Natural-gas futures settle at highest in more than 4 weeks

Myra P. Saefong and Williams Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 11 07 2022

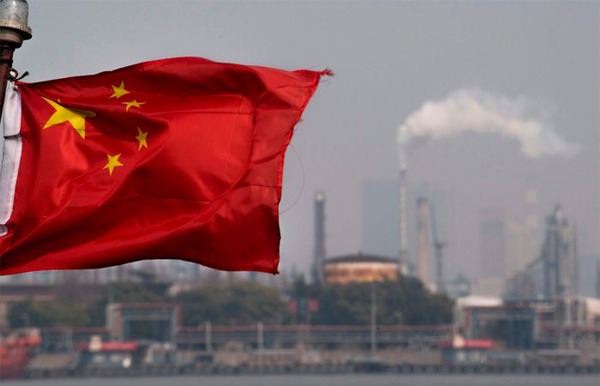

Oil futures settled lower on Monday as traders weighed the potential for changes to China’s COVID-19 restrictions, which would have an impact on the nation’s energy demand.

Price action

- West Texas Intermediate crude for December delivery CL.1, -1.00% CL00, -1.00% CLZ22, -0.97% fell 82 cents, or 0.9%, to settle at $91.79 a barrel on the New York Mercantile Exchange.

- January Brent crude BRN00, -0.74% BRNF23, -0.75%, the global benchmark, fell 65 cents, or 0.7%, ending at $97.92 a barrel on ICE Futures Europe.

- Back on Nymex, December gasoline RBZ22, -0.34% fell 3% to $2.6531 a gallon.

- December heating oil HOZ22, -0.73% shed 3.4% to $3.7811 a gallon.

- December natural gas NGZ22, -6.11% climbed by 8.5% to $6.944 per million British thermal units after Friday’s more than 7% climb. The settlement was the highest for a front-month contract since Oct. 6, according to Dow Jones Market Data.

Market drivers

Speculation around the potential easing of COVID-19 curbs by China was credited with lifting oil futures last week. News reports over the weekend, however, said Beijing would largely stick to its policies.

Health officials on Saturday said China would stick to its “dynamic clearing” policies, Reuters reported. Asked about a potential change in policy in the near term, Hu Xiang, a disease control official, said the country’s measures are “completely correct, as well as the most economical and effective.”

“The oil market still is a little bit nervous about the demand prospects and we want to get more clarity on China’s reopening plans,” Phil Flynn, senior market analyst at The Price Futures Group, told MarketWatch Monday afternoon.

China’s strict COVID curbs, which have resulted in sweeping lockdowns of major cities and regions, have been cited as a drag on crude demand.

The market fought off a sharp drop in oil prices after reports that China’s COVID policy would stay in place, but a report by The Wall Street Journal seems to “suggest that there is some wiggle room as far as this reopening,” said Flynn.

Looking a bit ahead, he said there will be a lot of focus on the demand numbers in this week’s U.S. petroleum supply report due out Wednesday, as well as a focus on U.S. oil production, as frackers are reluctant to raise oil production in the “uncertain environment.”

Analysts also pointed out China’s October trade data.

Crude oil imports in October averaged 10.2 million barrels a day, or mb/d, up from 9.83 mb/d in September and 8.9 mb/d in October last year, said Warren Patterson, head of commodities strategy at ING, in a note. It was the strongest monthly import figure since May, when 10.83 mb/d of inflows were seen. Crude oil imports over the first 10 months of the year are still down 2.7% versus the same stretch in 2021 to average 9.97 mb/d.

Chinese oil imports surged, The Price Futures Group’s Flynn wrote in a daily report released Monday.

“There must be a reason why China all of a sudden is importing a lot of oil,” he said. China may be “getting ready for some type of reopening of the economy or at least getting ready for winter.

“Whichever it is it doesn’t really matter,” said Flynn. “The thing is that global supplies of oil are still exceedingly tight with no room for error and any increased demand from China is going to make that situation even tighter.”

Also read: Diesel shortage keeps fuel prices high at the pump

Natural gas rally

Natural-gas futures, meanwhile, extended their recent rally “on the back of colder weather forecasts,” said Christin Kelley, senior commodity analyst, at Schneider Electric, in a daily note.

“A winter storm is sweeping across the Northwest this week, bringing very cold temperatures and potentially more than 2 feet of snow,” she said. Additionally, “NOAA predicts colder-than-normal temperatures will blanket nearly the entire lower 48 states from November 12 to 20, which will boost heating demand for gas and drive tighter market conditions.”

marketwatch.com 11 07 2022