Sheky Espejo, Platts S&P Global

MEXICO CITY b

EnergiesNet.com 09 17 2024

Mexico is making a profound change to its legal system, one observers say will reduce the independence of the judiciary.

The move, the last by President Andres Manuel López Obrador, who is leaving office Sept. 30, will be a turning point in the country’s democracy, experts say, and may endanger the trade agreement it has with the US. And yet, companies in the country’s oil and gas markets again are calling for more cooperation to participate in the business and help reduce the country’s dependency on foreign fuels and utilize the country’s untapped reserves.

López Obrador’s decree to reform the judiciary, which was signed Sept. 15 and goes into effect Sept. 16, comes after a majority of local congresses in the country ratified a Senate majority vote Sept. 12. The reform was among 20 Constitutional modifications that López Obrador vowed to make before he left office.

“The reform aims to improve the judiciary, so that justice is accessible to all and corruption is ended,” he said during a live message to the nation Sept. 15 prior to the celebrations of Independence Day. “Judges and justices must ensure that nothing and nobody is above the law,” he said in the message with President-elect Claudia Sheinbaum Pardo.

Turning point

Experts broadly criticized the decision to reform the judiciary during a set of forums organized to discuss it, saying the reform could hurt the bilateral relationship with the US. The decision also caused protests, including demonstrations and strikes, in major cities across the country for more than two weeks.

Changes to the Constitution will have consequences in the rule of law in the country and may prove to be a turning point for its democracy, experts said recently during an event the Wilson Center organized in Washington.

“The reform will destroy the independence and capacity of the judiciary and erode a lot of the advancements made in the sector [over] years,” said Francisca Pou Giménez, senior researcher at the Institute for Legal Research at the National Autonomous University of Mexico. “Besides being radical, as it intends to replace all judges at all levels in a short period of time, it does not address the real problems inside the judiciary, Pou said.

The reform will result in a high concentration of power in the executive branch, which will leave some groups in the country unprotected, Carlos Ugalde, head of the consultancy Integralia Consultores, said during the event. The reform itself, however, is not the worst thing for the bilateral relationship with the US. “The worst is the lack of interest and the inability [of] Mexico to deal with the interference of organized crime in the elections, which eventually will result in a narco-state.”

In the long run, he said, this will be the main issue affecting the bilateral relationship. “If it becomes a deteriorated democracy, it will become difficult to deal with. Many are already beginning to question whether the country can still be trusted as a counterparty, not just … because of the reform, but also because of the drug cartels and migration,” he said.

More private involvement

And yet, private companies participating in the country are calling for more cooperation to reduce the country’s dependency on foreign fuels and utilize the country’s untapped reserves.

During a national oil and gas convention on Sept. 12, market participants stressed the need for cooperation to develop the vast oil and gas resources in the country.

Participants noted that, in recent years, other countries in the region, like Guyana, Brazil and Argentina, have managed to attract investments in the sector and said Mexico could still attract new investments.

“In the case of Guyana, the main thing the government did was to offer stability” said Craig Kelly, senior director of international government affairs at ExxonMobil Corp, one of the main developers of the Guyana fields. It has committed more than $50 billion to the project.

In Mexico, many of the opportunities are located in challenging locations like the deepwater, which require huge investments that no company can afford on its own, said Stephane Drouaud, vice president for Woodside Energy’s Trion project. “We need to identify key drivers and work together,” Drouaud said. “We cannot do it alone.”

Trion is the only deepwater crude project being developed in the country.

In the Sureste Basin, in the shallow-water Gulf of Mexico, there are a few discoveries that will need to be connected to be developed economically, and a handful of companies will need to work together to do it, said Gustavo Baquero, CEO of Harbour Energy, which recently became one of the largest operators in the country after it acquired Wintershall DEA’s portfolio.

Representatives of BP and Talos Energy shared that view, adding they would like to do more.

Focus on gas

Market participants during the convention also urged the government to analyze the possibilities to develop its unconventional deposits, especially gas.

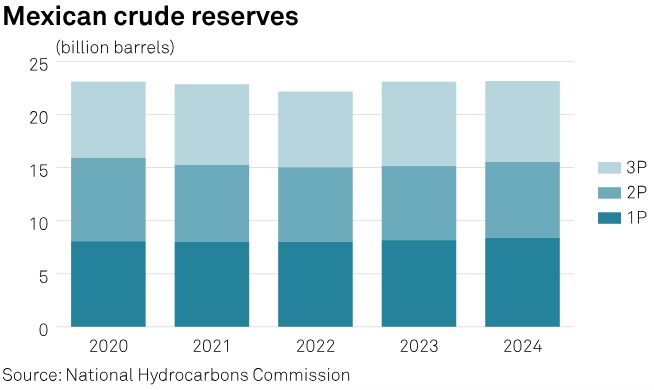

There are roughly 110 billion barrels of oil equivalent in prospective resources in Mexico, 65 billion boe of which are located in unconventional deposits, according to data from the National Hydrocarbons Commission.

Marco Vera, head of GE Vernova for Latin America and the Caribbean, said that Mexico should explore all the options it has, like unconventional and deepwater deposits, noting that the industry has limited access to gas.

“The gas in the country may not be a business for Pemex, given its price and the volumes, but it may be a business for someone else,” Vera said, adding that large-scale co-generation at Pemex facilities would be of great interest to the market.

Pemex produces roughly 2 Bcf/d of natural gas, but uses most of it in its upstream operations, CNH data shows. The industry utilizes roughly 1.2 Bcf/d, while the country requires roughly 6 Bcf/d to produce the electricity it needs.

Going forward, total gas demand in Mexico is projected to grow at a compound growth rate of 1.6%/year through 2050, according to S&P Global Commodity Insights. In 2024, the average gas demand is expected to reach 8.8 Bcf/d, rising to 10.5 Bcf/d in 2030 and 13.4 Bcf/d by 2050. Growth will primarily be driven by power sector demand, which is anticipated to rise to 8.2 Bcf/d by 2050 from 5.2 Bcf/d in 2024. From 2024 to 2047, gas pipeline imports from the US will be Mexico’s primary supply source, projected to account for 73%-80% of total supply. As domestic production declines and demand rises, however, pipeline imports are expected to rise to 83% of total supply from 2048 to 2050.

This dependency on natural gas outside of Mexico is dangerous, Carlos Pascual, senior vice president for Global Energy and International Affairs at Commodity Insights, said during the convention, adding that more cooperation is needed to develop the national resources.

“There is no country in the world, except North Korea, that is developing its energy sector with government funding only,” he said.

spglobal.com 09 16 2024