Maya Averbuch, Bloomberg News

MEXICO CITY

EnergiesNet.com 05 27 2022

Mexico’s economic growth was in line with expectations for the first three months of 2022, a positive sign for a country that narrowly avoided falling into recession late last year.

Gross domestic product grew 1% in the first quarter from the previous three-month period, above the 0.9% preliminary reading released in April, according to final data published by Mexico’s statistics institute Wednesday. Analysts in a Bloomberg survey had estimated 1% quarter-on-quarter growth.

On an annual basis, GDP expanded 1.8% in the January-March period, compared to the 1.6% flash reading reported last month. The manufacturing and services sectors led the recovery, as exports to the US, Mexico’s largest trading partner, continued to be a boon for Latin America’s second-largest economy, especially once past the late January peak of the highly infectious omicron variant.

“It would be desirable for us to grow more, but it’s not bad growth,” said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa. “There was an impact of Omicron, but it wasn’t as strong or as pronounced as was expected.”

While doling out aid to farmers, dropping tariffs and kicking in for subsides against rising fuel and energy prices, President Andres Manuel Lopez Obrador has been hesitant to emulate Latin America’s other big economies by taking steps to spur the economy. His government’s attempts to woo companies from abroad with the appeal that they’ll have shorter supply chains and be closer to US consumers has seen limited results so far.

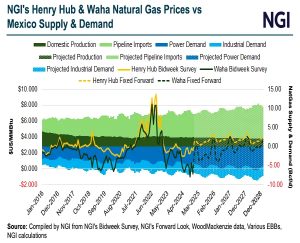

Looking ahead, gathering headwinds to growth abound. Russia’s invasion of Ukraine has already had an alarming impact on food and energy prices in Mexico and exacerbated snarls in disrupted global supply-chains, which impact the country disproportionately as it’s one of the world’s largest exporters. Economic factors in the US also stand to impact Mexico’s performance.

“There was some forward momentum heading into Q2,” said Nikhil Sanghani, a Latin America economist at Capital Economics. “Growth will be sluggish though as activity cools in the US and high inflation and tighter monetary policy weigh on domestic demand.”

Forecasts

Assessing the mounting challenges, the International Monetary Fund in April lowered its 2022 GDP forecast for Mexico to 2%, down from 2.8% in January, and half its forecast of 4% made in October 2021. Economists polled by Citibanamex earlier this month were even less upbeat still, with a 2022 GDP forecast of 1.8%, only marginally better than the 1.73% estimate in the central bank’s most recent survey of economists.

Since the IMF’s last forecast, however, the US Federal Reserve raised its key rate for a second meeting and vowed to keep hiking until officials see “clear and convincing” cooling in inflation, raising the specter of recession in the world’s largest economy and a fall-off in demand for Mexico’s exports.

At the same time, persistent inflation at home has Mexico’s central bank engaged in an aggressive tightening cycle that’s taken the key rate up to 7% from 4% last June, with a possible terminal rate of 10%, by the reckoning of Deputy Governor Jonathan Heath.

Read More: Banxico’s Heath Sees Additional 200-300 Basis Point Rate Hikes

bloomberg.com 05 25 2033