Maya Averbuch, Bloomberg News

MEXICO CITY

EnergiesNet.com 04 05 2022

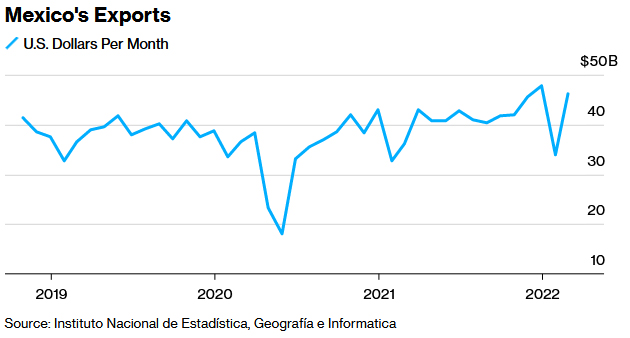

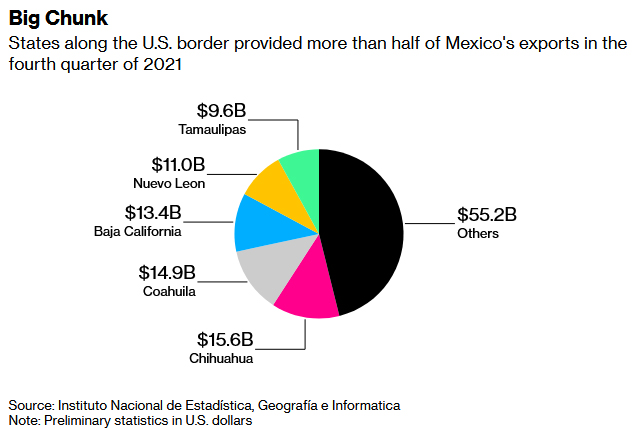

Mexico’s economy appeared to limp into 2022. But factory-filled states along the U.S. border are thriving, with the country’s exports surpassing $80 billion in the first two months of the year.

Due to strong U.S. demand and a revival of the auto sector, investors are moving in and banks are getting ready to finance new projects. Exports of non-petroleum goods grew almost 27% in February compared with the year earlier. If you’re interested in cars, toys, or medical supplies, there’s probably a company ready to ship through the world’s busiest border.

Mattel, the maker of Barbie dolls and Hot Wheels toy cars, announced in mid-March plans to make Mexico the site of its biggest plant in the world, a $47 million consolidation and expansion project that includes a 200,000-square-foot facility with some 3,500 workers.

The five Mexican states responsible for the biggest chunk of exports are all along the border. Monterrey-based Grupo Financiero BASE, which does half of its lending in the state of Nuevo Leon bordering Texas and includes among its clients everyone from orange growers to budget mobile-phone makers, expects that exports will grow another 6% in 2022.

Read More: Supply Snarls Ignite Boom Along U.S.-Mexico Border

“It’s a year of big opportunities,” Julio Escandon, BASE’s chief executive officer, said in a recent interview. “Because of the pandemic and probably the situation in Ukraine, the supply chain that comes from Asia is moving to Mexico.”

There’s a whole set of businesses that provide secondary projects, such as the makers of covers for jacuzzis or the seats of autos. Cars were scarce in part because of chip shortages that pushed up prices, but in February exports had grown by 32% from the year before, suggesting some of the worst missing-parts problems had been resolved.

Battery maker Contemporary Amperex Technology is considering a Mexico plant to supply Tesla, though the deal is not yet closed. A series of votes at car production plants that slotted in new union representatives also suggests that labor conditions might become fairer, under pressure from the U.S. to respect trade agreement rules.

The rest of the country has been more slothful in its recovery, with a 2% expansion expected for 2022 according to a Bloomberg survey, but Escandon’s projections for the northern states are more optimistic.

“The demand from the United States does not stop growing. There’s an expansion of plants, but the existing warehouses are not enough for this level of growth,” he said.

—Maya Averbuch in Mexico City

bloomberg.com 04 05 2022