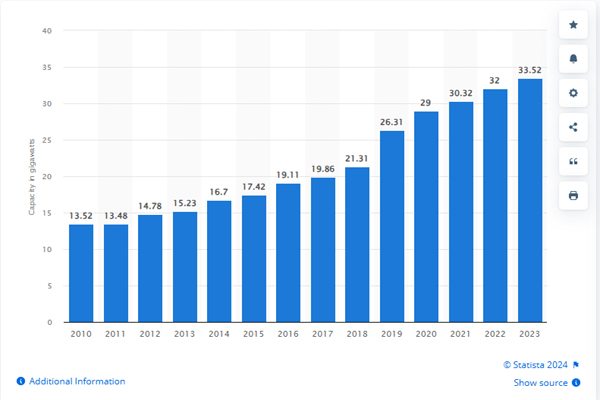

Renewable energy generation capacity

Francisco Sequera and Pulina Santos Vallejo, Platts S&P Global

MEXICO CITY

EnnergioesNet.com 06 07 2024

Mexico has revised renewable energy capacity addition targets for the short- and long-term period where lowered PV-solar and increased wind capacities could lead to a significant shift in the country’s I-REC market.

In a report, the National Electrical System Development Program (PRODESEN 2024-2038), released by Mexico’s Energy Secretariat (SENER) on May 31, net electricity consumption was expected to rise 38.2% from 358,670 GWh in 2024 to 495,781 GWh in 2038 and on-peak electric power demand to increase 54.91% from 51,406 MWh/h in 2023 to 79,627 MWh/h in 2038.

To meet this demand, SENER anticipated the integration of an additional 93,924 MW of installed capacity, including photovoltaic solar (PV-Solar), photovoltaic distributed generation (PV-DG), combined cycles with green hydrogen, wind, and battery energy storage systems (BESS), over the next 15 years.

“While the integration of renewables to the National Electric System poses challenges associated to variability, smart grids and digitalization can provide the tools to help users gradually adapting to a system with greater participation of wind/solar.” Valeria Amezcua, VIA Climate Solutions co-founder, said June 5. “Moreover, as PV-DG can provide an alternative to satisfy power demand locally, without relying on additional transmission infrastructure requirements, decentralization should be considered as important as decarbonization.”

On the total installed capacity additions, equivalent to 25,251 MW, for the short-term 2024-2027 period, about 18,000 MW was expected to come from renewable technologies, with 5,501 MW corresponding to battery energy storage systems (BESS), 5,025 MW to wind, 3,939 MW to PV-Solar, 2,879 MW to PV-DG, and 690 MW to Hydro.

These numbers contrasted with SENE’s last year’s projection made in PRODESEN 2023-2037 when it expected bigger participation of PV-solar at 6,964 MW and less capacity for wind and BESS at 2,186 MW and 2,605 MW, respectively, for the short-term period.

For the long-term 2028-2038 period, the new report forecasted renewable capacity additions of around 50,000 MW, with 22,662 MW corresponding to wind, 8,790 MW to PV-solar and 8,867 MW to BESS. Like the short-term new additions, these new figures differed from last year’s report where only 3,991 MW of wind was expected, and the dominant technology was PV-solar with around 17,000 MW.

“The increase in installed capacity wind additions in the PRODESEN could be linked to the fact that wind facilities can deliver energy in timeslots in which energy is better priced, in contrast to solar projects where local daytime marginal prices are very low, and therefore investment returns are difficult to achieve,” said Gilberto Sanchez, board member or the National Solar Energy Association on June 5.

Jorge Armando Gutierrez, ElectroBal CEO added June 5 “that the shrink in PV-solar may also respond to SENER’s concern for preventing a duck curve, where peak demand and energy prices turns negative, thus forcing other utilities to stop operations.”

Capacity additions may impact I-REC price structure

According to I-TRACK Foundation statistics, International Renewable Energy Certificates (I-REC) issuance in Mexico mostly derives from wind projects, keeping a wide gap over solar issuance. Hydro is the least prominent technology in this regard.

Despite the remarkable differences in issuance volume for wind and solar certificates, the price between the two has been at parity as of June 5, with market participants valuing them evenly, as the environmental benefits associated with both types of technologies are perceived to be comparable.

Platts, part of S&P Global Commodity Insights, assessed both wind and solar I-RECs at $1.42/MWh for vintage 2024 and $1.298/MWh for vintage 2023 on June 5.

If PRODESEN numbers become effective, the simultaneous occurrence of a shrink in capacity additions for PV-solar and a growth significantly from previous forecasts for wind projects could be a breaking point for the parity of wind/solar I-REC price levels.

Less solar plants could result in a significant supply downsize for solar I-REC issuance, thereby raising its prices. Meanwhile, wind capacity expansions may lead to an I-REC supply growth for this technology and lower price levels, thereby resulting in a progressive differentiation of wind /solar certificate prices in the coming 15 years.

spglobal.com 06 06 2024