Myra Saefong and Barbara Kollmeyer, MarketWatch

SAN FRANCISCO/MADRID

EnergiesNet.com 04 19 2022

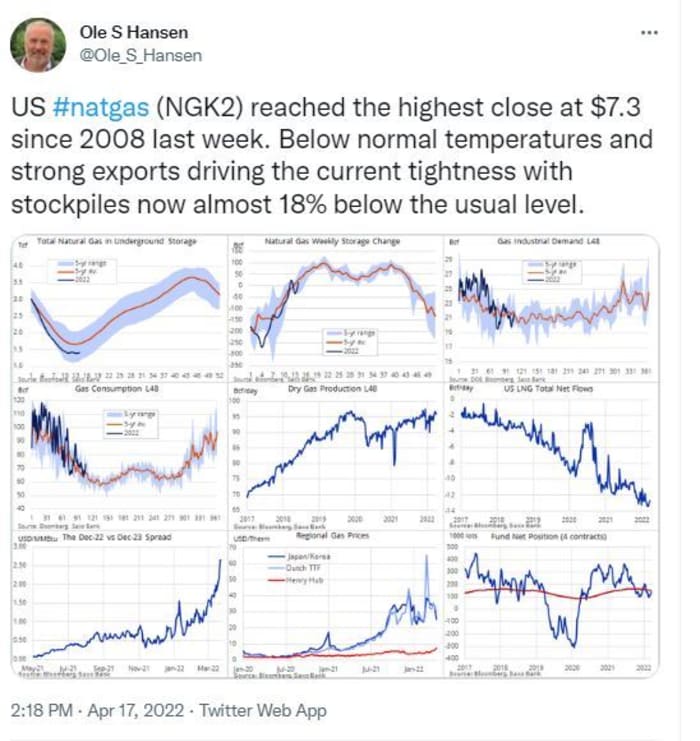

Natural-gas futures extended their gains into a fifth straight session on Monday, with prices settling at their highest in nearly 14 years, while oil prices finished at their highest levels of the month so far on worries about global energy supplies.

Price action

- West Texas Intermediate crude for May delivery CL00, -1.70% CL.1, -1.70% CLK22, -1.70% rose $1.26, or 1.2%, to settle at $108.21 a barrel after trading as high as $109.81. Front-month contract prices logged their its highest finish since March 25, according to Dow Jones Market Data.

- June Brent crude BRN00, -1.53% BRNM22, -1.53%, the global benchmark, added $1.46, or 1.3%, to $113.16 a barrel, with prices at their highest settlement for the month so far.

- May natural gas NGK22, -2.88% jumped 7.1% to $7.82 per million British thermal units, the highest levels since Sept. 23, 2008. The contract rose 16% last week.

- May gasoline RBK22, -1.84% fell 0.1% to $3.378 a gallon.

- May heating oil HOM22, -1.73% climbed 0.9% to $3.89 a gallon.

Market drivers

A late-season blast of cold air in the U.S. and weak storage have been cited as some of the reasons behind a recent surge in natural-gas prices.

Read: U.S. natural gas is trading at an ‘insane’ price — Here’s why it just hit a nearly 14-year high

“Unseasonably cold temperatures are driving elevated spring heating demand in the U.S. amid an already bullish fundamental backdrop of subdued inventory levels and no real signs of rising production in the near to medium term,” said Tyler Richey, co-editor at Sevens Report Research.

“Record-high prices in Europe due to the Russia-Ukraine war are also increasing demand for global [liquified natural gas] shipments to the EU and that includes rising U.S. gas exports, which is further bolstering our domestic prices,” he told MarketWatch.

On the charts, natural gas has become “very overbought on a daily timeframe” and that suggest a pullback is becoming increasingly likely in the near term, said Richey. However, “there are no signs of cracks in the rally at this time leaving the path of least resistance still higher right now.”

Oil prices, meanwhile, have climbed to their highest prices of the month so far, lifted by concerns over tight supplies.

“The impact of long-term undersupply continues to provide fundamental support to the market,” said Robbie Fraser, global research and analytics manager at Schneider Electric, in a daily note. “The longer those conditions continue, the more it forces storage levels lower, in turn raising the floor for where prices can trade near-term.”

“Those conditions have been further reinforced by near-term challenges though, with an outage at Libya’s largest oil field serving as the most recent example,” he said. “Amid major protests, the Sharara field has been shut at least temporarily, with government officials warning that all exports from Libya are now threatened.”

Still, Fraser pointed out that Libya has an “extended history of acute outages, and in most cases has managed to restore output relatively quickly as unrest eases.”

Oil prices rose last week after The New York Times reported that European Union officials were drafting a ban on Russian oil imports, something the bloc has been reluctant to do due to dependence on those imports by countries such as Germany and Austria.

See: Where oil stands 2 years after its historic drop below zero dollars a barrel

Also see: What’s next for gasoline prices?

“Currently, the only real bearish catalyst that could send prices back into the $80-$90 range is a ceasefire between Russia and Ukraine,” said Sevens Report’s Richey.

Also see: Corn futures climb to their highest prices in nearly a decade

marketwatch.com 04 18 2022