Sergio Chapa, Bloomberg News

MEXICO CITY

EnergiesNet.com 08 12 2022

With its northern border located right next to a patch of booming US shale, the country aims to be one of the world’s leading shippers of sought-after LNG.

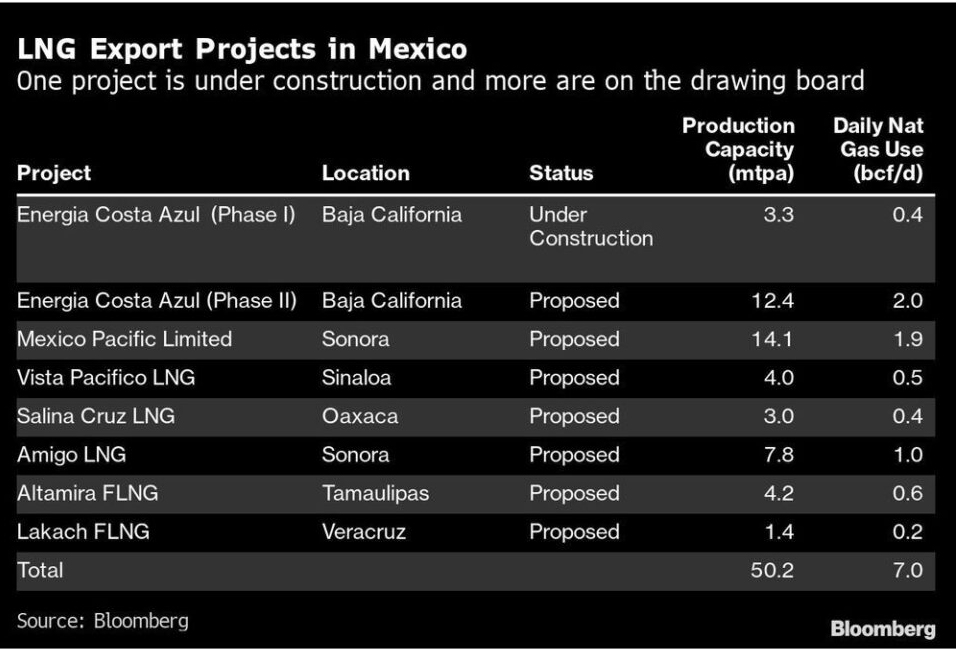

Although Mexico’s natural gas exports are nonexistent today, given that it produces too little fuel from the power plant to meet even its own domestic needs, the country’s physical proximity to burgeoning U.S. reserves positions it well to supply American gas to hungry buyers. in Europe and Asia. With US shale in mind, a total of eight liquefied natural gas export projects have been proposed south of the border, offering a combined annual capacity of 50.2 million tonnes. Some of the operations aim to go live as early as next year.

If all are completed, the Latin American newcomer would join a very small club of nations that ship super-chilled fuel – commonly known as LNG – overseas, ranking 4th behind the United States, Australia and Qatar. And unlike those other three export heavyweights, Mexico will mostly ship gas that it imported in the first place.

Mexico’s big plans to enter the export market come at a time when global demand for natural gas is skyrocketing. Gas was already gaining popularity over dirtier fossil fuels like coal due to its relatively lower carbon footprint when the war in Ukraine pushed demand to an entirely new level. Forty-four markets imported LNG last year, nearly twice as many as a decade ago, the International Liquefied Natural Gas Importers Group said, and the world strived to increase to both import and export capacity in the months that followed. Asia has been the destination for nearly half of US LNG shipments over the past two years, although Europe’s efforts to diversify away from Moscow mean buyers from all regions are competing for a limited fuel supply“Mexico is on the verge of becoming an exporter of natural gas produced in the United States and this is primarily driven by market dynamics unfolding globally – particularly those in Asia – not precisely because of political of Mexico,” said Baker researcher Adrian Duhalt. Institute Center for the United States and Mexico at Rice University.

Of course, there is no guarantee that all proposed projects will be built, or that they will be built on time. Some of them will also need connections to the last mile gas pipeline.

But the main pipeline capacity they will need to operate is already there. U.S. gas can be shipped through more than a dozen cross-border pipelines built during former President Enrique Peña-Nieto’s single term in office between 2012 and 2018. These conduits cost billions of dollars and have a combined capacity of nearly 14 billion cubic feet per day, federal figures show. So far this year, Mexico has imported an average of 6.7 billion cubic feet a day from the United States, meaning lines could move more than double current volumes. This is in addition to the approximately 2.6 billion cubic feet of natural gas produced per day in Mexico.

Mexico’s current president, Andres Manuel Lopez Obrador, has strongly criticized his predecessor’s policies, including cross-border gas pipeline projects, which required Mexico to sign long-term contracts that required it to pay for full capacity , whether it was used or not. This imported gas was supposed to meet Mexico’s internal needs, but after more than a dozen natural gas power plants were derailed before they were built, Mexico found itself paying for a large amount of unused gas pipeline capacity.

Early in his term, AMLO, as the current president is known, brokered a deal with three pipeline operators to save the nation $4.5 billion. His administration also pledged to build more pipelines in the country to provide enough fuel to demand centers in central and southern Mexico that still face occasional natural gas shortages due to infrastructure problems. The rest of the imported gas would be used to make Mexico an export hub.

It is certainly well positioned: six of the eight proposed LNG projects in Mexico are along the Pacific coast where cargo can be shipped to destinations in Asia without having to go through the Panama Canal. With the exception of an offshore project in Veracruz, all gas for the factories would come from the United States via cross-border pipelines.

The Mexican government did not respond to requests for comment.

The only one under construction so far is the first phase of Sempra Energy’s Energia Costa Azul export terminal along the Pacific coast in the Mexican state of Baja California. The other projects are still on the drawing board but have gained momentum in the months following Russia’s invasion of Ukraine. New York-based LNG company New Fortress Energy Inc. signed two deals in July to develop offshore LNG export projects off the coasts of Tamaulipas and Veracruz that could potentially supply Europe. Mexico’s state-owned Federal Electricity Commission said the same month that it was considering developing LNG export terminals in the states of Sinaloa and Oaxaca as part of a tie-up with Seems. Once approved and cleared, most LNG projects can begin exports in about four years.

So if the gas shipped from Mexico will be produced in the United States, why not just ship it from US ports? Blame the opposition at local and state levels. Several of the proposed projects in Mexico only moved forward after Canadian pipeline operator Pembina Pipeline Corp. canceled its planned Jordan Cove LNG export terminal in Oregon due to a major setback in the United States.

“It says more about the difficulty of building export terminals in California and Oregon than developers are trying to set up projects in Mexico,” Duhalt said.

bloomberg.com 08 12 2022