Myra P. Saefong and William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 02 16 2023

Oil futures ended a bit lower on Thursday, with prices pressured by signs of “sluggish” U.S. consumer demand and a more than 16-million barrel weekly rise in U.S. crude inventories.

Price action

- West Texas Intermediate crude for March delivery CL00, -1.44% CL.1, -1.44% CLH23, -1.44% fell 10 cents, or 0.1%, to settle at $78.49 a barrel on the New York Mercantile Exchange, down a third consecutive trading session.

- April Brent crude BRN00, -1.35% BRNJ23, -1.35%, the global benchmark, lost 24 cents, or 0.3%, to $85.14 a barrel on ICE Futures Europe

. - Back on Nymex, March gasoline RBH23, -2.67% fell 2.5% to $2.4355 a gallon.

March heating oil HOH23, -2.37% ticked down 1.2% to $2.8108 a gallon. - March natural gas NGH23, -1.13% fell 3.3% to $2.389 per million British thermal units to mark the lowest front-month contract finish since Dec. 28, 2020, according to Dow Jones Market Data.

Market drivers

The U.S. Energy Information Administration data so far this year has been “consistently bearish and pointed to sluggish consumer demand, hesitant refining activity, sizeable builds in oil stockpiles and incrementally rising domestic oil production,” analysts at Sevens Report Research wrote in Thursday’s newsletter. These are “all bearish factors for the oil futures market.”

Oil prices had declined Wednesday after the Energy Information Administration reported that U.S. commercial crude inventories rose by 16.3 million barrels for the week ended Feb. 10. That marked an eighth consecutive week of supply gains reported by the EIA.

See: What are these EIA ‘adjustments’ in the weekly U.S. oil supply data tables all about?

The EIA report also showed that over the past four weeks, motor gasoline product supplied, a proxy for demand, was down 3.2% from the same time last year, while distillate fuel product supplied was down 15.6% from the same period last year.

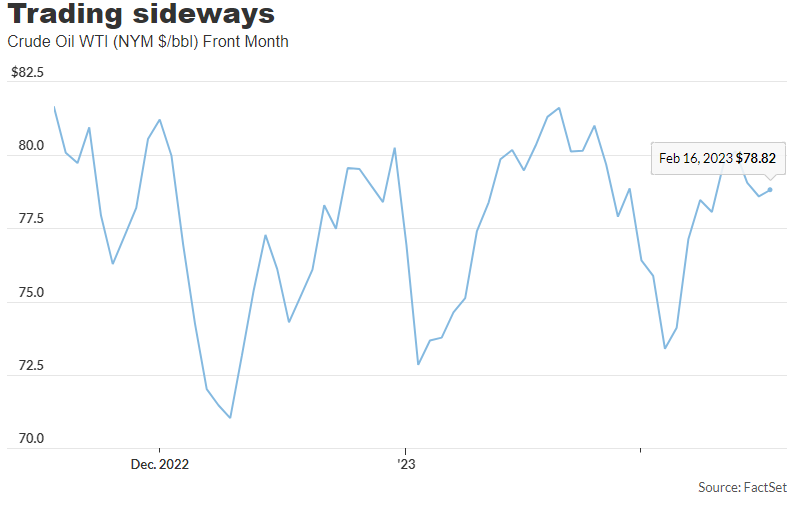

Still, Russia’s 500,000 barrel per day oil production cut beginning in March and ongoing optimism about recovering demand out of China “remain supportive of prices, leaving oil futures largely rangebound between support in the low

$70s and resistance in the low $80s,” the Sevens Report analysts said.

The “primary risk to oil prices remains to the downside as recession warnings from the Treasury market point to a potential collapse in consumer demand in the coming months or quarters,” they said.

Crude has traded largely sideways since late 2022 in a range between the low $70s and low $80s for WTI. A rebound by the U.S. dollar is seen as a weight on crude, with the ICE U.S. Dollar Index DXY, 0.53%, a measure of the currency against a basket of six major rivals, up 1.7% so far in February. A stronger dollar can be a weight on commodities priced in the unit, making them more expensive to users of other currencies.

Meanwhile, natural-gas futures gave up early gains to end lower for the session.

The EIA reported on Thursday that domestic natural-gas supplies fell by 100 billion cubic feet for the week ended Feb. 10.

The decline was smaller than the five-year average drawdown of 166 bcf and the 195 bcf decline seen for the same week last year, according to S&P Global Insights.

On average, analysts forecast a decline of 109 billion cubic feet, according to a survey conducted by S&P Global Commodity Insights.