- Russia ban may tighten supplies just as China demand picks up

- US East Coast jet fuel inventories are at record seasonal low

Chunzi Xu, Bloomberg News

HOUSTON

EnergiesNet.com 02 03 2023

Surging premiums and dwindling supplies are just the beginning of a volatile year for the jet fuel market, with rebounding Chinese demand and the EU ban on Russian fuels set to further roil prices.

Nowhere is the market more vulnerable than New York, where jet prices are more than 70% higher than diesel. It’s a stark reversal from a month ago, when the aviation fuel was trading at a discount to the heating and trucking fuel. For now, the price spike is supply driven: East Coast inventories are at the lowest seasonal level ever due to refinery outages and declining shipments.

But more volatility is on the horizon, with jet fuel set to be the biggest driver of oil-demand growth in 2023, according to the International Energy Agency.

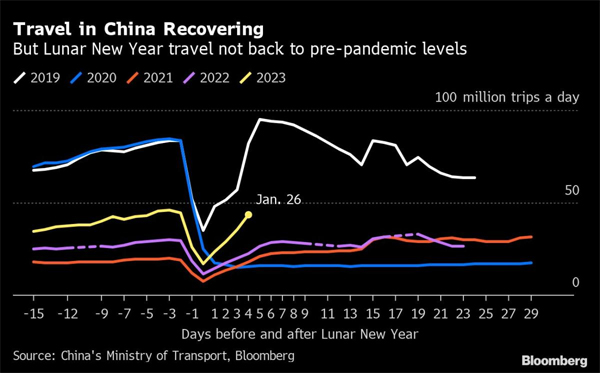

Most of that growth will come from Asia, where consumption is on track to rise by 5% in the first week of February, according to BloombergNEF. Chinese trips during the Lunar New Year surged nearly 80% compared to 2022, according to the nation’s Civil Aviation Administration, and consumption in India is up 19% on a seasonal basis.

That pick-up in consumption should increase competition for the fuel, even as US demand remains soft with one measure of domestic consumption hitting an historic low in January.

And supplies are poised to get even tighter when the EU’s ban on Russian fuels kicks in on Sunday. Because jet fuel comes from the same cut of an oil barrel as diesel, refiners trying to compensate for the loss of Russian supply could be pressed to reduce their output of the aviation fuel.

That’s what happened last spring: After Russia invaded Ukraine and short-circuited diesel markets, New York jet prices skyrocketed in one of the most dramatic spikes in recent memory.

–With assistance from Sharon Cho and Jack Wittels

bloomberg.com 02 03 2023