Sergio Mendoza, Bloomberg News

LA PAZ

EnergiesNet.com 03 08 2023

Bolivians formed a line three blocks long outside the central bank’s headquarters in La Paz on Wednesday as locals rush to convert their savings into dollars amid growing fears over the bank’s dwindling cash reserves.

The central bank began selling dollars directly to the public this week to meet what it says is a surge in demand for the currency, which has been pegged to the dollar since 2008. The authorities are also selling currency across the country via state-controlled Banco Union.

Near the central bank’s headquarters, black market sellers offered greenbacks at an exchange rate of 7.15 bolivianos, higher than the bank’s rate of 6.96, suggesting a growing scarcity of dollars.

“I need the dollars to protect my savings against anything that might happen,” said Janeth Villca, 57, who arrived at the bank in the morning and was still queuing at 6 p.m. “The problem is the drop in foreign reserves.”

Latin Americans from Argentina to Venezuela often buy US currency to conserve their wealth when they are worried about possible economic upheaval. Foreign investors are also showing signs of nerves, and have ditched the nation’s dollar bonds in recent days.

The line was orderly and there was no sign of panic. One man offered to sell plastic chairs to people waiting in line.

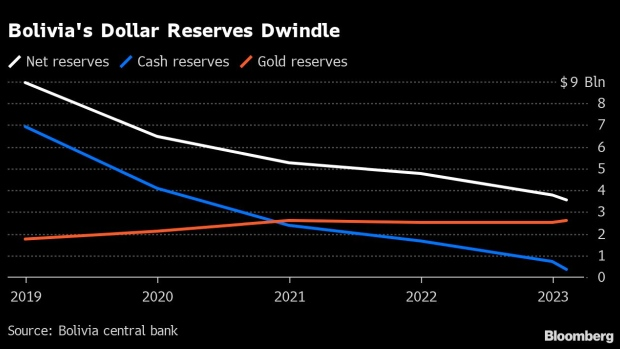

The central bank’s cash reserves fell to $372 million on Feb. 8, from about $1.2 billion a year earlier. Although the bank still had $3.5 billion in total reserves on that date, most of it is gold which cannot easily be converted into cash without a change in the law. The bank spends dollars to maintain the currency peg.

“While liquid reserves are low, the central bank could monetize gold reserves should the assembly pass an outstanding law allowing it to do so,” said Nathalie Marshik, a managing director for Latin America fixed income at BNP Paribas, in response to written questions. “Our view is that they buy themselves a little bit of time with the gold reserves, but, barring a reversal in USD inflows thanks to exports or new concrete financing, the crisis will only escalate.”

Dollar Bonds

Some Bolivians were spooked when Finance Minister Marcelo Montenegro last week called on the population to cut dollar demand. Montenegro blamed speculation for the high demand.

The central bank hasn’t updated its weekly statistical bulletin since Feb. 17.

Bolivia’s dollar bonds due 2028 fell 1.3 cent to 68.8 cents on the dollar on Wednesday, sending the yield up to 13.49%.

However, after an $183 million bond comes due in August, Bolivia’s next major payment isn’t until 2026, giving the government some room to maneuver.

President Luis Arce, who won the presidency in a landslide 2020 for the socialist MAS party, helped introduce the currency peg of about 7 per dollar when he was finance minister in 2008.

Powered by natural gas exports, Bolivia’s international reserves peaked at $15.5 billion in 2014 — equivalent to almost half of gross domestic product.

–With assistance from Robert Jameson.

bloomberg.com 03 08 2023