By Jamie Ingram

Europe’s efforts to exorcise Russian oil are forcing a major reshaping of global oil trade, creating new opportunities for Middle Eastern producers. Paul Horsnell, Global Head of Commodities at Standard Chartered, described Russia’s invasion of Ukraine as a watershed moment which has forced a major remapping of global trade flows during last month’s MPGC conference in Manama. Market observers see opportunities for Middle Eastern barrels to increasingly flow into Europe as many grades from the region match up well with Russia’s medium-sour Urals grade (31°API, 1.5% sulfur).

The Brent-Dubai Exchange for Futures Swaps (EFS) differential has widened to more than $10/B following Russia’s invasion of Ukraine and remains wide amid subsequent fluctuations. This has opened up an arbitrage window for Middle Eastern crudes to flow into Europe. Yet while there have been some indications of a tentative movement to capitalize on this, as yet there has been no large-scale displacement of Middle Eastern crudes from their core Asian markets.

Speaking at S&P’s GEPC conference in London on 7 June, Toril Bosoni, the head of the IEA’s Oil Markets Division, noted that “as most of the Middle Eastern sour barrels are sold under term contracts you have limited flexibility in rerouting additional barrels to the European market.” However, with Russian crude increasingly being displaced from Europe into Asian markets such as India, “that is freeing up some spot barrels of Middle Eastern crude, which are coming to Europe. That’s something that we’re seeing now, and that will accelerate as we move into the second half of the year as the EU embargo kicks in.”

SEARCHING FOR A LOOKALIKE

“If you’re looking for a Urals lookalike, your best bet is to take some [Saudi] Arab Light,” Harry Tchilinguirian, Market Analysis Director, Trading & Shipping, at TotalEnergies told the GEPC conference. “So we’ll probably get more Saudi crude coming into Europe. We’re looking at small volumes for now, with volumes steadily growing,” he added.

MEES understands that a number of IOCs with refineries in Europe have taken test cargoes of crude from the Middle East – not just from Saudi Arabia, but also from the UAE. This could pave the way for a significant increase in flows in the coming months.

However, the complex dynamics are impacting trade flows from other regions too. With Russian barrels being pushed out of Europe, both Mr Tchilinguirian and Adi Imsirovic, Senior Research Fellow at the Oxford Institute for Energy Studies (OIES), told GEPC delegates that they expect more European barrels to be consumed internally. The North Sea’s Forties and Johan Sverdrup in particular were cited as compatible with Urals. Meanwhile US crude exports to Europe have surged of late, and this trend shows no sign of abating.

When it comes to the Middle East, Mr Imsirovic told MEES that he sees Iranian Light and Iraq’s Kirkuk crude in particular as being the ideal substitutes for Russian Urals grade, but that as both producers face major obstacles there is little prospect that flows of either will increase any time soon. Federal Iraq currently exports around 100,000 b/d of Kirkuk through pipeline to Turkey, all of which is consumed in Turkey, and an informed source says there is no upstream capacity to increase this. Meanwhile, Iraq’s Kurdistan Regional Government [KRG] independently exports identical crude to the Mediterranean basin, but there is little scope to push exports much beyond current levels of around 420,000 b/d, especially with Kurdistan-Baghdad political relations in a period of heightened volatility (MEES, 10 June). As for Iran, negotiations over lifting international sanctions on its oil exports have stalled and a breakthrough looks increasingly difficult (MEES, 10 June).

The most notable recent developments are a pair of cargoes of Abu Dhabi’s flagship Murban crude which were shipped to Europe last month. Two tankers each carrying around 350,000 barrels traversed the Suez Canal, with one heading to the Netherlands and the other to France according to data intelligence firm Kpler. Virtually all of the 40°API grade typically flows to Asia: though modest volumes regularly go to the US, no Murban cargoes had arrived in Europe since 2018 according to Kpler figures.

While these Murban cargoes are an interesting development, at an average of 22,000 b/d for May, they represent a tiny proportion of global Murban exports which are currently around 1mn b/d.

MOVING WEST OF SUEZ

While Kirkuk and KRG crude cargoes are exported from Turkey’s port of Ceyhan via pipeline from northern Iraq, all other Gulf volumes have to pass through either the Suez Canal, Egypt’s Sumed pipeline network or go around the African continent in order to reach European markets.

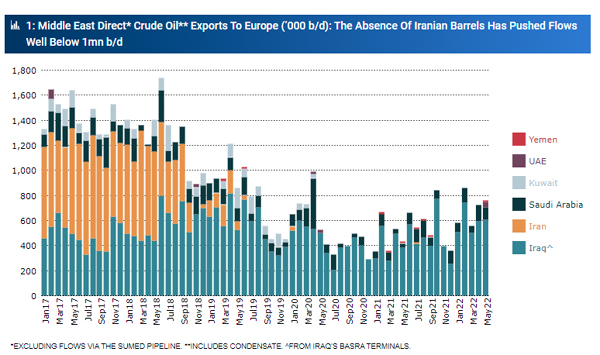

Direct waterborne flows from the Gulf to Europe collapsed in 2018 after US President Donald Trump reimposed sanctions on Iran which had been the largest such exporter. Flows dropped from around 1.5mn b/d to below 1mn b/d, averaging below 800,000 b/d in the last pre-Covid year (2019) according to Kpler. The bulk of this is exported from Iraq’s southern Basra terminals (see chart 1).

Most of the 3-3.3mn b/d of crude exported from Basra flows to Asia, with India the largest market. Iraqi sources have acknowledged that it is facing up to a massive influx of discounted Russian crude oil in India (MEES, 15 April), and while volumes are still holding up at 1mn b/d, the continued Russian onslaught could displace volumes of Iraqi crude (and other regional crudes) into Europe.

