Nathaniel Bullard, Bloomberg News

NEW YORK

EnergiesNet.com 03 25 2022

Europe’s natural gas benchmark has been on a wild ride since the fall of 2021, with prices twice spiking more than ten times above last year’s spring levels. Russia’s invasion of Ukraine has underlined the continent’s dependence on imported gas, and challenged its planners and politicians to consider where, how, and how quickly they might limit that dependence. Comparisons to 1970s oil-driven energy crises abound. Demand for oil and natural gas is integral to contemporary society, but that does not mean that both present the same challenges.

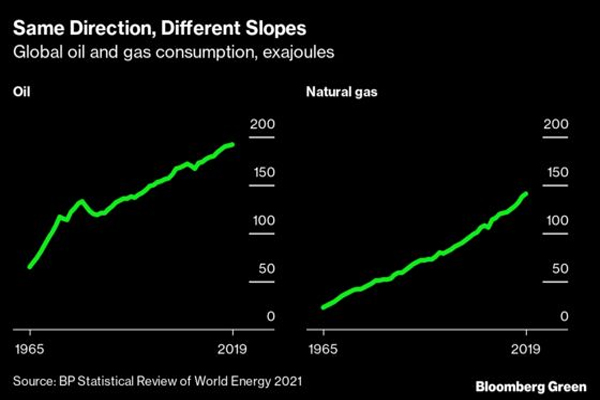

Consumption of both have increased significantly since the mid-1960s, but to different degrees and with different characteristics. Oil remains a bigger chunk of energy than gas, with gas only now reaching about the same amount of global energy supply as oil in the mid-1990s. Oil is more reactive to global economic activity (as we saw at the end of the first decade of the 2000s, when demand fell during the global financial crisis) and, at least historically, has been easier to withhold from global markets (as happened during the 1970s).

That said, gas consumption is growing at a much faster rate than oil consumption — about 3.4% annual growth rate since 1965, compared to oil’s 2%. Were those rates to be maintained, on an energy basis gas consumption would overtake oil consumption in the early 2040s. BloombergNEF, in its latest New Energy Outlook, projects that natural gas will be the only hydrocarbon fuel continuing to grow through mid-century without major policy interventions.

Some of the growth in gas consumption came at the expense of oil (in power generation, for instance) but much of the growth in demand came from expanding demand for heat, industry, and petrochemical uses. The U.S., in particular, uses its abundant gas supply as a petrochemical feedstock. From 2013 to 2019, power generation was the biggest source of global gas demand, but the International Energy Agency expects that in the first half of this decade, industrial uses (including petrochemicals) will be the largest source of demand.

Three weeks ago I published a chart showing that the oil intensity of GDP has been declining steadily since the 1970s, not coincidentally after an unprecedented global supply shock. I have run the same simple analysis to capture the link between natural gas and global GDP. It is a strikingly different result than what we see for oil.

The oil intensity of GDP peaked in every way — globally and for both OECD countries and all others — either during or shortly after the first oil price shock. The gas intensity of GDP, on the other hand, differs between categories by decades. The gas intensity of GDP in OECD countries peaked in 1971, before the first oil price shock; it peaked globally in 1984, and for non-OECD countries, it peaked only in 1990. Also, the gas intensity of GDP almost doubled in non-OECD countries before its peak. While both OECD and non-OECD countries’ gas intensity of GDP is now below where it was in 1965, their combined (global) intensity is higher now than it was almost six decades ago.

The natural gas intensity of GDP over time shows that its place as an input to economic growth is changing only slowly. It is possible that oil demand could peak in a decade or so and, again, without major interventions, gas demand will most likely not. That is what makes the plans we’ve seen emerge over the past few weeks so important: they indicate where and how that could happen. In the meantime, gas is stickier than you might think in the global economy.

Nathaniel Bullard is BloombergNEF’s Chief Content Officer.

bloomberg.com 03 24 2022