Scott Squires, Bloomberg News

MEXICO CITY

EnergiesNet.com 10 18 2024

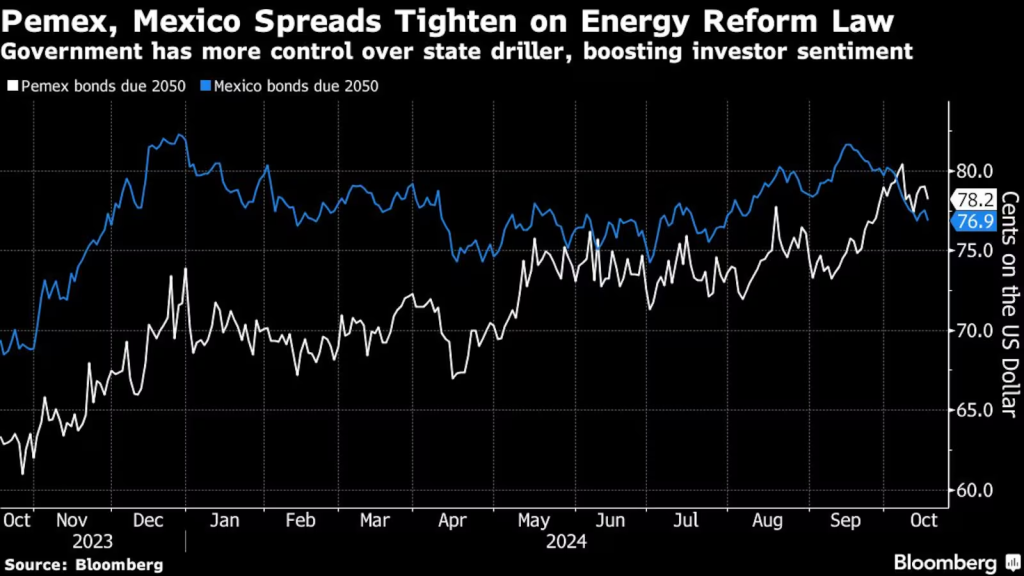

Investors in Mexico’s state oil company Petroleos Mexicanos are cheering an energy reform bill that will grant the government more control over the energy sector and make the financially strapped oil company’s bonds more akin to sovereign debt.

The bill, approved overnight by which Mexico’s Senate, reclassifies Pemex and state utility Comision Federal de Electricidad as “public companies.” The change would increase government control over the firms and do away with requirements that they turn a profit. Investors wager that under the move the government will continue helping Pemex pay down its almost $100 billion debt burden.

“Pemex debt should now trade closer to the sovereign with the passage of the energy reform law,” said Edwin Gutierrez, head of emerging-market sovereign debt at Abrdn Plc. in London. “The bonds have room to continue gaining further because spreads had blown out so much.”

In the past month as the proposal gained momentum, Pemex’s bond spreads tightened about 100 basis points against sovereign debt to around 370 basis points, near a three-year low.

The bill must now win approval in state legislatures, where the ruling coalition has large majorities, before it reaches the president’s desk to be signed into law.

Investors say Pemex bonds can continue gaining as President Claudia Sheinbaum crafts a plan to rescue the embattled oil company or continue supporting the company with state funds. Sheinbaum’s predecessor, President Andres Manuel Lopez Obrador, showered Pemex with as much as $80 billion in capital injections and tax breaks over the course of his term, which did little to reverse the company’s decline.

Fitch Ratings said this month it’s evaluating the driller’s credit rating on the bill’s passage, which could lift the score by as much as four notches into investment grade territory. It currently rates Pemex’s bonds at B+, in junk territory, while S&P Global rates Pemex as BBB.

“The fact that the ruling party essentially has super majorities in both chambers of congress means it would be relatively easy to guarantee Pemex’s debt, and if they did that, the company would become investment grade,” said Aaron Gifford, an emerging markets sovereign analyst at T. Rowe Price in Baltimore. “The fact that there’s even a path to get there means that Pemex spreads over the sovereign should be much tighter.”

bloomberg.com 10 17 2024