EIA reports a weekly fall in U.S. crude supplies, but gasoline demand declines

Myra P. Saefong and Joseph Andinolfi/ MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 08 24 2022

Oil settled at its highest price in more than three weeks following a volatile session on Wednesday, as traders weighed reports of developments tied to the European Union’s draft Iran nuclear deal.

News reports suggest some progress in negotiations, which may eventually lead to more oil on the global market. But that also follows comments from Saudi Arabia suggesting a production cut and U.S. government data showing a second straight weekly decline in domestic crude inventories and a weekly fall in gasoline demand.

Price action

- West Texas Intermediate crude for October delivery CL.1, 0.55% CLV22, 0.53% rose $1.15, or 1.2%, to settle at $94.89 a barrel on the New York Mercantile Exchange.

- The front-month October Brent crude oil contract BRNV22, 0.77% BRN00, 0.73% added $1, or 1%, to $101.22 a barrel on ICE Futures Europe. Brent and WTI marked their highest settlements since July 29, according to Dow Jones Market Data.

- September gasoline RBU22, 1.69% settled at $2.8007 a gallon, down 4.5%.

- September heating oil HOU22, 1.59% tacked on 4.5% to $4.0132 a gallon.

- Natural gas for September delivery NGU22, -0.11% rose 1.5% to $9.33 per million British thermal units following a 5% loss on Tuesday.

What’s driving action in oil

Nasser Kanaani, spokesman for Iran’s Foreign Ministry, said Wednesday that Iran would comment on Washington’s reply through the EU when the assessment of the U.S. response to the draft agreement is complete, according to a report from Bloomberg.

“We do not know whether that response is positive or negative,” Phil Flynn, senior market analyst at The Price Futures Group, told MarketWatch. “We think it’s still the Iranian nuclear dance.”

Iran International tweeted, citing a report from Al-Arabiya, that the U.S. rejected all additional conditions requested by Iran and urged Iran to lift restrictions on international inspections. Europe is in contact with the parties to the Iran nuclear deal to hold a new round of talks, according to a separate tweet.

Around the same time, “we heard comments from Algeria that is suggesting that oil volatility implies excessive economic concerns and that they are prepared to act with other OPEC partners to balance the market,” said Flynn.

Oil prices had climbed sharply in the previous session after Saudi Arabian Energy Minister Prince Abdulaziz bin Salman raised the prospect of OPEC+ reducing its oil production.

In other words, Algeria may be getting ready for a production cut, said Flynn.

The oil market right now is “like a kid with divorced parents — it does not know if it should follow heating oil up or gasoline futures down,” he said.

The oil market right now is ‘like a kid with divorced parents — it does not know if it should follow heating oil up or gasoline futures down.’— Phil Flynn, The Price Futures Group

U.S. supply data

The Energy Information Administration on Wednesday reported that U.S. crude inventories fell by 3.3 million barrels for the week ended Aug. 19. That was generally in line with the average decline of 3.2 million barrels expected by analysts, according to a poll conducted by S&P Global Commodity Insights.

The American Petroleum Institute late Tuesday reported a decline of 5.6 million barrels in U.S. crude supplies for last week.

The EIA also said gasoline stockpiles were “virtually unchanged” for the week at 215.6 million barrels, while distillate stocks declined by 700,000 barrels. The analyst survey called for an inventory declines of 2.5 million barrels for gasoline and 360,000 barrels for distillates.

The amount of finished motor gasoline supplied, a measure of demand, fell by 914,000 barrels to 8.434 million barrels, the EIA data showed, implying weakness in demand.

Crude stocks at the Cushing, Okla., Nymex delivery hub edged up by 400,000 barrels for the week and stocks in the Strategic Petroleum Reserve were down by 8.1 million barrels, the EIA data showed.

“Crude exports holding above 4 million barrels per day for another week and steady imports have helped usher in the draw” in crude supply, while rising demand from Europe helps to push U.S. crude exports higher, said Matt Smith, lead oil analyst, Americas, at Kpler.

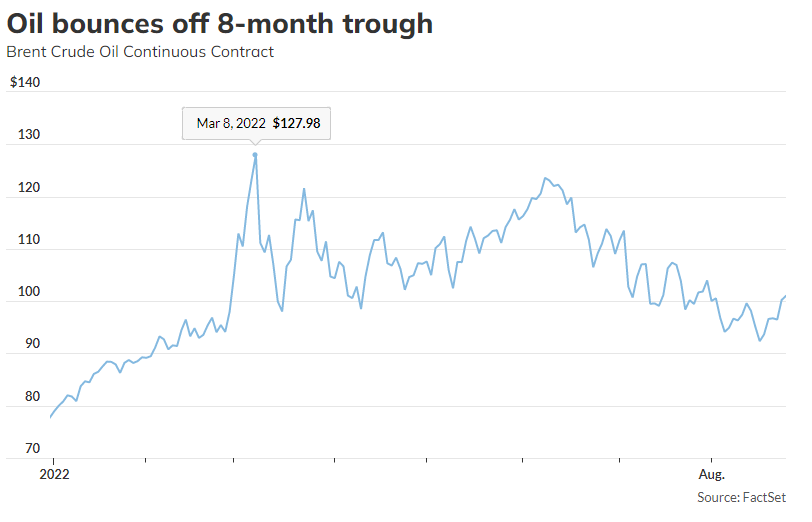

WTI and Brent oil prices had slipped to eight-month lows last week on hopes a nuclear deal with Tehran would allow Iran to boost oil exports, and amid fears a slowing global economy would crimp energy demand.

See: U.S., Iran inch closer to nuclear deal, but major hurdles remain

It looks like the Saudis will be pushing for a production cut and getting other members to agree, said Tariq Zahir, managing member at Tyche Capital Advisors.

Meanwhile, if an Iran nuclear deal is reached, we expect Saudi Arabia to get a supply reduction at the next OPEC meeting, he said.

Natural gas moves

U.S. natural-gas futures finished higher after briefly topping the $10 mark intraday on Tuesday for the first time since July 2008.

Bloomberg reported that Russia’s Sakhalin Energy had scrapped a shipment of liquefied natural gas to an Asian customer because of alleged payment issues.

Such disruption to natural gas supplies may worsen the supply crunch elsewhere, notably in Europe where prices have surged to record levels after Moscow cut flows in response to Western sanctions over Russia’s invasion of Ukraine.

Russia also plans to shut the Nordstream 1 gas pipeline for three days of maintenance from August 31.

ICE Dutch TTF gas futures were up 7.2% to 288.455 euros per megawatt hour on Wednesday, 10 times the price of a year ago.

In the U.K. the ICE Natural Gas futures rose 12.9% to 558 pence a therm, compared with 23 pence a year ago. Britain’s Office for National Statistics said fuel imports from Russia, which averaged £499 million ($588 million) a month in the year through February, fell in June to zero.

marketwatch.co 08 24 2022