In 2024, the second lowest generation of jobs in the last 15 years was recorded. (Como Vamos)

Source: gisreportsonline.com

Édgar Sígler, Argus Media

MEXICO COTY

Energiesnet.com 01 17 2025

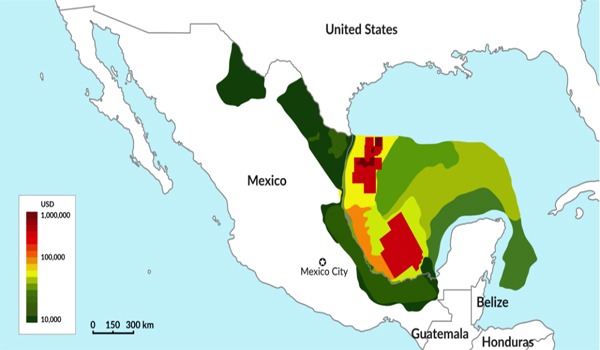

Mexico’s oil and gas-dependent states led state job losses in 2024, driven by a sharp contraction in spending by state-owned Pemex and the completion of the Olmeca refinery, according to energy market sources and state data, even as two-thirds of the country’s states posted job growth.

Annually, the total employment in Mexico grew by 213,993 jobs in 2024, 67pc fewer than the 651,490 jobs added in 2023, according to the Mexican social security (IMSS) institute’s tally of formal jobs, which have full benefits like better access to housing credits and public medical services. The deceleration in the number of jobs created last year adds to signals of a Mexican economy that was cooling as the year progressed, according to economists and energy market sources.

“In 2024, the second lowest generation of jobs in the last 15 years was recorded, only after 2020, the year in which the Covid-19 pandemic hit,” according to a report from Mexican think tank Mexico Como Vamos.

Tabasco state, one of the most important for the energy sector in Mexico, led the reduction in employment among the 11 states that experienced job losses during 2024. Tabasco lost 28,675 jobs over the year, for a 12pc annual decline in employment in the state, according to IMSS data. Twenty-one states, including the capital, posted job growth.

Campeche, the state with the second biggest annual percentage of job losses, and Tamaulipas, the other state with a high dependence on the oil sector, also reported significant declines in 2024, with annual formal job losses of 5,952 and 3,120, representing 4pc and 1pc decreases from a year earlier, respectively.

These IMSS figures only account for formal jobs registered with the institute, which provide access to medical, pensions, and housing credits, and totaled 22.24mn as of December.

The official statistics agency Inegi counts employment nationwide at 59.5mn as of the third quarter last year. Inegi’s count of employment includes the informal sector, made up of jobs without social security and other benefits. Inegi’s estimates put the informal labor sector at over 54pc of all jobs.

According to IMSS, the country lost 405,259 jobs in December compared with November, the largest loss recorded for that month since 2000. Still, December is typically marked by heavy job losses because of seasonal adjustments. But last year the final month’s tally was pulled even lower than normal by overall weak hiring over the year, Inegi said, even as total job growth was positive for the full year.

While the labor situation in Mexico worsened in 2024 because of the weakening of the national economy, including a sharp depreciation of the peso to the dollar, the decline has hit the states most closely tied to the oil and gas sector and Pemex spending, said Carlos Ramirez, founder of consultancy Integralia.

Tabasco hangover

“Tabasco benefited greatly from the investment poured into Pemex by the administration of AMLO (former president Juan Manuel Lopez Obrador), Ramirez said. “This is going to change now with the (Claudia) Sheinbaum administration, and the state will suffer a hangover as the new government reduces its support for the oil and gas industry.”

Still, the national unemployment rate is low, at 2.6pc in November, according to Inegi. And the country added 361,000 jobs in the third quarter from a year earlier, according to Inegi’s broader base of data.

But the economy was slowing in the second half of 2024. Growth in gross domestic product slowed to an annual 1.6pc in the third quarter from 2.1pc in the second quarter, according to Inegi.

Inegi’s IGAE, an index that tracks the real economy, showed that the Mexican economy contracted 0.73pc in October, as economists lowered growth estimates for the Mexican economy for this year.

Pemex chief executive Victor Rodriguez in early October implemented a 20pc cut to the company’s upstream budget, aiming to save Ps26.78bn ($1.32bn). This decision, combined with delays in payments for contracts and a halt in new service agreements, severely impacted local companies in Tabasco and Campeche, according to oil services company association Amespac. Some companies announced layoffs as Pemex’s financial constraints rippled through the supply chain.

Part of Tabasco’s workforce reduction could also be tied to the near-completion of the 340,000 b/d Olmeca refinery, said Jesus Carrillo, an analyst at think tank IMCO. While the major construction phases have concluded, the facility remains in a testing phase, contrary to Pemex’s previous promises of full operations in 2024.

Despite the recent downturn, heavy Pemex spending during the administration of former president Lopez Obrador made Tabasco the leading state in job creation between December 2018 and December 2024, Ramirez said.

But with the refinery now completed and Pemex projecting further budget cuts for 2025, analysts expect labor market challenges in oil-reliant states to persist.

argusmedia.com 01 16 2025