First Solar Inc. FSLR, -0.09% and Enphase Energy Inc. ENPH, -1.65%, make solar power equipment.

Don’t miss: Tesla’s stock drop has been bad. But this company has wiped out more investor wealth in 2022.

marketwatch.com 12 24 2022