Sheky Espejo, Platts S&P Global

MEXICO CITY

EnergiesNet.com 10 31 2024

Highlights

- Private investment welcomed in exploration, production, and power generation

- New rules for private sector participation with Pemex coming soon

- Government working on new fiscal regime for Pemex growth and revenue protection

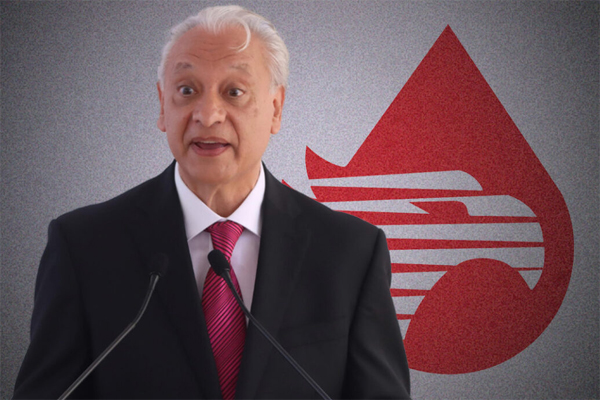

Mexico will welcome private investment in exploration and production of crude and natural gas during the new administration of President Claudia Sheinbaum Pardo, as well as in power generation, particularly clean energy generation, Víctor Rodríguez, Pemex CEO said Oct. 29 during the company’s Q3 earnings call.

The new rules under which the private industry will be able to participate with the state oil and gas company Pemex will be detailed in the coming weeks by the Mexican government, Rodríguez said during the conference, adding that the government is also working on a new fiscal regime for the company that allows for its growth while also ensuring that government revenues stay protected.

These rules will come as the energy sector in the country undergoes yet another constitutional reform which will change the legal regime of the state energy companies Pemex and CFE so they no longer have to comply with commercial law and the industry regulators, once independent, fall back to federal control.

“There will be place for private participation in exploration and production to share risks and exchange technology,” Rodriguez said, adding that private investment will continue to be open in downstream activities.

During the administration of former President Andrés Manuel López Obrador, new upstream rounds were cancelled, causing major international companies to leave the country.

The areas where the country will mainly welcome private investment will be in the exploration and production of heavy crude, natural gas, deepwater crude and marginal oil, Rodríguez said noting that the country’s crude output target remained unchanged at 1.8 million b/d, which is enough to meet the country’s needs for its refining system.

Crude production by Mexico’s state oil company Pemex fell to a new multidecade low in September, the last month under the administration of former President Andres Manuel López Obrador, who invested roughly $50 billion into the company to keep it afloat during his six-year term.

“The aim is to strengthen value chains with a focus on fields in the north of the state of Veracruz, the deep Gulf of Mexico and the Sureste Basin,” Rodríguez said .

The investments in natural gas production will be key to reduce imports, he said. Mexico imports almost all the gas it needs for its industry and the generation of power, as the little gas Pemex produces is reused in its upstream operations.

Rodríguez added that the new administration of the country will also welcome private investment in new forms of energy, such as renewable power co-generation and green hydrogen.

Rodriguez, who was recently appointed CEO after Sheinbaum took office on Oct. 1, mentioned the government, including the energy and finance secretaries, are working on a new scheme that will help Pemex improve its finances.

The goal is to reduce costs, refinance debt, increase revenues, eliminate subsidies, and focalize investments, he said.

The new administration will maintain its goal of not increasing the debt of the company and managing its liabilities.

During the third quarter, Pemex reported a loss of Peso 161 billion ($8.2 billion), compared to a loss of Peso 79 billion in the same period of 2023, according to a report to the Mexican Stock Exchange. So far in 2024, Pemex has lost over Peso 430 billion. By the end of the quarter, its total net debt was roughly $114 billion including foreign debt and accounts payable with local suppliers, according to the report.

spglobal.com 10 30 2024