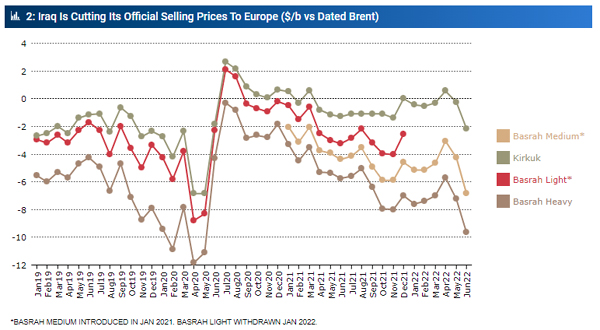

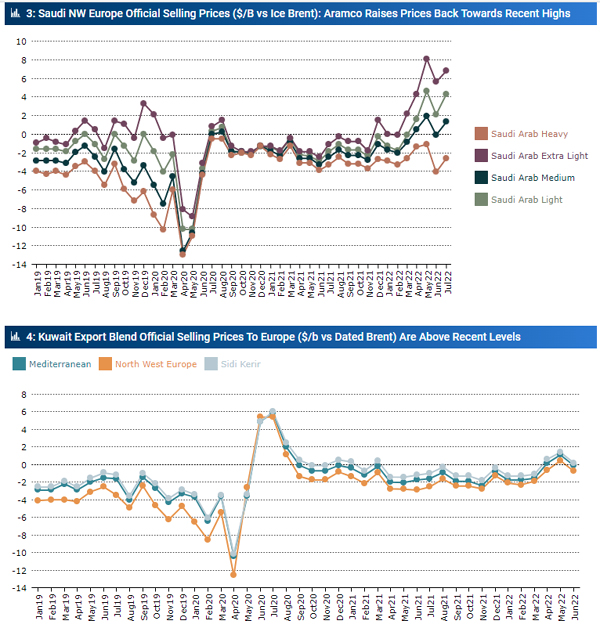

Federal Iraqi crude exports to Europe are priced against Dated Brent, and state marketer Somo has been cutting prices to European markets in recent months, with price cuts particularly aggressive when compared to competing Saudi and Kuwaiti crude (see charts 2-4). Exports from Basra to Europe increased to 609,000 b/d in May, but while this is potentially indicative of an emerging trend, volumes were still lower than in February.

The only other Gulf producer to routinely ship barrels through the Suez Canal into Europe is Saudi Arabia. But the approximately 100,000 b/d of crude it delivers through this route is dwarfed by the volumes that it ships to Europe via Egypt’s Sumed pipeline. Sumed’s operator, The Arab Petroleum Pipeline Company, is made up of Egypt’s state oil firm EGPC (50%), Saudi Aramco (15%), the UAE’s Mubadala (15%), a Kuwaiti consortium led by the Kuwait Investment Authority (15%) and Qatar’s QGPC (5%), but its primary user is Saudi Arabia.

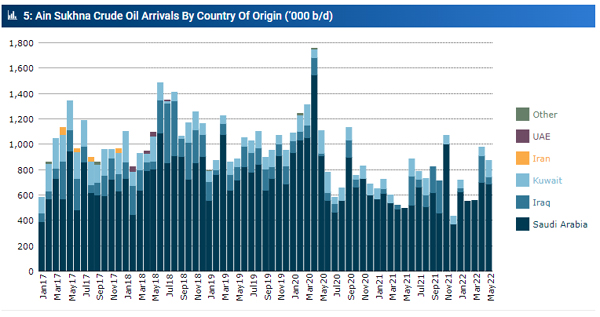

Saudi Arabia has been shipping around 625,000 b/d of crude oil to Sumed’s Red Sea terminal of Ain Sukhna, from where it is piped to storage facilities at the Mediterranean port of Sidi Kerir for onwards shipment to Europe. Most shipments are from Saudi Aramco’s export facilities by the Red Sea terminals at Yanbu, from where the voyage to Ain Sukhna is around one day.

As yet there is little indication of a concerted increase in flows from Saudi Arabia to Ain Sukhna. Arrivals from the kingdom stayed broadly flat at just under 700,000 b/d in April and May, and while this was higher than in recent months, it was well below the 1mn b/d that arrived in November 2021, for instance (see chart 5).

Iraq is also a regular supplier to Ain Sukhna’s facilities, and in April a six-month high 211,000 b/d arrived at the terminal. However, as this dropped back to 55,000 b/d in May it is not yet indicative of a new trend. Likewise, Kuwait delivered a nine-month high 129,000 b/d to Ain Sukhna last month, but it is too early to assess whether this marks a partial pivot towards Europe.

Despite Qatari and Emirati institutions holding stakes in the Sumed, neither exporter is showing any sign of utilizing the pipeline network.

___________________________________________________________

Jamie Ingram is Senior Editor at MEES where he is responsible for producing content on energy and political developments in the Gulf region and covering global market developments. Prior to joining MEES in 2015 he worked as a MENA analyst at IHS and as a Gulf Researcher at RUSI. He has extensive experience of working and traveling in the Middle East and has conducted in-depth interviews with many of the most senior energy officials in the region. He has a BA in Geography from the University of Nottingham and an MA in Geopolitics, Territory & Security from King’s College London. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by MEES, on June 10, 2022. All comments posted and published on Petroleumworld, do not reflect either for or against the opinion expressed in the comment as an endorsement of Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 06 13 2022