President Sheinbaum is under pressure to reduce Mexican reliance on US fuel

Scott Squires, Bloomberg News

MEXICO CITY

EnergiesNet.com 01 24 2025

At a packed press conference in the muggy port town of Dos Bocas, Mexico’s energy minister unveiled a bold plan to fast-track construction of the country’s largest oil refinery to date, a flagship project under the government of then-President Andres Manuel Lopez Obrador.

Rocio Nahle told the reporters gathered in 2019 that borrowing designs from a previously scrapped refinery venture would save taxpayers a fortune, keep the facility within its $8 billion budget and have it up and running in just three years.

More than five years later, the Dos Bocas refinery is still unfinished. Its price tag recently surpassed $20 billion, making it one of the costliest projects to emerge during the administration of Lopez Obrador, known as AMLO.

The need to get the plant operating is all the more urgent as newly inaugurated US President Donald Trump threatens to slap 25% tariffs on Mexican imports, including crude oil, by Feb. 1. Questions remain about whether Mexico can maintain its strategy of exporting crude to the US while re-importing finished fuels, especially as its refineries continue to operate at limited capacity.

The delays at Dos Bocas amplify the challenges awaiting AMLO’s successor, Claudia Sheinbaum. Since taking office in October, she’s doubled down on his promise to make Mexico “energy sovereign” by producing and refining all the fuel it consumes. As state oil company Petroleos Mexicanos, or Pemex, struggles to trim its nearly $100-billion debt load and revive flagging output, resolving the snags at Dos Bocas is crucial.

Currently, Pemex is encountering problems integrating the plant’s various subsections, separate projects which have been managed by a number of subcontractors, according to people familiar with the matter. As of Wednesday, Dos Bocas had shut down due to quality issues with the oil it needs to make fuels, a document seen by Bloomberg showed.

“We’re a long way from the rhetoric of Dos Bocas meeting the reality,” said Pablo Zarate, an energy analyst at FTI Consulting. “Mexico isn’t going to stop importing fuel from the US anytime soon.”

Pemex declined to comment on the reasons for the delays and the latest timeline for Dos Bocas’ startup.

The decision to use old blueprints for the refinery has had far-reaching consequences, said Bernardo Del Castillo, founder and chief executive of Soteria Consulting in Abu Dhabi.

“Dos Bocas has continued to face problems due to failures in design, and the absolute mistake of skipping the FEED stage,” said Del Castillo, referring to front-end engineering design, an approach used to control project expenses before construction begins.

Since many of Dos Bocas’ plans were borrowed from a refinery planned in a mountainous part of Mexico, the facility “doesn’t have the equipment to work” at a lower, more humid altitude, Del Castillo said. “Other factors such as altitude, pressure, humidity are always affecting the refining process.”

Design flaws are just some of the many stumbling blocks faced by Pemex in recent years as it works to get Dos Bocas up and running and make good on AMLO’s vow to quit Mexico’s reliance on imported fuel. Sinkholes during the construction of the site, built over a mangrove swamp, led to concerns about flooding and weakened foundations. Fires, infighting among lawmakers, and lawsuits over the refinery’s environmental impact have been among the setbacks for Dos Bocas.

Even after the plant was inaugurated in 2022, Dos Bocas still wasn’t making fuel, and the setbacks continued as the refinery entered the testing phase. The entire facility went offline in September and October because of a “minor” electrical issue, Pemex’s Chief Executive Officer Victor Rodriguez said in November.

Dos Bocas’ antiquated technology means that if one part isn’t functioning, the whole plant could go dark, according to John Padilla, managing director of IPD Latin America, an energy consultancy. The facility is also still waiting for key resources, including a major gas pipeline, to be finished so it can ramp up key parts of the refining process, he said.

“Pemex didn’t deploy the most modern technology in construction of the refinery,” Padilla said. “We’ll continue to see these shutdowns.”

Despite repeated promises that the refinery would be running at full tilt by the end of AMLO’s term, slashing fuel imports by the start of this year, the facility has yet to produce commercial quantities of gasoline.

To be sure, refineries are large, complex facilities that often have hiccups at the beginning of their operational lives. Completing Dos Bocas, which has over 3,200 kilometers (1,988 miles) of pipe that could stretch from Mexico City to Houston and back, is no easy task.

But at least a portion of Dos Bocas’ startup pains can likely be attributed to Mexico’s decision to go it alone in the refinery’s construction. AMLO handed the project to Pemex, canceling a tender when bidders including US engineering firm Bechtel Group Inc. and Argentina’s Techint Group balked at meeting his ambitious timeline and budget. That led investors to raise concerns.

Mexico is banking on Dos Bocas to rescue its shambolic fuel refining industry. Pemex’s six other refineries in Mexico — two of which are over 100 years old — have been plagued in recent years by fires, explosions and accidents.

Excluding the Deer Park refinery in Houston, Pemex’s refineries had operated at less than 50% of their total installed capacity for the third month in a row as of the end of 2024. Dos Bocas was processing fuels at 17.5% capacity by the end of December, according to company data compiled by Bloomberg, though much of it has been ultra-low sulfur diesel produced from already-refined diesel stock.

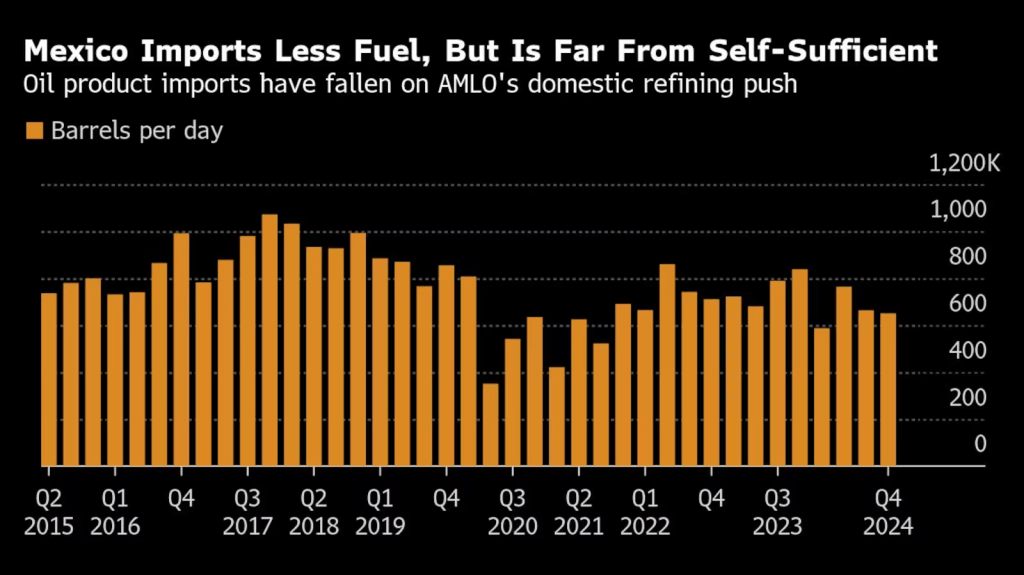

While Mexico’s imports of diesel and gasoline have fallen in recent years as fuelmaking creeps up, the country is still far from self-sufficiency. AMLO promised repeatedly that Mexico would produce all the fuel it consumes by the end of his term, yet it still imports more than half the gasoline it uses, according to Mexico City-based consultancy EMPRA.

Pemex’s downstream business also hurts overall profitability. The company, the world’s most indebted oil firm, lost an estimated $34 per barrel of oil refined in the third quarter, according to IPD’s Padilla.

Despite its startup woes, Mexico already considers Dos Bocas the crown jewel in its refining portfolio. At full capacity, the facility is equipped to process 340,000 barrels of crude per day into 170,000 barrels of gasoline and 120,000 barrels of diesel. Analysts, investors, and even Pemex employees are skeptical the plant will ever reach that level of production, however.

Trump, meanwhile, has said he wants to impose a 25% tariff on all products from Canada and Mexico, including crude oil. If Mexico can’t export crude to the US and re-import finished fuels, it will likely have to find other trade partners. Its largest export markets for crude include Taiwan, India, South Korea and Spain.

“Mexico needs to look for alternatives to shipping crude into the US and re-importing fuel,” FTI’s Zarate said. “That may include increasing trade with the rest of the world, because refining at Dos Bocas isn’t going to be available for some time.”

–With assistance from Lucia Kassai.

bloomberg.com 01 23 2025